Global Market Developments

The 3rd quarter of 2021 provided markets with much food for thought, as US inflation concerns, some significant policy shifts in China and rising energy prices created an uncertain outlook. Although equity markets took somewhat of a breather in the quarter - with both the S&P 500 and the MSCI World Index both essentially flat for the quarter, there is still significant risk appetite in markets, as global bond yields remain subdued by historical standards. This narrative is the primary market driver - that of TINA - There Is No Alternative. Although the US Fed has communicated that a tapering of the QE programme will begin - most likely before the end of 2021, actual interest rate hikes are still some way off.

There are some early signs of an economic slowdown in China, and this was also compounded by a shift to what was termed a “shared prosperity” drive, rather than an unfettered capitalist approach. In September a default event by Evergrande, the largest property developer in China gave rise to global worries about a Lehman-style crisis, which could have the potential of developing into another global financial crisis. It does appear though that the fallout will be relatively confined from a financial systemic perspective. However, if it impacts in some way to consumer behaviour in China, a consumption and investment slowdown there will certainly have wider impacts - in particular on commodity producers.

A debate still rages around the inflation trajectory, and whilst most observers see it as being transitory, there are concerns that the global supply-chain issues are going to be compounded by rising oil prices, with spot oil prices continuing to rise. Oil prices are up roughly 55% year-to-date, and are certainly cause for concern, as they may also prove to be a brake on the global economic recovery. Indeed, US bond yields also rose in tandem with the rise in energy prices, with the 10-year bond yield - after testing a low of below 1.2% in July - rising to end the quarter at around 1.6%.

Local Market developments

What is surprising about the local markets in the 3rd quarter was the absence of a significant downside move in bond, equity and FX space after a major lapse in law and order during the July riots. Markets appear to be taking the lead from global developments rather than local, although it may be argued that asset prices already reflect a rather gloomy SA outlook. The JSE All Share Index reflected international indices and was down 0.8% for the quarter. The SA bond market also reflected global moves, with 10-year yields rising from around 9.6% to 9.9% by quarter-end. This, coupled with the steepness of the yield curve, continues to provide income investors with access to very high real yields. Inflation remains fairly well contained, and with the economy still in the doldrums (albeit recovering from the extreme lows of 2020) the outlook remains favourable from an interest rate perspective, with the SARB holding rates steady at the MPC meeting.

We continue to believe that the market remains too pessimistic about the possibility of rate hikes, and this provides us with ample opportunity to add positions within our funds.

Fund Strategy and Performance

Despite some upward pressure on inflation in South Africa from energy, administered prices (including electricity, municipal rates, and water) and possible short term price increases resulting from shortages and supply disruptions, we believe that the SARB will be able to keep inflation broadly under control. With 10-year bond rates above 9%, we believe that investors are adequately compensated for the risk. Accordingly, over the past year we have increased our fixed rate bonds to a full exposure, within our long-term strategic limits. In the medium term we believe that there is a risk of rising inflation and accordingly we are monitoring our bond position closely. Furthermore, our largest category exposure is to inflation linked bonds, which offer some protection to investors if inflation rises. Credit exposure is limited as we see risk in the credit space, without seeing great protection from the credit spreads in the market.

In equities we have invested in selected opportunities, including several recovery situations. We are cognizant of the risks facing the broad economy, and the pressure this could place on general corporate earnings. It may take several years to fully recover from the pandemic, while recent social unrest highlights the issues facing SA. Despite a large downward correction in property values, we remain underweight this asset class until there is more evidence of where equilibrium market rentals may settle.

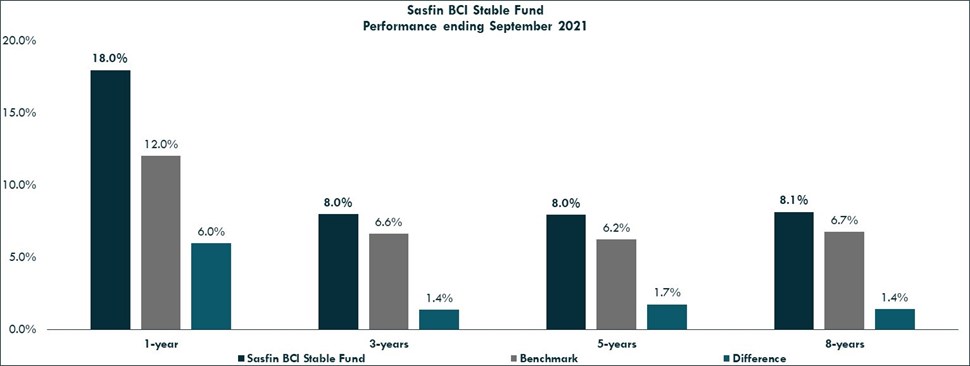

The Fund has enjoyed solid but stable returns over the past year, yielding 18.0% over the past year and 8.0% pa over the past 5 years, ahead of the Fund’s benchmark of CPI. The Fund also remains firmly in the top quartile of performance compared to its peers. Going forward we will continue with our objectives of inflation beating returns, while controlling risk through both strategic asset allocation and individual security selection.

Source: Morningstar. Notes: All performance numbers greater than 1-year are annualised. Annualised return of the fund refers to the weighted average compound growth rate over the measured period; Actual annual figures are available to the investor on request. Benchmark refers to the Average of the ASISA SA Multi Asset Low Equity category.