Massmart operates as an investment holding company with interests in the distribution of fast‑moving consumer goods (food and liquor), general merchandise and home improvement and building materials.

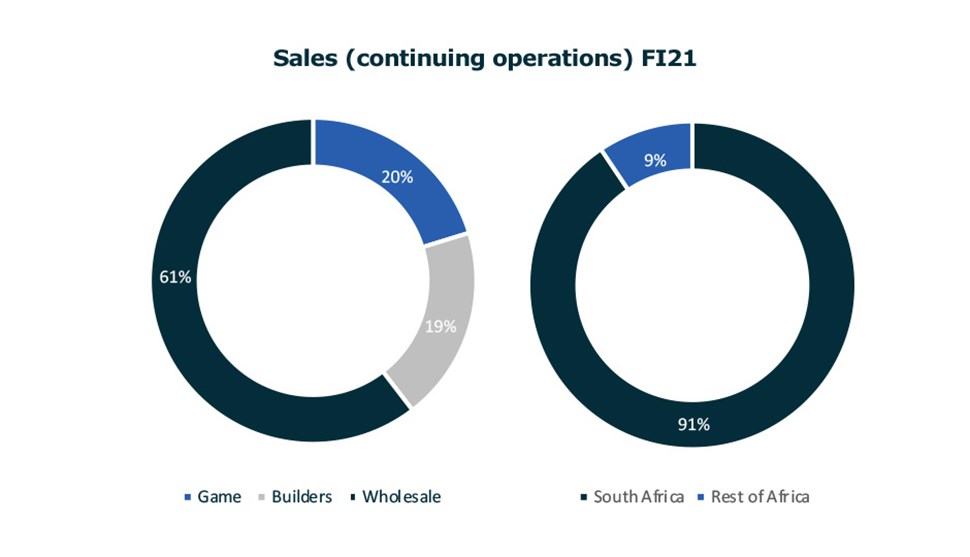

For many years Massmart grew earnings handsomely supported by solid management and strong volume growth as the middle class expanded in a growing economy. However, years economic mismanagement reversed the middle‑class progression and consumer spending and volume growth dried up. At the same time Massmart, who’s business model relied on high volumes to drive earnings growth, succumbed, not helped by the arguably complacent and uninspired successive management teams who failed to position the group for the new economic reality and changing consumer/retail dynamics, even with the backing of the world’s largest retailer. Then, enter a ‘Walmart insider’ at the helm. Under the new leadership, the group has been reorganised into two divisions, namely Retail (Builders and Game) and Wholesale (Makro, Jumbo Wholesale and the Shield buying association) as part of a multi-faceted recovery plan.

1. High brand recognition and market shares in key categories, albeit increasingly losing share of wallet to online in recent years, internal failures (strategy and operational) and sub-optimal execution that have frustrated the profitable capitalisation on the group’s market profile and procurement scale.

2. Mitch Slape, the new (Walmart-insider) chief executive officer has initiated a comprehensive recovery plan, which while addressing glaring shortcomings in the group’s go-to-market strategy and operational execution, in our view essentially addresses the complacent and uninspired leadership of recent years in effectively leveraging 51%‑owner, Walmart’s know‑how and resources, and positioning the business for growth in the face of obviously changing consumer and market dynamics and behaviour.

3. In our opinion the notable features of the recovery plan are

a)The definitive and far‑reaching nature of the plan to stabilise the business, covering the group’s operating model, portfolio and supply chain optimisation, a reset of the cost base, wholesale route to market and the Game chain; and

b)The highly motivated and energised, Walmart ‘insider’ at the helm, who appears to have re-invigorated Massmart’s executive management with detailed objectives and focussed accountability.

