Unless you were an avid gamer or fancied yourself as a “cryptobro” you had probably never heard of a company called Nvidia. On the back of the artificial intelligence (AI) mania that has swept the markets, Nvidia’s stock price has tripled year-to-date as many have anointed it the “AI winner”, at least for now. Having become the latest company to reach $1 trillion in market capitalisation, the first “semiconductor” company to do so, many have grown green with envy of the stock’s performance leading them to pile in, hoping the positive momentum will continue. Envy is a fitting term as it forms the foundation of Nvidia’s name. The “Nv” in Nvidia stands for “Next Version” while the word “Invidia” translates to “envy” in Latin. This would also explain why the company’s logo is green.

To understand why Nvidia become the poster child for the AI mania one need only consider the basic structural foundation of AI. At a simplistic level, AI is merely software running on hardware. By hardware, we are referring to the semiconductors or microchips that you might find in your computer or smartphone. In the case of AI, these chips are located in massive data centers, in what is commonly referred to as the “cloud”.

As demand for AI exploded, be it users accessing AI applications such as ChatGPT and Midjourney or even heightened interest by enterprises to build their own AI capabilities, so has the demand for these “chips”, grown at an exponential pace.

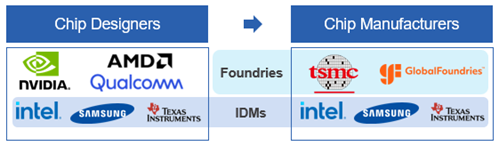

This is where Nvidia fits in. Nvidia is effectively supplying the chips that are fuelling the current AI revolution. Supplying in this instance is somewhat of a relative term as Nvidia does not actually manufacture the chips, it merely designs them, effectively serving as an architect for the “blueprints” of a semiconductor chip. In the semiconductor industry, firms tend to specialise in either designing or manufacturing chips, though there are still firms that perform both functions (see graphic below). Those that focus purely on design are referred to as the “fabless”, those without fabrication plants or foundries. Then there are companies such as Taiwan Semiconductor Manufacturing Company (TSMC) that focus purely on manufacturing the chip, essentially operating as a contract manufacturer. Nvidia relies on TSMC to manufacture its chips.

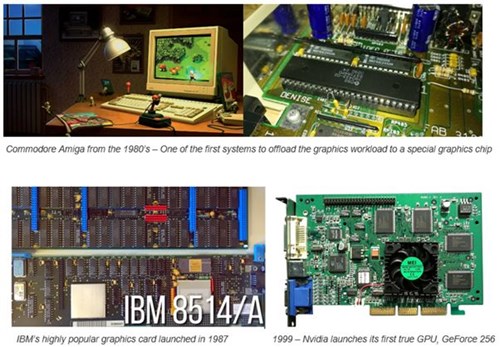

With a better understanding as to what Nvidia does (“supplies” the hardware underpinning AI), the next logical question is “What makes Nvidia’s chips so special?”. To answer this question, it must first be noted that Nvidia specialises in designing chips called GPUs (graphical processing units). Nvidia is regarded as the market leader in GPUs, well ahead of its nearest competitor, AMD, as least as far as GPUs used for AI purposes are concerned. Secondly, it is worth taking a trip back in time to gain a basic understanding around the history of computing and the different computer processing techniques.

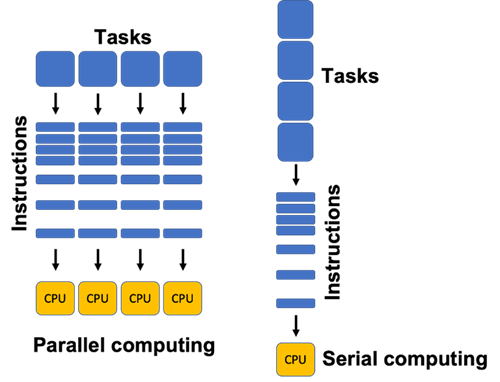

Historically, CPU’s (central processing units), the kind made by Intel, have served as the brain when it came to computer processing. CPUs are incredibly fast and efficient but they are designed to process one instruction at a time. The idea of processing instructions one at a time, what is referred to as “serial processing”, works incredibly well when it comes to operations such as the mouse, keyboard or even a spreadsheet (see graphic below). However, as computer graphics became more sophisticated and the graphical user interface (GUI) became a bigger part of our computing experience, the CPU began to struggle owing to the increasing number of pixels on the screen and the resulting calculation requirements.

