Apart from a period of about ten years, when he was employed by various other banking and financial services groups, Roland has been associated with Sasfin since 1962, culminating in his retirement from the Group in December 2018.

After a year’s regulatory gardening leave, he will return to the Board as a Non-Executive Director in 2020.

In this wide-ranging interview, we discuss Roland’s philosophy of entrepreneurship and deal-making, the influence that his various mentors, including his father, had on him along his journey, as well as some of the day-to-day complexities involved in running a large-scale, diversified Group such as Sasfin in the 21st century.

BS: Tell us a little bit about yourself. Where did you grow up, how did you end up working in the financial services sector?

RS: The story starts in the mid- 1940s. Directly after World War II, together with my family, as an infant, I immigrated to South Africa from the United Kingdom. My father was one of seven brothers and two sisters living in England, the United States, Brazil, Argentina and France.

Collectively, the brothers were in the textile manufacturing business, and it was against this backdrop that my father set up an importing and wholesaling business in South Africa and Zimbabwe (then Southern Rhodesia), and Zambia (then Northern Rhodesia) under the names Sassoon’s Textiles and Sasstex, selling textiles for school uniforms and other basic needs.

The ‘winds of change’ started to blow in Southern Africa in the 1960s. In an attempt to withstand the aggressive trade sanctions that had led to regime change in Zimbabwe, the apartheid regime in South Africa introduced aggressive tariff and quota protection for local industry, which was the beginning of the end of our family’s textile importing business.

After school, I joined my father’s declining textile business. We effectively sold our surplus import permits to importers of high fashion fabrics. We then saw that we could make a turn by granting trade finance to these importers, but unfortunately, we lacked the necessary expertise, which resulted in credit losses.

I decided that, notwithstanding these setbacks, business finance was the ideal career for me, as it was a far more sustainable business. I was always interested, and in fact, stimulated by the world of business finance which is vital for economic and employment growth. However, the big banks were too bureaucratic to satisfy the needs of their entrepreneurial small business customers.

That being said, I had a lot to learn, so I left my father and spent about ten years with four banking and finance institutions, whilst I studied part time for a CIS diploma. While all this was happening, my father kept going as a one-man-show by discounting bills and post-dated cheques.

I met Eva, my wife-to-be at Barclays Bank where we both worked. When we decided to get engaged, she left the Bank and joined my father as his bookkeeper. I then joined my father a couple of years later and we built up Sasfin in trade, debtor and equipment financing. The rest, as they say, is history.

BS: Talk us through one or two of the largest challenges you faced during your tenure at Sasfin. I can imagine the multiple banking crises can’t have made doing business easy.

