The purchase of a living annuity normally symbolises the transition into retirement. At this stage, the retiree starts drawing income from their retirement capital. A living annuity offers the owner numerous advantages, especially from an estate-planning point of view. In this article, we explore the death benefit options that beneficiaries have with a living annuity during the winding up of a deceased estate.

CHOOSING YOUR BENEFICIARIES

The owner of a living annuity can nominate primary and secondary beneficiaries at any stage once the investment has been set up. Secondary beneficiaries can only inherit the living annuity should the primary beneficiaries die before the owner of the living annuity. A prearranged list of beneficiaries nominated for a living annuity can guarantee that the proceeds are distributed amongst the nominees according to the allocated percentage. Living annuity owners can either nominate individuals as beneficiaries or they can allocate the living annuity death benefit to a trust.

DEATH BENEFIT OPTIONS

Upon the death of the owner of a living annuity, the value of the annuity is distributed amongst the beneficiaries. Beneficiaries have the following three options when accessing the death benefit:

Option 1: Commute the full benefit as a cash lump.

Option 2: Transfer full benefit into a new living annuity in the beneficiary’s name.

Option 3: Combination of cash lump sum and new living annuity.

Depending on the option selected, there will be tax implications that are outlined in the following sections of the article. The beneficiary can, with the assistance of a wealth advisor, select the option that suits them best based on their financial needs at the time.

COMMUTING THE FULL VALUE AS A LUMP SUM

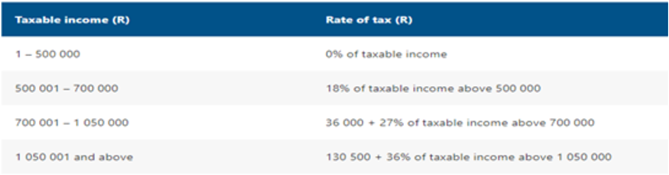

When a beneficiary elects to receive the living annuity death benefit as a cash lump sum, the funds will be taxed in the hands of the deceased owner. The funds will be taxed according to the retirement lumpsum categories in the table below. The deceased owner’s contributions to retirement funds that did not previously rank for a deduction in terms of the Income Tax Act (ITA), will qualify as a deduction before applying the retirement tax table. The beneficiary will receive the net cash lump sum after the tax calculated as per the table below has been deducted from the living annuity death benefit.

TRANSFERRING THE FULL DEATH BENEFIT TO A NEW ANNUITY

When a beneficiary elects to transfer the deceased living annuity into a compulsory annuity in their name, the transfer is tax neutral. The income payable from the new annuity will be taxed in the hands of the beneficiary, according to their marginal tax rate.

The deceased’s contributions to retirement funds that did not previously qualify for a deduction, will not be considered as an exemption for annuities as stipulated in Section 10C of the ITA and will only be available to the person who made those contributions.

COMBINING A LUMP SUM AND NEW ANNUITY

When a beneficiary chooses to commute a portion as a cash lump sum and for the remaining balance to be transferred to a living annuity, the two portions will be taxed separately as discussed in Options 1 and 2.

IMPORTANCE OF NOMINATING A BENEFICIARY

With regards to distributing proceeds to beneficiaries, living annuities are not subject to Section 37C of the Pension Funds Act. This means that the owner’s choice of beneficiaries is final. While the proceeds of a living annuity are not included in the owner’s deceased estate, the annuity will however be included in the estate if beneficiaries have not been nominated. This nomination of beneficiaries is therefore critical, as the inclusion of the living annuity in the deceased’s estate will attract executors’ fees, although no estate duty will be levied. To conclude, it is important that the beneficiary nominations be reviewed regularly as and when the circumstances of the living annuity’s owner change.