To alleviate the CPU from the ever-increasing strain, a new chip was developed to take over the task of displaying graphics. This led to the birth of the GPU (graphic processing unit) as we know it today. GPUs adopt a different method of processing to CPUs in that they are designed to execute multiple tasks simultaneously or in parallel, what is referred to as “parallel” processing or computing. The parallel processing method is significantly more efficient when it comes to performing multiple calculations that are similar in nature, displaying pixels on a screen being a good example.

It turns out that GPUs are not only superior chips when it comes to displaying graphics but other tasks are also best performed or accelerated by using a GPU over a CPU. Using GPUs to mine cryptocurrencies is one such example but of more interest is the use of GPUs when it comes to machine learning, a subset of artificial intelligence. The process of machine learning or training an AI model requires enormous amounts of data and parallel processing is much better suited to handling the processing when compared to CPUs.

We have now established why chips are in demand with regards to the AI boom and that the chips in question are GPUs. That still does not fully answer the question as to why Nvidia has been crowned the AI champion. As mentioned, Nvidia competes with AMD when it comes to GPUs so what makes Nvidia’s chips superior to that of AMD?

Once again, we have to return to the annals of history to understand why. While the early GPUs helped accelerate the computing process, the GPU and CPU often did not work well together, leaving users frustrated from the constant errors that would occur. Nvidia sought to resolve this issue by creating a layer of software that would allow software developers to easily access the GPU when developing applications or games. This low-level layer of software is called CUDA (Compute Unified Device Architecture). Having this layer of software, which is now quite familiar to its users, has become increasingly important as both the number and diversity of AI models continue to expand. Developers of AI models want the chips that are training the models to learn to be highly optimised. They do not want to tweak code for different sorts of chips only to achieve a moderate gain, at best. Having the familiar CUDA framework, which is fairly easy to configure, regardless of the programming language or compiler, is the preferred approach by those building today’s AI models.

It may sound overly simplified but the factor, or competitive advantage if you will, that puts Nvidia’s chips ahead of others is its CUDA software. Nvidia does not charge its customers for the use of CUDA but the catch is that CUDA only works on Nvidia’s chips. Other chip designers have built faster, more efficient chips but they lack a software layer. For those actually using the chips, having a better chip is somewhat irrelevant if it is difficult to configure. Nvidia’s ecosystem of CUDA has expanded rapidly over the past year or so. The number of CUDA downloads has grown from 25 million in 2022 to over 40 million year-to-date 2023. Nvidia’s ecosystem (see graphic below) now has around four million developers including 40,000 enterprises and over 15,000 startups. It is estimated that around 90% of the chips used for AI purposes are GPUs, that vast majority of which will be from Nvidia

