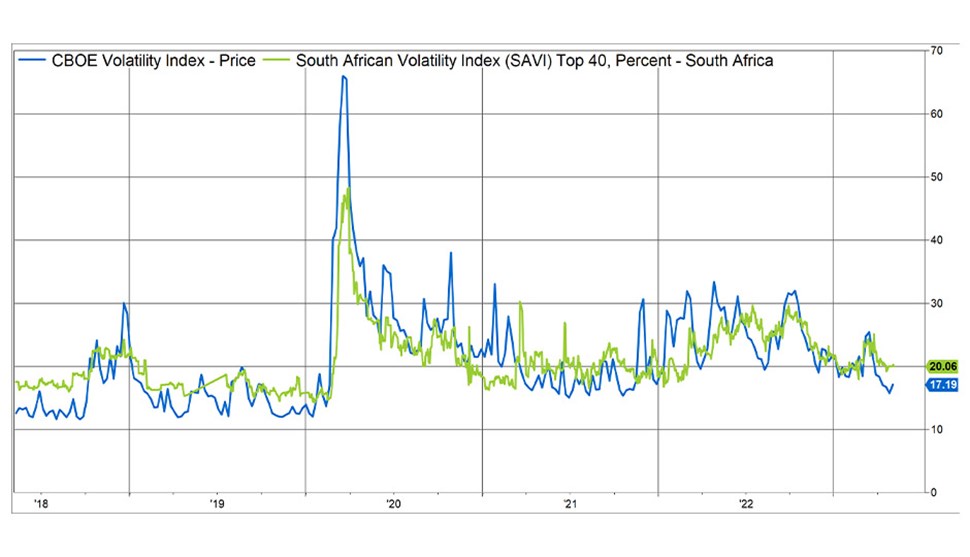

The first three months of the year were marked by considerable uncertainty and market volatility as investors pondered the course of inflation, the magnitude and direction of central bank interest rates, the stability and integrity of financial systems and the robustness of corporate revenues and earnings in a weakening macro-economic environment. While investors didn’t suddenly get clarity on all the issues in April, the month was marked by less volatility and some modest market gains. The five-year chart below shows the course of the VIX index (blue) and the SAVI index (green) which represent the market volatility of the S&P 500 and the FTSE/JSE Top 40 indices respectively. Volatility reduced as the FTSE/JSE All share index gained 2.9%, the S&P 500 gained 1.5%, US quarterly earnings generally beat expectations and as concerns around US regional banks subsided. No daily move on the JSE was more than 1.2% in either direction with the FTSE/JSE All share index trading in a 3,194-point range and closing at 78,218 points. The S&P 500 index remained above the 4,000 level for the entirety of April, trading in a very narrow range of 113 points and closing at an index level of 4,169 points.

Equity Market Volatility – VIX (S&P 500) and SAVI (FTSE/JSE Top 40): Apr 2018 – Apr 2023 (daily)