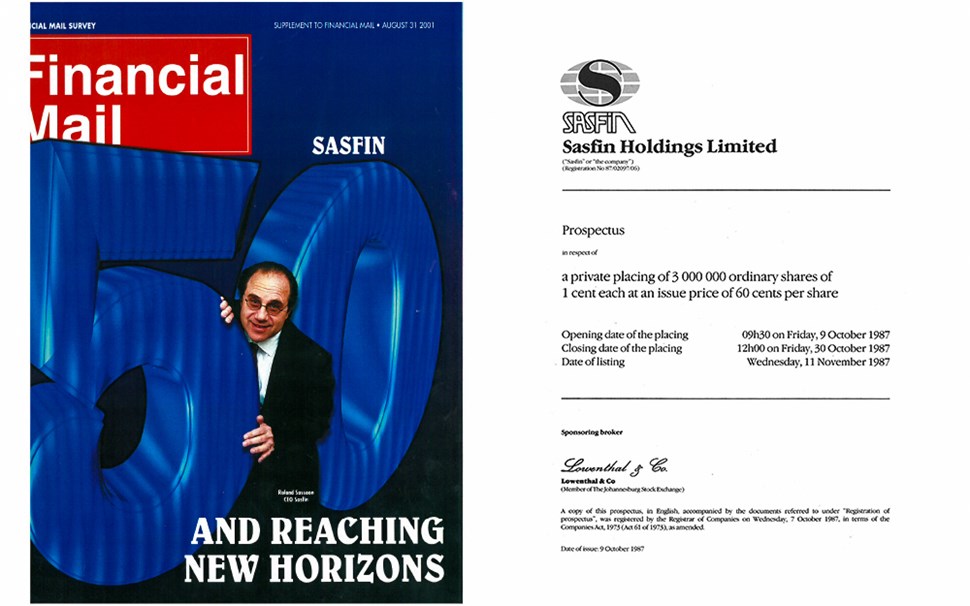

RS: Sasfin grew strongly after I rejoined the Company. This, however, presented a problem, as we started to run out of liquidity as we hit our facility limits with our bankers. I embarked on a number of initiatives to disintermediate from the banks. These were the listing of Sasfin on the JSE in 1987, pioneering securitisation in 1991, getting a bank licence in 1999 and acquiring Frankel Pollak Securities, which we renamed Sasfin Securities, a private client stock broking business in 2000, which gave us access to private clients.

These moves, though complicated and time consuming, culminated in Sasfin becoming the financial institution that it is today.

The Reserve Bank was awarding bank licences quite freely in the 1990s – in fact, Sasfin was the last of the small bank licences that was awarded at that time. In 2001, there was a run on small banks in South Africa brought about by an irresponsible report issued by a rating agency, following what was termed the Asian Contagion in the Far East. Because our deposits were well spread from the high net worth clients of Sasfin Securities, there was no run on Sasfin. Some 30 small banks disappeared from the market in a short space of time. The next big crisis happened in 2008 after Lehman Bros collapsed in theStates, which resulted in the freezing of securitisation markets worldwide. As luck would have it, we were about to roll over most of our securitisation paper of R700m. After many sleepless nights and a lot of sweat and tears, we managed to place the full R700m plus an additional R200m in the market, due to the exceptional performance of our book and the loyalty of our investors.

BS: Name some of the greatest day-to-day operational challenges facing a diversified company such as Sasfin?

RS: My wife Eva, who headed up our admin and accounting in the early years, used to complain about having to have separate systems for all our activities. She always asked, “why don’t we specialise in one product like all the other small finance companies?” Luckily for me, Eva was brilliant and despite her complaints she was always on top of the accounts, which is so important in our business.

Although this diversified model is certainly not the most efficient for a small institution, it is far more sustainable than being a one-product shop, as firstly, it caters for all the needs of the client, and secondly, you are well positioned, given the swings and roundabouts in the economy. To me, long-term sustainability was always vital. I prefer to sleep well rather than eat well.

BS: With some of the well-documented challenges facing the local economy, how can established companies – particularly those in the retail and manufacturing sectors – adapt and withstand these pressures?

RS: As you say, the local economy has huge challenges. Most of the state-owned Enterprises, as well as government, provincial and municipal departments are in terrible financial trouble, due to mismanagement.

This especially applies to Eskom, which is central to the entire economy. The resultant drain on the Treasury is taking South Africa’s debt levels into unsustainable territory. To add to our woes, the ruling party is heavily factionalised, resulting in the leadership having to watch its back, which to some extent puts the economy on the backburner.

Sadly, our population growth exceeds our economic growth, which means that we are going backwards and South Africa is expected to be downgraded to junk by the last of the rating agencies, Moody’s. Added to all this, unemployment and with it, crime, has become a huge issue. There is no quick fix to this downward spiral, but with time, I do believe that we’ll start seeing some successes, but we must expect a fair amount of turmoil during this interim period.

All businesses in South Africa and elsewhere, whether in retail, manufacturing or anything else, must reinvent themselves to adapt to the Fourth Industrial Revolution, brought about by an explosion of technology. Fortunately, as South Africans are very entrepreneurial, I have no doubt that we will see many in retail, manufacturing and other sectors successfully navigating their way through these obstacles, although clearly there will be, and in fact already are, a number of failures along the way.

BS: Running a listed entity can be incredibly demanding – how (if at all) did you manage a healthy work/life balance?

RS: The main focuses of my wife and I were our family and Sasfin and not always in that order. Unfortunately, there wasn’t a lot of time for other activities. Having said that, I have no regrets. I always enjoyed Sasfin, even when the dark clouds started to gather.

