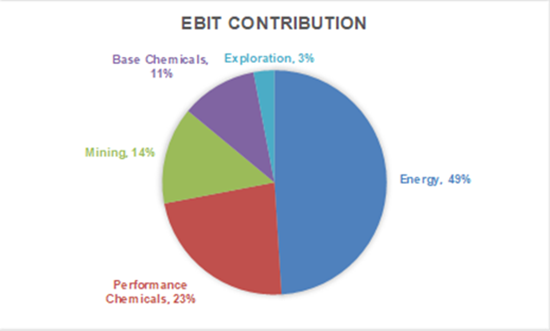

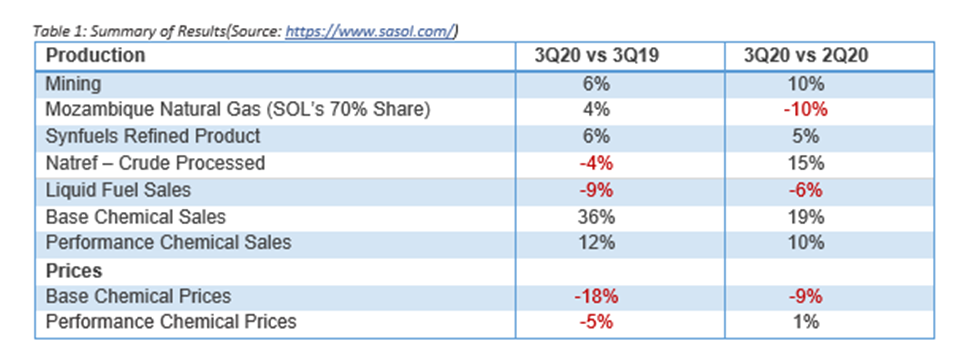

Sasol was on track to have a solid third quarter before the COVID-19 outbreak caused disruptions in the markets. The strong Base and Performance Chemical sales volumes were offset by low global chemical prices. Consequently, Sasol has had to do a downward revision on the EBITDA (earnings before interest, taxes, depreciation and amortization) contribution expected to come from the LCCP (Lake Charles Chemicals Project). The company now expects a loss of between $50 to $100 million for the 2020 financial year (FY20) as opposed to the previous EBITDA guidance of a positive $50 to $100 million. This is on the back of the global demand reduction that has resulted in a decline in oil and chemical prices as a result of the COVID-19 pandemic.

Sasol also highlighted that it is making significant progress on its cash conservation programme and aims to maintain liquidity headroom in excess of $1bn. Added to this, the company put in place some self-help measures which include salary sacrifices of 10-20% from the CEO to junior management for a period of 8 months as well as a 20-40% reduction in director fees. The company is also engaging its funders to make adjustments on its debt covenants before June 2020. In a statement released earlier in the month, Sasol announced that the South African lockdown has resulted in a significant decline in fuel demand. As a result, the company decided to suspend production at Natref and also reduced the production rates of Synfuels at its Secunda operations by approximately 25%. Liquid Fuel sales volumes were revised down by 12% from what was previously guided. Base Chemicals sales volumes are expected to decline by 4-6% while mining productivity is also expected to be lower at FY20.

It is our view that Sasol is currently operating in an incredibly difficult macro environment which is putting pressure on its already strained balance sheet. 75% of its oil exposure is hedged at an oil price of $32/bbl. We therefore assume that Sasol does not break-even at current Brent prices that are well below $30/bbl. There is limited foresight as to how long the global economy will continue to suffer under the impacts of the COVID-19 outbreak. It is therefore our opinion that the weaker global demand in chemicals and fuel will continue into the fourth quarter and consequently, will have a negative impact on Sasol’s full-year earnings. We believe that the Sasol’s potential capital raise and the sale of a minority stake in the LCCP are a fair reflection of the company’s negative outlook in the near to medium term. Accordingly, we maintain a cautious view on Sasol.