Source of data: Factset

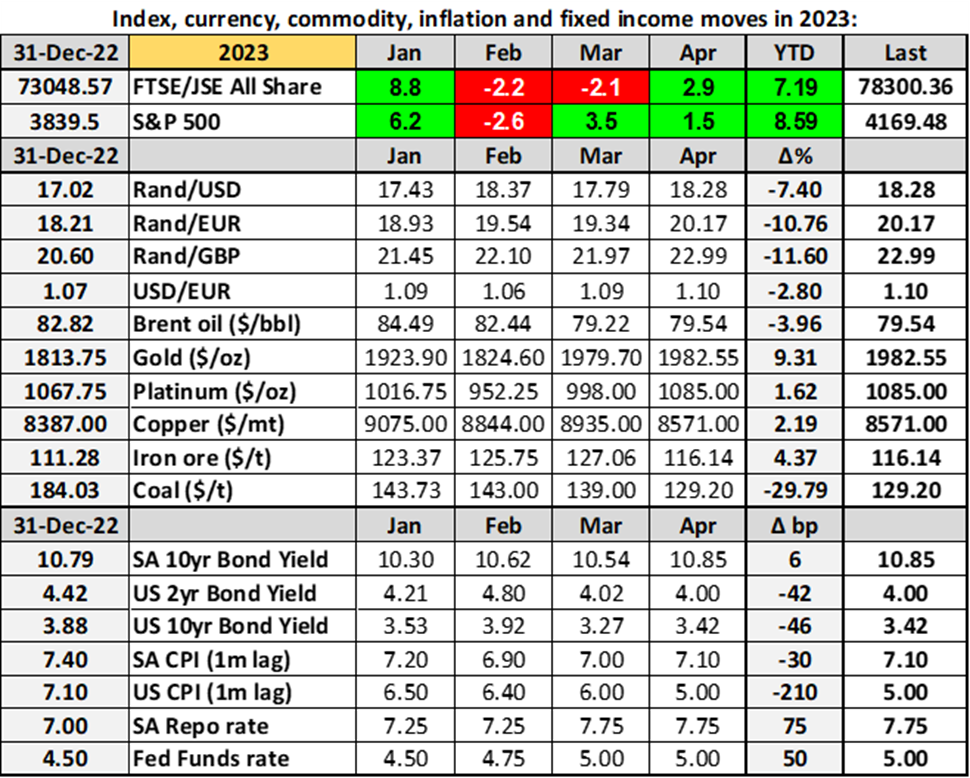

Following central bank rate hikes in the US, Europe and South Africa in March, there were no monetary policy meetings to navigate during April. The markets continued to speculate that the US Federal Reserve would hike rates by a final 25 basis points in May before cutting rates later in the year. The US jobs market remained robust in April to provide little respite to inflation on the wages front. Nevertheless, US inflation continued to decline with the headline CPI declining from 6.0% y/y to 5.0% y/y in the month. However, there was no shortage of reminders from Federal Reserve officials that, despite having fallen from 9.1% y/y in June 2022 to the latest reading of 5.0% y/y, inflation was still well above the targeted level of 2.0% and that there would be no quick easing of policy.

The US earnings reporting season kicked off mid-month with the banking and healthcare stocks leading the reporting. Closer to month-end, the much-awaited results from the big technology names started to come through. While the average earnings result was around a 3-4% decline in earnings per share, around 80% of companies beat market expectations on the earnings line. Results from the major banks provided investors with some comfort that despite mid-size bank troubles, the financial system was still on a sound footing. The results from most of the technology stocks also provided investors with a collective sigh of relief that technology company earnings weren’t going to fall in a heap. Despite positive news from the large banks, concerns still abounded around the health of mid-size regional banks and First Republic Bank was front and centre of those concerns. After customers withdrew $100bn from the bank in the first quarter, First Republic Bank was on the brink of collapse as the month ended and ultimately became the US’ second largest-ever bank failure when JP Morgan stepped in to take over the book on 1 May. This third major bank failure of 2023 followed the collapse of Silicon Valley Bank (third largest US bank failure) and Signature Bank (fourth largest US bank failure) in the preceding months. As the markets moved into May, concerns were still rife over the health of other regional banks including Pacific West Bancorp and Western Alliance Bancorp.

Source of data: Factset

While the US dollar lost only marginal value against the euro in April, the rand lost significant ground against all the crosses in the month. Against the US dollar, the rand lost 2.8% while it lost 4.3% against the euro and 4.6% against sterling. Local bond yields drifted higher with the SA 10yr bond yield tracking the US 10-yr yield higher. At the end of April, the markets were anticipating a final 25 basis point hike from the Federal Reserve at their early May meeting and further hikes from the European Central Bank in the coming months. With headline SA inflation picking up over the course of the past two months and with the latest print of 7.1% y/y still outside the target range and well above the mid-point of the range, further monetary policy tightening was still expected. This is despite the fact that GDP growth expectations for South Africa this year remain barely above zero.

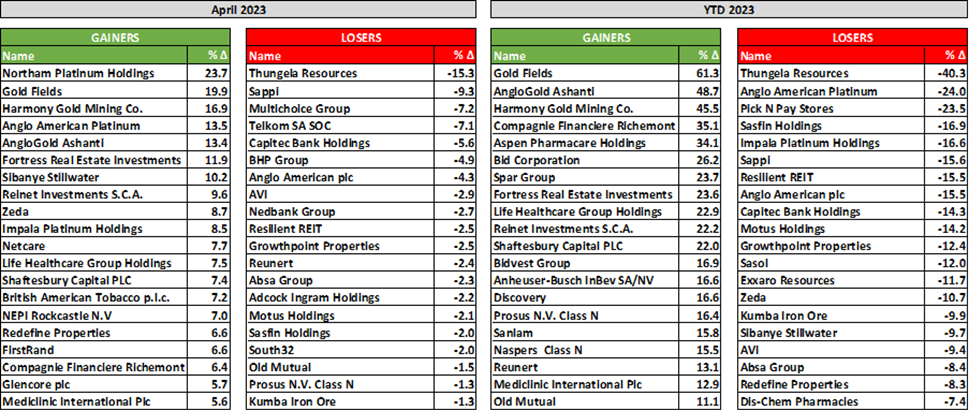

The gold price closed out the month around the level where it started but it did have a brief foray to almost $2,045/oz. The metal continues to have a firm undertone on the back of central bank buying, ongoing geopolitical concerns and falling real interest rates. Gold stocks and platinum stocks were the biggest gainers during the month of April (see table below) with the platinum price gaining almost 10% in the month. The gold stocks remain firmly atop the winners list for the year-to-date while the platinum stocks remain among the biggest losers in 2023 so far.

Winning and losing stocks on the JSE over April and 2023 Year-to-date (price change only):

Source of data: Factset

Following the expected rate hikes from the Federal Reserve (“the Fed”) and the European Central Bank (“ECB”) in May, the market will be watching for signs of the Fed pivot and for more pointers on how much further the ECB still has to go in their hiking cycle. In an environment where the Fed is cutting interest rates and the ECB is still hiking interest rates, investors would expect the US dollar to weaken. Growth in the Chinese economy is expected to pick up modestly post its protracted period of slower growth and that, together with a weaker dollar, should be supportive of commodity prices in the near-term. Corporate results will continue to be a key driver of the market but investors will be watching each inflation release, each labour market indicator and every central bank soundbite for signs of when interest rates will peak and begin declining.