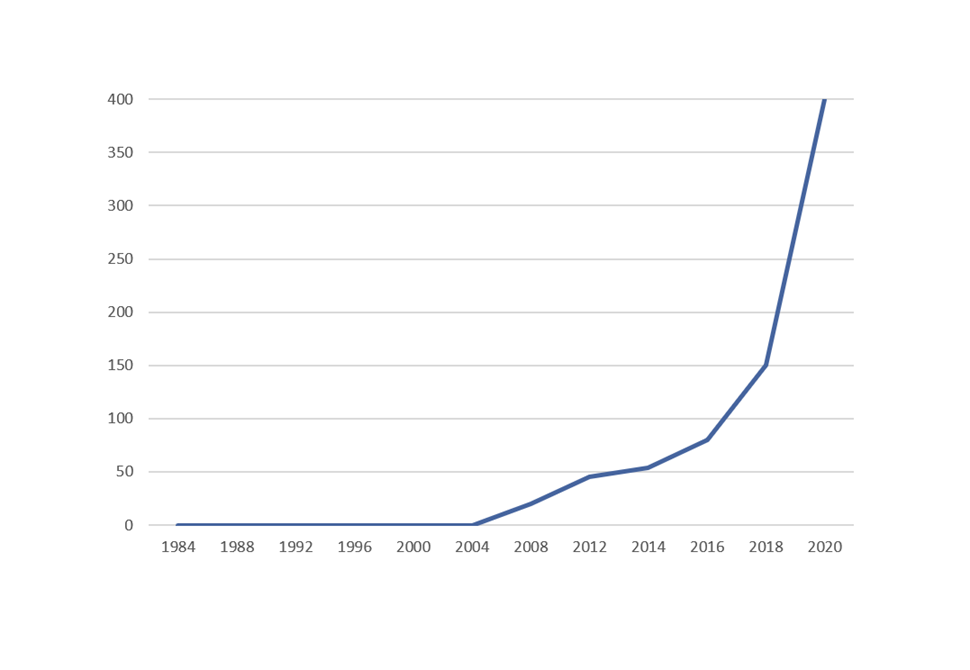

There is no doubt the world is radically shifting more and more digital, and we see no reason for this trend to stop.

ASML is an incredibly company that supplies hardware and software to the semiconductor industry. The team at ASML believe Moores law will hold for 8 or 9 years. What does it mean if ASML are right and computing power gets 60 times more powerful over the next decade? What will the world look like?

Adidas appointed Kasper Rosted as their CEO in 2016. One of the first things he did is make “digital” an agenda item in their weekly exco meetings. Nike appointed John Donahoe as their CEO in 2019. John is the Chairman of Paypal and was the CEO of eBay.

What we are seeing is CEO’s with digital skills taking over the reins in traditional companies.

Some of the largest tech companies are cloud based. Think Netflix as well as Paypal. The square meterage of data centres exceeds the square meterage of skyscrapers globally and is growing at a much faster rate. Snapchat paid $150million for developer Looksery in 2015. Snapchat used Looksery technology to launch their lenses. This feature allows you to do things such as vomit rainbows when you stick your tongue out. That’s a form of Artificial intelligence. But what if we could use similar Artificial intelligence and put cameras on tractors to allow farmers to zap weeds and deploy fertilizer with pinpoint accuracy? This would make their operations much more efficient and environmentally friendly.

Blue River Technology is a company that focuses exactly on this space. They were bought by John Deer in 2017. Have a look at their website. The opportunities globally may not be technology companies as such, but rather businesses within old school industries that use technology to disrupt.

I heard a fantastic podcast last year where the guest said, “saying you are a technology investor now is like saying you were an electricity investor 100 years ago”. Everyone is using technology to help improve their businesses, from banks, to hospitals, to old school businesses like farming.

Companies need to adapt to the changing landscape and prepare for a digital world. Investors need to explore these types of opportunities and adjust their portfolios accordingly.