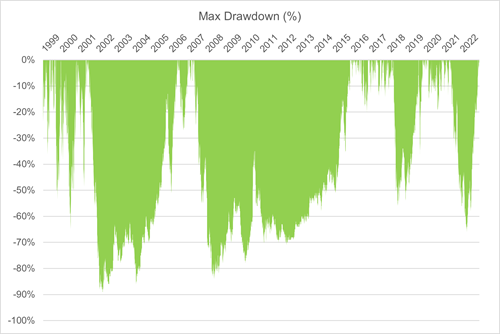

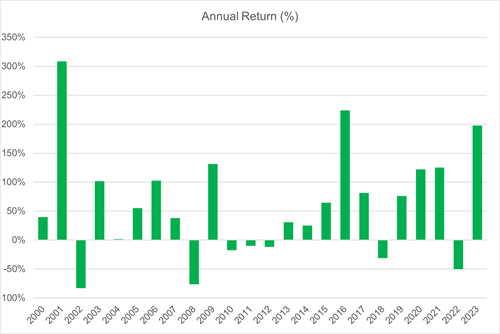

Before rushing off to by yourself some Nvidia stock you should take note of the risks you will be faced with when investing in the company, especially in the current environment. As a warning shot, Nvidia is a highly volatile stock, subject to extreme price moves, both up and down. The below graphs illustrate just how extreme the drawdowns (price decline from peak-to-trough) have been for Nvidia over the past two decades:

Source: FactSet

If elevated volatility and sizable drawdowns scare you, it is probably not advisable to purchase any Nvidia stock as you may end up having trouble sleeping at night. If you are however able to stomach the volatility and periods of large drawdowns then the chart below shows how you would have been rewarded for holding Nvidia stock through the years of sizable ups and downs. Over the past two decades, Nvidia’s stock price has grown at a rate of 33% per annum leading to a cumulative return of over 100,000%!

Source: FactSet

This type of performance is not guaranteed to be repeated, certainly not at current stock price levels. Having recently passed the $1 trillion mark in market capitalisation and with its stock price above $400, there is a sizable amount of optimism “baked in” to the current stock price. For a new investor, Nvidia will have to deliver some sizable growth to justify buying at current price levels. Failure to meet these lofty targets would leave the investor with sub-optimal returns, at best.

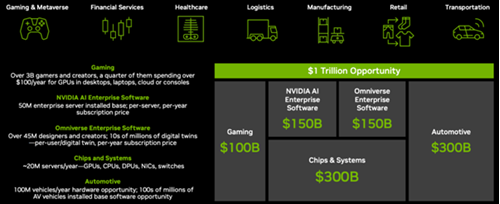

That is not to say that Nvidia will fall short of expectations. The current opportunity that stands before the company stands at $1 trillion. That is, at least according to Nvidia management, the total addressable market (TAM) that Nvidia could grow into (see graphic below). It does have an element of hubris to it but even if Nvidia only makes it a quarter of the way to its target over the next decade, it would have likely exceeded expectations currently embedded into the stock price.

Source: Nvidia

The highly attractive growth opportunity facing Nvidia must still be weighed against two other risks which could materially impact the company. The first is the possibility of China invading Taiwan. While the occurrence of such an event would be significantly material, the probability remains low, albeit slightly more elevated than in previous years. For more detail on this risk refer to [Link to previous semiconductor article]. A risk that may not be as material but has a far higher probability of occurring, is the US increasing export restrictions on the sale of Nvidia’s chips to China. During 2022, the US government implemented rules that effectively prohibited the sale of Nvidia’s most advanced AI chips to China. US officials have grown concerned that the Nvidia’s chips are being utilised in China for “military applications”.

Nvidia was previously able to circumvent these restrictions by designing slightly less powerful chips that did not exceed thresholds set by the US government. However, as we head into the second half of 2023, the US government is considering increasing the extent of the export controls such that Nvidia’s previous efforts to circumvent the rules will be rendered null and void. It is possible that Nvidia could once again redesign certain chips such that they fall outside the ambit of US export restrictions, effectively turning into a cat and mouse game. As Johann Rupert once noted, “Don’t play cat and mouse games if you’re the mouse”. That said, Nvidia makes for a rather large mouse.

Taking into consideration the above risks and the prodigious price rise that the Nvidia stock has experienced year-to-date, it would be advisable to first speak to your advisor or portfolio manager before deciding to place your buy order.

Click here to read more about The enablers of Artificial Intelligence

Explore the latest innovative industries at Sasfin for valuable insights. Visit us today.