The two pots at the end of the retirement rainbow

This article will focus on the proposed two-pot retirement fund system that will permit for partial withdrawals before retirement and compulsory retirement savings for all members.

The South African retirement fund system has undergone significant changes over the past years with an aim to improve the sustainability and administration of retirement funds for the ultimate benefit of fund members. The National Treasury’s latest discussion paper titled, "Encouraging South African households to save more for retirement", has proposed further changes to retirement funds by introducing suggestions relating to the mandatory enrolment of formal sector workers, governance of umbrella funds and the two-pot retirement fund system. This article will focus on the proposed two-pot retirement fund system that will permit for partial withdrawals before retirement and compulsory retirement savings for all members.

NATIONAL TREASURY’S MOTIVE TO INTRODUCE THE NEW TWO POT RETIREMENT FUND SYSTEM

According to the National Treasury, an alarmingly high percentage of retirement fund members do not preserve their retirement savings when changing jobs which leads to very poor retirement outcomes. Furthermore, discretionary savings are low which puts cash strapped South Africans under financial pressure when they cannot meet their emergency needs in the short term.

For these reasons, the proposed changes are essential to address retirement fund members’ short-term financial needs while making certain that their long-term retirement savings goals are met. The discussion paper offers proposals designed to allow limited access to retirement fund savings prior to retirement. Retirement fund members who experienced financial hardships because of Covid-19 have expressed support for the new system as businesses had to shut down because of low economic activity in South Africa, which led to rising unemployment.

The Treasury intends to improve household savings by increasing preservation before retirement and increasing flexibility through partial access to retirement funds through a two-pot retirement system. In addition, the Treasury mentions that permitting access to one-third of future contributions at any point and removing the option to withdraw the full amount upon resignation will discourage retirement fund members to leave their jobs to access retirement funds.

HOW THE TWO-POT SYSTEM WILL FUNCTION?

The two-pot retirement system proposal is currently being considered through the first discussion paper released for public consultation. This system will permit the rearrangement of retirement contributions into two pots:

Although the South African government wishes to support people to survive challenging current circumstances, it also wants to address the issue of reliance on the state during retirement. The two-pot retirement system will ensure the protection of vested rights on accumulated retirement savings before it takes full effect.

HOW THE PROPOSED TWO-POT SYSTEM MAY LOOK

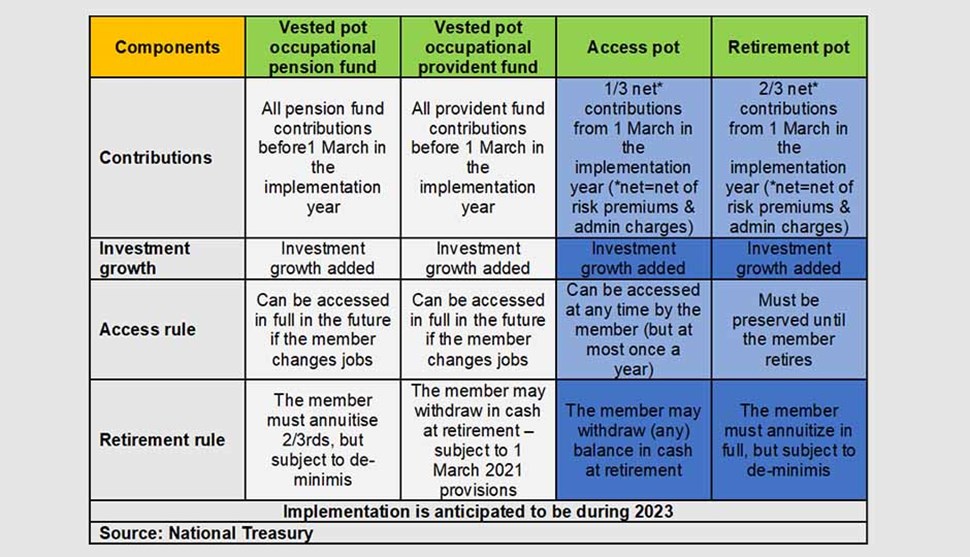

The discussion paper proposes that the system includes retirement annuity funds, defined-benefit funds, pension preservation funds and provident preservation funds. The table below illustrates what the two-retirement fund system as proposed by the National Treasury in its discussion paper might look like.

The occupational pension vested pot means a member's contributions plus investment growth accumulated up to the implementation date of the two-pot system can be accessed in full in the future if the member resigns and at retirement, the member must annuitise two thirds, unless, if the total retirement benefit does not exceed R247 500, the member may take the full retirement benefit. On the other hand, the vested pot for an occupational provident fund means a member's contributions plus investment growth amassed up to the implementation date of the two-pot system can be accessed in full in the future when a member leaves their job and at retirement, the member can opt to withdraw the balance in cash subject to legislation introduced on 1 March 2021.

The Treasury discussion paper further suggests that:

THE WAY FORWARD REGARDING THE TWO-POT RETIREMENT SYSTEM

Looking ahead there is expected to be much deliberations before the suggested two-pot system could be approved and implemented. Public comments on the National Treasury discussion paper need to be submitted by 31 January 2022. If the public is interested in contributing to this process, they may send their comments to retirement.reform@treasury.gov.za.