Last week Statistics South Africa released data regarding retail sales in February 2021.

While it seems futile to try make sense of monthly numbers in an environment that is still being distorted by the impact of the Covid‑19 pandemic, we couldn’t help sharing some of our observations of the 2020 and early 2021 data, to the extent that it develops our thoughts on the retail exposure that we hold in our models and client portfolios. It is important to try and determine as soon as possible whether or not any observed pandemic‑fuelled shifts in consumer behaviour are temporary, and if so, their longevity, or whether the changes are permanent or structural.

- Real retail sales in February were up 2.3% year-on-year (y/y), far better than the economist consensus expectation of a decline of almost 2%.

- This enormous beat was probably attributable to the lifting of the post December infection spike-fuelled restrictions imposed in January and of course, the lifting of the alcohol sales ban.

- Hence, General retailers and Specialised Food, Beverage and Tobacco stores (the category where liquor stores are captured), saw jumps up +3.9% and +8%, respectively from -6% and -32.3% in January.

- Sales of Clothing, Footwear & Textiles also picked up, increasing by 12.3% versus 3.6% in January. This was probably boosted by more people returning to offices (and having to buy bigger clothes after the lock‑down/work-from-home‑in‑tracksuits binge) and back-to-school purchases. Anecdotally, this is evidenced by the greater number of cars on the road, especially during the traditional peak-hours.

- Consumers are still spending on improvements to their homes, both inside and outside, suggesting the emergence of a hybrid office/work-from-home model, seen in sustained spending on household, Furniture and Appliances (+17.3%) and Hardware, Paint & Glass (+5.9% in February and +24.6% in January).

- The fact that the Other Retailer Stores category was down 23.6% in February from a 16.5% decline in January, points to an ongoing consumer focus on lower tiers of Maslow’s hierarchy, meeting the more basic needs of food, clothing, health and shelter.

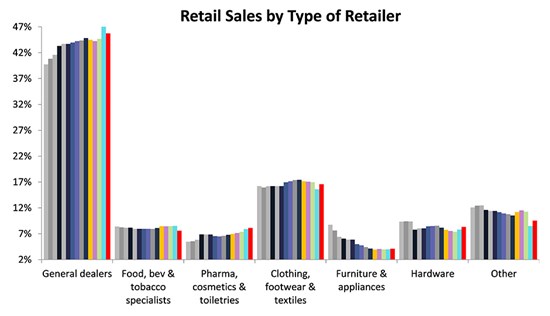

In the chart above we illustrate the retail spending by type as a percentage of total retail spending from 2008 to the year-to-date 2021. We make the following observations:

- Real (excluding inflation to focus on volumes) spending at General retail stores (such as the national supermarket chains) spiked as a percentage of total retail sales in 2020 because 1) these were the only stores that were able to trade during the hard lock down and 2) pantry stocking amid the uncertainty of the intensity and duration of the pandemic. In 2021 this spending has fallen back closer to ‘normal’ levels, albeit still at a slightly higher level than recent years.

This sustained elevation in spending at grocery stores could also be partly attributed to fewer people working away from home and/or the fact that some consumers continue to avoid public places and choose to eat more meals at home. This conclusion is borne out by the latest official sit-down restaurant and take‑away trade statistics, that show that the real income for the year‑to‑date 2021 remains -41.7% and ‑6.3% respectively, below the comparable pre‑pandemic period.

- Spending at Pharmaceuticals, Cosmetics and Toiletries retailers has continued to build on their 2020 spike, suggesting that the consumer focus on hygiene and vitamin/immune boosting remains prevalent.

- Furniture & Appliance and Hardware retailers have also sustained their 2020 pandemic boost, supporting the likely ‘new normal’ hybrid office/work-from home model.

- Finally, while spending at Clothing, Footwear and Textiles retailers has recovered from its pandemic lock-down-fuelled dip, it is clear that spending on this retail segment appears to have plateaued. In our view the Clothing and Footwear retail segment was the primary beneficiary of the almost two-decade rise of the middle-class population in South Africa. According to according to LSM (Living Standards Measure) data from the South African Audience Research Foundation the middle class (defined as LSM 6-9) increased from 28.6% in 2001 to 55.5% of the total population by 2014.

As a side-note: The 2015 survey, unfortunately the last one, reported a decline in the middle class to 54.7% of the population, the effect of years of negligeable economic growth through government mis‑management.

In conclusion, while it is still too early to draw definitive conclusions on the lasting impact on consumer behaviour and the retail spending patterns, it appears that some shifts in spending behaviour are proving a little sticky and it seems plausible to expect some permanent nuances in the composition of retail spending.