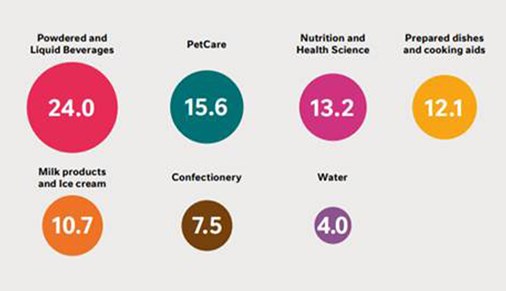

Nestlé is one of the largest global fast-moving consumer goods companies. Its operations encompass powdered and liquid beverages, pet care, nutrition and health science, milk products and ice cream, prepared dishes/ cooking aids, confectionery and waters. Major brands include Nescafé, Nespresso, Nido, Vittel, KitKat, Maggi and Purina.

Nestlé is a defensive stock with 1) exposure to product categories that are arguably less vulnerable to down-trading and have lower demand elasticity, including coffee, infant formula and pet food, 2) high US exposure (where consumer wallet is strongest), and 3) well managed and diversified geographic footprint (see chart on the right) (Russia 2%, China 6% sales in FY2021).

|

Source: Company report, Sasfin Wealth |

Nestlé’s geographic exposure is well balanced between more mature developed markets (59% in 2021) and higher volume growth emerging markets. The contribution to sales from emerging markets has, however, trended lower accounting for 41% of sales in 2021 from 43% in 2017 – a consequence of the portfolio re‑positioning and premiumisation strategy in recent years.

In years to come, 2017 will be marked as a turning point in Nestlé’s history. Since taking office as the CEO in 2017, Mark Schneider has actively worked at repositioning the group in more than 85 transactions...and counting. In this period, Nestlé has rotated 20% of its product portfolio to higher growth, higher margin categories with enhanced premiumisation scope, while also ramping up its digital transformation. Key signposts of the transactions already completed are as follows:

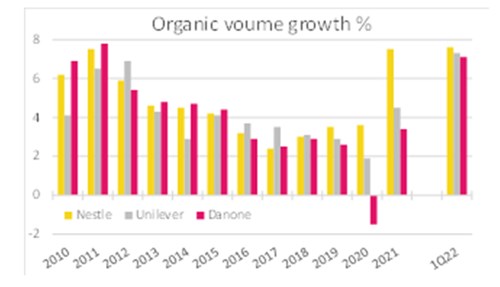

As a result of the abovementioned volume and price drivers, the group’s organic sales growth has recently outperformed its peers (chart on right) and management has elevated its organic sales growth outlook/ guidance to mid‑single digits (4%-6%), bolstered by an improved price mix.

With management indicating that the portfolio review process is still ongoing and that further corporate activity remaining in focus, we anticipate that the abovementioned positive company characteristics that have emerged during the process thus far, are likely to be enhanced further. Nestlé has, if necessary, a readily accessible source of funding for any such strategic corporate action, in the form of its remaining 20.1% equity stake in L’Oreal.

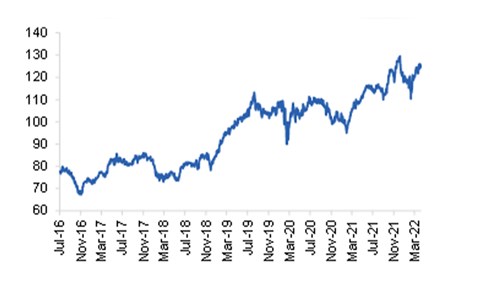

In addition to funding strategic corporate action, L’Oreal share sales can also fund the share buy‑back program, which will support the share price, thus enhancing the stocks defensive quality in the face of interest rate increases. The CHF9.3bn proceeds from the sale of L’Oreal shares in December 2021, have been ear‑marked to fund the around CHF10bn share buy-back in the next 12 months. This is part of a new CHF20bn share buy-back program (2022-2024), initiated as the prior 2020-2022 CHF20bn share buyback program comes to an end.

Nestlé generally scores average or slightly above peers on ESG metrics, which are improving further with ongoing sustainability initiatives. This commitment to sustainability is a vital business imperative in the face of the heightened importance of sustainability to consumer preferences. With a 6% reduction in its carbon footprint in 2021 versus its peak in 2019, Nestlé is on track to achieving its goal of a 20% reduction by 2025 and 50% by 2030.

Like other food producers, Nestlé is facing elevated prices of commodities and other direct and indirect inputs and expenses. Selling price increases will protect margins, however, much price-demand elasticity uncertainty Price elasticities not only differ across product categories and brand positioning within categories, but demand elasticities can change over time and/or change as price increases accumulate. So, while we believe that this risk is ameliorated by Nestlé’s premiumisation strategy and re‑positioned portfolio mix and observe that Nestlé’s demand elasticity appears to be fairly benign thus far, we flag the heightened financial uncertainty during this potentially protracted inflationary phase. The benign demand elasticities are evidenced by the strong organic sales growth reported in 1Q22, and stable volume growth despite the sequentially higher pricing increase of 5.2% from 3.1% in 4Q21.

Infant Nutrition appears to be Nestlé’s Achilles Heel and continues to underperform, resulting in Nestlé taking an over CHF2.1bn write‑off in 2021 on the value of goodwill and other intangible assets associated with the business. Recent headwinds for the business are both structural (declining birth rate globally) and cyclical (lower sales in China on improved confidence in local brands following more stringent quality regulations). In fact, according to data published in “The Lancet” medical journal, 183 out of 195 countries having a fertility rate below the replacement level. This includes China, currently the most populous nation in the world, where the population is expected to peak at 1.4 billion in four years' time before nearly halving to 732 million by 2100.

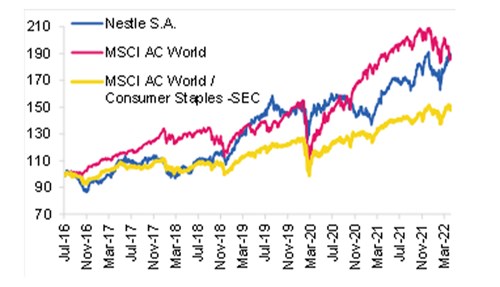

Nestlé (and Consumer Staples generally) is considered a bond proxy, which in theory replicates a bond’s price stability while often offering higher levels of income, making such shares particularly attractive during periods of low interest rates. The corollary to this position is that bond proxies are also sensitive to sharply elevated yields, as is currently the case....and may be for some time. However, we note that the negative correlation between the US 10-year treasury yield and Nestlé’s earnings yield appears to have reversed since the start of 2021, possibly suggesting heightened macro‑economic fears of a recession in 2023 and 2024, making Nestlé’s defensive qualities more sought‑after.

Figure 1: Share price (CHF)

Figure 2: Indexed performance (CHF)