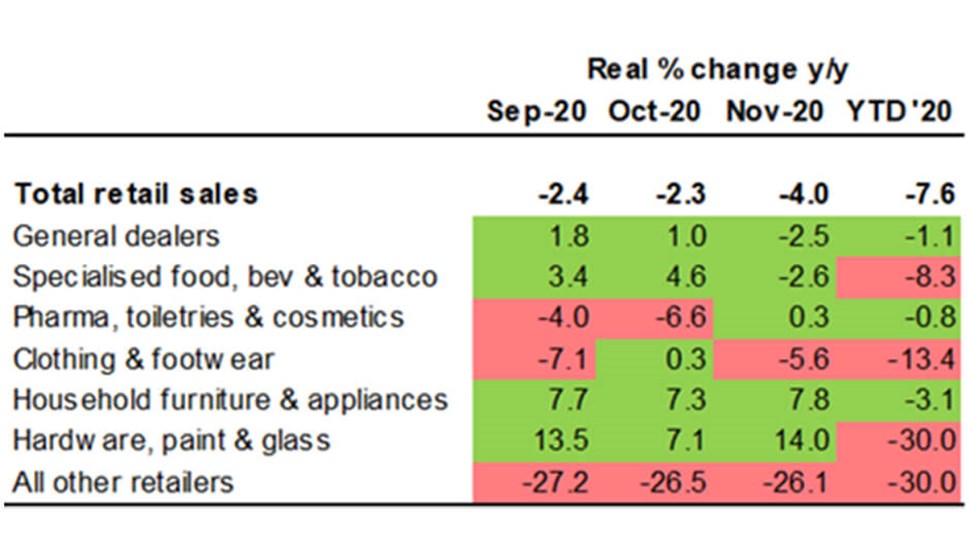

South African Real (excl. inflation) retail sales in November 2020 slumped by 4% year-on-year, compared to a 2.3% y/y decline in October. This highlights the dismal Black Friday trading conditions experienced by retailers.

Key: Red denotes worse growth than average total retail sales growth and green denotes better growth than average total retail sales growth.

Source: Statistics SA, Sasfin Wealth

Because of the lock-down distortion, it is probably more relevant to consider the year-to-date (ytd) figures.

The key points that we believe are worth highlighting in this data are the following:

- On a year-to-date basis, real retail sales declined by 7.6% y/y.

- The ‘biggest loser’ categories are the discretionary categories of Textiles, Clothing & Footwear (a real decline of 13.4% y/y) and All Other Retailers (-30.0% y/y).

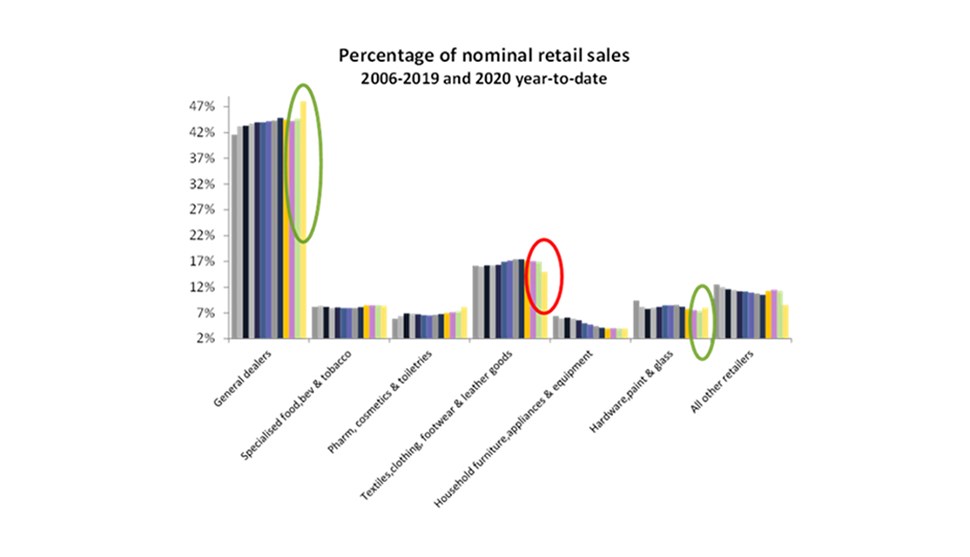

- The make-up of retail sales has also shifted, driven by the lock-down specifics and pandemic‑laced behaviour changes.

- A focus on basic food, groceries and health increased the participation of General Retailers (48.1% of nominal retail sales ytd compared to 44.7% in calendar year (CY) 2019), despite their loss of tobacco and liquor sales.

- Pharmaceutical, Cosmetics & Toiletries retailers (8.1% ytd versus 7.3% in CY2019).

- Textiles, Clothing & Footwear lost ground, accounting for 14.9% of nominal retail spend ytd versus 16.9% of retail spend in CY2019.

- Spending at All Other Retailers declined to 8.5% of nominal sales from 11.3% in CY2019.

- A surprising shift observed is the slightly higher allocation of retail spending to Hardware, Paint & Glass (8% versus 7.4%) as people are clearly upgrading their homes because they’re spending more time at home for work and less out-of-home entertainment.