4. The extent of the recovery plan and the speed of execution to date bode particularly well for the prospect of an explosive return to profitability within a short time-frame and renewed growth prospects. Early wins include:

a) The restructuring of the group operating model to a clearly defined Retail and Wholesale customer-facing model;

b) Cost savings delivered thus far of R1.1bn (of R1.8bn targeted initially over 3 years) as part of the ‘Cost Reset’;

c) The optimisation of the portfolio with the closure of Dion Wired, the sale of multiple non-core chains and the divesture of stores in West and East Africa. These divestures alone will lead to a R750m improvement in the group’s profit before tax; Better focus and earnings uplift from non-core asset sales: Restructuring along retail and wholesale and disposal of non-core distractions where the group had no competitive advantage or does not support the directions of the group to follow modern retail trends, especially online. These proceeds are largely funding investment behind “the new direction”, namely online and delivery investment to stem market share losses to online players and other company’s online investment.

5. To date Massmart’s online execution has been woefully poor and has likely led to a market share loss. With early gains in stabilising and focussing the business, Massmart has wasted no time to take definitive steps to invest in raising the future growth trajectory with a renewed focus on e-commerce, both business-to-business (B2B) and business-to-consumer (B2C). In addition to leveraging off Walmart’s extensive experience and capability in the field, Massmart has seconded the Walmart North America Vice President for Last Mile Delivery to lead the Massmart e-commerce team. Massmart has also recently acquired the fast‑moving consumer goods marketplace and logistics platform, OneCart, to support its 2017 acquisition of last‑mile delivery start‑up, WumDrop.

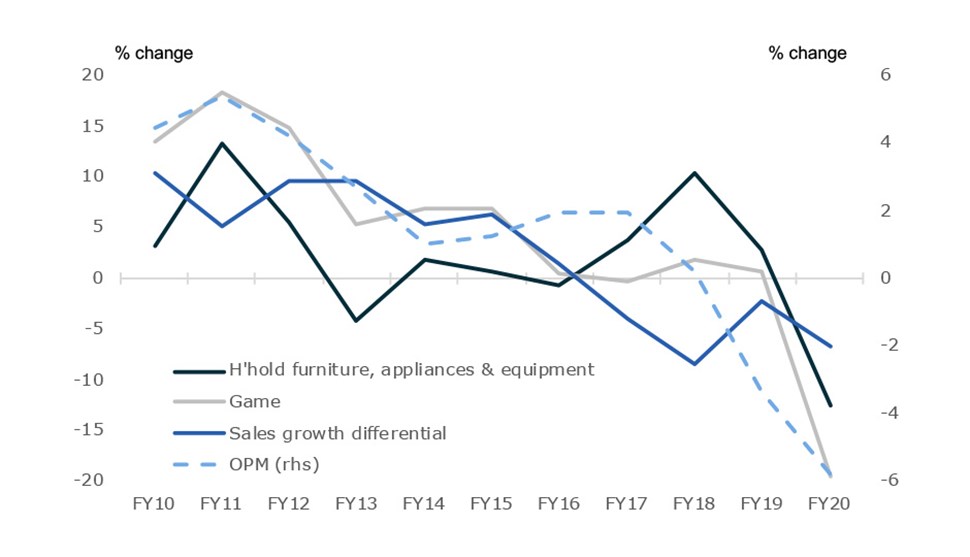

a) Game’s real sales growth exceeded the sub-sector’s growth up to FY16, even after the deteriorating macroeconomic conditions started weighing on the sub‑sector from FY13 – suggesting that Game continued to gain market share during this period. Despite this sales out‑performance however, Game’s operating profit margin deteriorated along with the macroeconomic deterioration from FY13 – pointing to sub‑optimal operational execution with poor procurement and expense control.

b) From FY17 Game’s sales growth started to underperform the sub-sector – suggesting market share losses, arguably at least in part to online retailers. With the loss of operational gearing of sales growth, Game’s margin compression accelerated, eventually turning negative.

c) A review of the above observations suggests that Game’s issues appear to be largely internal (poor execution) and thus management are likely to have a fair degree of control in stemming the tide of the chain’s financial downfall.