BS: Who were some of the influences whose mentorship you relied on early on in your career?

RS: There are too many to mention – teachers, directors, employees, my father, lawyers, accountants, my wife, the SARB and of course, books like Man’s Search for Meaning by Viktor Frankl, The Seven Habits of Highly Effective People by Stephen Covey and From Good to Great by Jim Collins. I try to follow what is taught in the Ethics of our Fathers where it says, “Who is a wise man? One who learns from everyone.”

BS: The theme of this newsletter is around corporate malfeasance in South Africa and how Portfolio and Fund Managers can identify the right companies and instruments to invest in, in order to protect and grow their clients’ wealth. What traits do you look for in a prospective business partner, borrower or client to ensure a degree of integrity in your investment?

RS: Sasfin has always adopted a negative test in assessing impact financing and investing, i.e. we will not finance any immoral enterprise. An example of this is Adult World who we declined for this reason. Integrity is essential in dealing with clients and investees. We do our best to select wisely in this regard, but mistakes are inevitable. The trick is to exit quickly as soon as we discover a lack of integrity amongst stakeholders. An example of this was Sasfin’s dismissal of KPMG as its auditor, when their association with some of the Gupta scandals became apparent.

BS: What is the greatest investment you have ever made?

RS: Acquiring Frankel Pollak Securities– which has evolved into the present Sasfin Wealth business, which has become a great pillar for Sasfin with huge potential.

i) What advice do you have for those wanting to close a deal?

RS:

ii) Which of those milestone acquisitions over the years had the greatest impact on Sasfin’s operations and sustainability?

RS: The acquisition of Frankel Pollak Securities.

BS: What is your favourite holiday destination and why?

RS: The Wilderness in the Garden Route– it’s beautiful, quiet and there is lots to do for the youngsters.

BS: Sasfin has in the recent past been criticised for its seemingly high cost-to-income ratio. Obviously growing the top line is critical, but how challenging is it in terms of the regulatory environment for a company such as Sasfin to maintain a reasonable cost base and yet still grow?

RS: Sasfin’s cost-to-income ratio is high, partly because of the sizable relative contribution to Group earnings of Sasfin Wealth (approximately one third) – Wealth businesses tend to operate at a higher cost-to-income than banks. If you were to look at the other larger banks, their Wealth Management businesses make up a much smaller, relative component of their businesses.

Furthermore, as Sasfin is very diversified, we lack economies of scale in any one area. If you compound this with our high touch service and a highly complex, onerous and costly regulatory environment, together with a weak economy, a high cost-to-income ratio is inevitable. Having said that, this is not where we want it to be, and we must scale up and become more automated in some of our middle and back office processes.

“I was always interested, and in fact, stimulated by the world of business finance which is vital for economic and employment growth.”

BS: How important was the presence and influence of your father, Sydney Sassoon, in shaping your approach to business in the early years?

RS: I was privileged to have worked for my father for about seven years, which was vital in shaping my approach to business. Most importantly, he taught me the soft skills of customer service, spreading risk while remaining focused, attendance, honour and reputation, humility and respect. I cannot overstate his importance in my development. He was open minded and encouraged me to be the same.

My father was very charitable and would often quote the following from The Ethics of our Fathers, “If I am not for myself, who will be for me? But if I am only for myself, who am I? If not now, when?” I took this to heart and I’m pleased to have passed this vital value on to my children.

BS: How do you relax in your spare time?

RS: Reading, exercising, family, friends, keeping abreast of world and business affairs.

BS: What advice do you have for young entrepreneurs or young graduates looking to grow in a business?

RS: It is important, firstly, to have a long-term and sustainable vision – as I said, sleeping is more important than eating. As Sasfin has effectively been family controlled, we were able to make some important long-term decisions, which would not have been easy for professional management.

Coupled to this, you must be very focused on your mission – the business should occupy your mind constantly. My favourite slogan is “attend, attend and attend” – don’t abdicate your responsibilities.

Below are a few additional tips to assist you along your journey: