On the 30th of November 2022, the general public was introduced to ChatGPT, an artificial intelligence (“AI”) chatbot developed by OpenAI. In less than a week, ChatGPT had over 1 million users and in just two months its user base had grown to over 100 million users. This unprecedented rate of growth surpassed popular social media applications such as WhatsApp, Twitter and Instagram, which took years to reach this kind of scale. Even TikTok “only” reached this particular milestone after nine months.

The hype surrounding the potential of AI has filtered into global equity markets leading to a surge in stock prices for companies expected to benefit from the technology. The so-called “AI-mania” that has engulfed global equity markets has led some to label the current environment as a bubble. Given the sizable moves that we have seen in the so-called “AI winner” stocks, even the investors that have benefitted from these gains may be wondering whether an opportunity still exists to invest in AI, fearing that most of the gains have already been registered. To better assess the opportunity, a useful starting point would be to gain an understanding of where we might be in the lifecycle of AI, what may yet be one of the most evolutionary technologies that world has ever seen.

The pace at which ChatGPT has grown serves as evidence of the excitement of this new technology which has some referring to its launch as the “iPhone moment” of AI. Others remain sceptical, questioning the real-world application of AI as well as the risks that it poses to humanity. From our perspective, it is hard to ignore the potential of this technological development, both good and bad, and we are inclined to believe that we are likely in the early stages of a new technological paradigm, much like we saw with the introduction of mobile phones or the internet.

As our interest lies in identifying investment opportunities that may arise from the adoption of this new technology, it is a useful exercise to try and determine where we may be in the cycle of this technological evolution. For that purpose, we apply the Perez technological cycle developed by Carlota Perez. Her framework has been used to explain how many of the major technological revolutions over the past few centuries have evolved over long periods of time, often decades, how the new technology engages the financial system and of course the different stages of the cycle.

According to Perez, there are two key periods in the cycle. The first is an Installation period which can be further separated into an Irruption phase and a Frenzy phase. This is followed by the second period, the Deployment period, which can also be separated into two stages, a Synergy phase and a Maturity phase.

It should be noted that Perez believes that we are in the midst of a much broader technological evolution, an age of information and telecommunications that began in the 1970’s and that is closer to the “Turning point”, somewhere between the Installation and Deployment stage and yet to reach the Synergy phase and experience a “Golden Age”. Perhaps she is right but she does acknowledge that such frameworks belong to the public, available for alternative interpretations.

Perez is not alone in thinking we are currently progressing through a much broader cycle. Microsoft founder Bill Gates is also of the view that we are in the midst of a much broader evolution, one of digitalising information. According to Mr. Gates, we have moved from PCs (zero marginal cost of duplicating information) to the internet (zero marginal cost of distributing of information) and now we are transitioning toward the AI era (zero marginal cost of generating information).

One could however argue that AI is worthy of its own classification as an evolutionary technology and that we are still at the early stages of its evolution. Viewing AI from this standpoint, the current climate surrounding the technology would also suggest that we are somewhere between the Irruption and Frenzy phase.

The Irruption phase is described as a period when:

During the Frenzy phase:

One of the outcomes from the Installation stage, a period of uncertainty arising from future potential, is that it leads to speculation and risk-taking which ultimately results in a financial bubble.

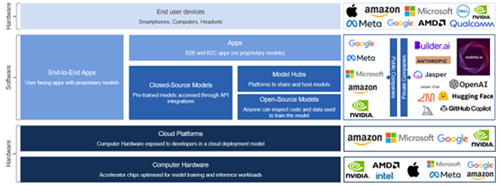

In pursuit of potential investment opportunities in AI, it is important to understand the lay of land (see the graphic below). Simplistically, AI is “just” software, running on hardware. The hardware layer begins with semiconductors or microchips that process data used to develop and run AI models such as ChatGPT. The microchips are placed into massive data centers to be accessed via cloud computing platforms. The software layer that runs on chips housed in the data centers consists of AI models and applications, both open-source or closed-source. The final hardware layer is where users can gain access to the software through their end-user or edge devices such as smartphones, headsets, cameras or even a piece of machinery on a factory floor.

Source: a16z – Andreessen Horowitz

An analysis of the ecosystem shows that given the capital intensity and computing power required to develop and run AI models, the incumbents, be it semiconductor companies or hyperscalers (large cloud service providers), are best positioned to enable the “first wave” of AI.

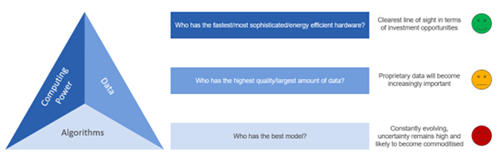

When trying to assess which part of the AI ecosystem offers the best investment opportunity, using the AI Triad as a lens shines a light on where one should focus during this Installation stage of AI. The AI Triad is based on the principle of “machine learning systems use computing power to execute algorithms that learn from data”. Breaking down this idea into its components creates three areas of focus: Computing Power, Data and Algorithms (see graphic below).

Source: CSET – Center for Security and Emerging Technology, Sasfin Wealth

Computing Power provides that best opportunity of focus as it offers the clearest line of sight in terms of investment opportunities. In this segment, we know which companies provide the best hardware for the job of AI, be it the semiconductors or the cloud computing platform. Data is somewhat less attractive, though still important, as having an attractive data set does not necessarily materialise into a monetisable opportunity. Those with the largest, most proprietary datasets are best positioned in this segment. Algorithms is the least attractive area when it comes to identifying an investment opportunity. That said, it is likely that the next Amazon or Google is likely to arise from this segment. Perhaps it will be OpenAI, the company behind ChatGPT or maybe even a company that is yet to be founded. The trouble with this area, as far as providing an investment opportunity set is concerned, is that there is still so much uncertainty around models. The space continues to evolve at a rapid pace, with a new model or version thereof coming out every week. It is quite possible that it could become quite commoditised – a concept that is not attractive as far as identifying opportunities with sustainable long-term growth outlooks.

Narrowing our focus down to hardware effectively provides two camps of investment opportunities, semiconductor firms and Big tech, specifically the cloud computing firms.

Within semiconductors there are a number of companies that stand to benefit from the growing demand for AI chips but the one standout currently is Nvidia. Not many may have heard of the semiconductor designer prior to the start of the year unless they were a gaming enthusiast or crypto miner. The California-based firm has seen its market value increase almost threefold year-to-date as the market ascribed over $600 billion in additional value to the company which saw its market capitalisation surpass the $1 trillion level, the first semiconductor firm in history to do so. To understand why the market has become infatuated with Nvidia requires a separate discussion which can be found at [Link to Nvidia article].

Nvidia is not the only semiconductor name that is benefitting from AI. There are a host of companies within the semiconductor industry that stand to gain, some more than others (see the graphic below). Those that are likely to be on the forefront of enabling AI include semiconductor designers or as they are referred to in the industry, “fabless” firms. Firms such as AMD, Qualcomm, Broadcom as well as Nvidia fall into this category given that they do not perform the actual manufacturing, opting instead to outsource this process to a firm that owns fabrication plants or what may also be referred to as foundries. One firm in particular that operates as a contract manufacturer and possesses the most advanced “fabs” in the world is Taiwan Semiconductor Manufacturing Company or TSMC.

To perform the manufacturing process, the Taiwanese-based firm requires highly specialised tools and equipment. Perhaps the most notable name in this regard is a firm called ASML. The Dutch-based company manufactures arguably the most advanced piece of equipment in the world which is used to draw the design or “blueprints” onto a silicon wafer using highly sophisticated lasers. Beyond ASML, there are other equipment providers that are likely to benefit from AI such as Applied Materials, BE Semiconductor, LAM Research, KLA and Tokyo Electron.

Two other areas within the semiconductor industry that stand to benefit from the proliferation of AI are those that provide the software to design semiconductors as well as those that assist companies in designing chips, essentially “chip design as a service”. One of the driving forces that is likely to lead to growth in both areas is the increase in the number of non-semiconductor firms wanting to design their own chips. Big Tech companies such as Amazon, Apple, Google, Meta and Microsoft are increasingly opting to design their own silicon. Even industrial companies such as Ford and John Deere are opting to follow the path of custom chip design. Custom chip design is primarily a strategic initiative. It allows firms to create a chip that will perform the exact functions required, at a faster yet more efficient pace than the general-purpose chips from traditional semiconductor firms. Designing your own chip is incredibly expensive as it requires special software from firms such as Cadence Designs or Synopsys. It is worth noting that as chips become increasingly sophisticated, the need for specialised software is essential. In addition, the process of making a chip, from the design to the actual manufacturing is also incredibly complex and this is where the use of a design firm such as Alchip or Global Unichip would also be required.

As mentioned, beyond companies within the semiconductor industry there are the cloud computing firms or hyperscalers. In assessing these companies, it is useful to apply the lens of the AI Triad as many of the Big tech names (see above) possess strong capabilities in at least one of the segments (computing power, data, algorithms), if not all.

At this point in time, Microsoft and Google offer the greatest exposure to AI and are best positioned to benefit from its proliferation. From Microsoft’s perspective, users can gain access to AI infrastructure resources on its cloud computing platform (specifically Nvidia chips but in the future also Microsoft’s own custom chips) but that is not the only avenue from which it can benefit. Through its investment in OpenAI, the company that brought us ChatGPT, Microsoft could gain a larger share of the search market, though the monetisation aspects do remain somewhat uncertain. In addition, Microsoft can utilise the AI capabilities of OpenAI across its suite of productivity applications such as Microsoft Office as well as making Windows a more user-friendly and user-accessible experience.

Google arguably has the broadest exposure to AI across both hardware and software and has a long track record of investing in artificial intelligence. Google offers its own cloud computing platform that provides access to both Google’s own silicon as well as to Nvidia chips. In addition, Google offers its own ChatGPT equivalent (Bard) trained on models developed in-house as well as an array of other AI models and applications. Of particular interest will be the generative AI tools that Google will offer to advertisers to develop ad campaigns. At the click of a button keywords for search can be generated along with product images that can automatically be edited with a written prompt as opposed to having a graphic designer manually removing or adding image effects.

Amazon is another Big tech name that offers a broad range of AI hardware and software solutions. Much like Microsoft and Google, Amazon offers access both to Nvidia chips as well as its own inhouse silicon. What makes Amazon slightly unique compared to the likes of Microsoft and Google is that in similar fashion to the broad range of goods on its e-commerce platform, it is also looking to do the same as far as its AI offering is concerned. Amazon is following the approach of providing users with access to an array of different AI models along with the ability to customise models rather than being bound to models developed inhouse or by partners (such as Microsoft’s investment in ChatGPT) which are effectively closed-source.

It may not offer cloud computing at the scale of Microsoft, Google or Amazon, yet, but what Meta (formerly Facebook) may lack in computing power it certainly makes up for in data, in both scale and quality. Mark Zuckerberg’s firm has developed inhouse a number of AI models, some of which are open-sourced, allowing users to customise to their needs. Meta has already shown the strength of its AI capabilities, using it to ramp up its Reels offering as it attempts to combat competition from TikTok. Similar to Google, advertising is the key revenue generator for Meta and the firm could see an opportunity in generative AI in the form of personalised ads stemming from Meta’s text-to-video technology.

A common thread amongst Microsoft, Google, Amazon and Meta is that they all possess strengths (some relatively stronger than others) across computing power, data and algorithms. Not many other companies in the world can boast such a feat and it is a key reason why Big tech is well positioned to enable AI for the masses.

One name that we haven’t mentioned is Apple. The iPhone maker has been relatively quiet so far as its efforts in AI are concerned and has been more focused on the launch of its recent headset, the Apple Vision Pro. What makes Apple so interesting as far as AI is concerned, is the competitive position that it holds from an edge device perspective. It is likely that most consumers, specifically in the US, Western Europe and Japan will likely access an AI application on their iPhone (perhaps headset in the future?). Apple is also incredibly focussed on user privacy and how your data is shared. While much of AI takes place in the “cloud” currently, we could see much of the workload being shifted to edge devices such as a smartphone.

Who better to dominate this market than the company with the most popular consumer electronic device. Users would be far more comfortable having their data remain on their iPhone rather than being sent off to the cloud for processing. A big question mark nevertheless remains over Apple as far as its AI capabilities are concerned. The Cupertino-based company has a mixed track record in machine learning given the mediocre functionality of Siri when compared to the likes of Amazon’s Alexa. That said, Apple does design its own silicon and its chips do have cores that cater for AI-like processing. Perhaps Apple is the dark horse in the AI race despite it currently bringing up the rear among its Big tech peers.

A word of caution before heading off to purchase yourself some “AI stocks”. As we close off the first half of the year, both semiconductor stocks and Big tech stocks have risen prodigiously on the back of expected growth to be had from AI. One could argue that a portion of the large price moves that we have seen year-to-date can be attributed to a pullback from the sharp falls experienced by many of these stocks in 2022 brought about by the negative impact of rapidly rising interest rates and the fears arising from the Russia/Ukraine conflict. That said, many of these stocks, especially the likes of Nvidia, have risen to such a level that their current prices may not offer an attractive return outlook over the long-term.

At Sasfin, we have a preference for holding stocks over the long-term rather than looking to profit from gains over a short period. We also tend to err on the side of conservatism when making a long-term assessment, anticipating that overly optimistic expectations will eventually fizzle out, shifting back towards more sustainable levels in the long run. To avoid potentially overpaying for any of these stocks, we would therefore advise you to speak to your financial advisor or portfolio manager before hopping aboard the AI locomotive.

Stay informed about the latest trends, technology, and investment opportunities by visiting Sasfin today!