This is meant to be the age of the machine, where new technology seeks to enhance and improve the delivery and usage of various types of financial products and services. This is meant to be the age of machine-aided investing and its transformation of the investment industry with its ability of predictive analytics, sifting, processing and interpretation of an increase in exponential amounts of data in the blink of an eye.

Institutions are already adopting machine-learning and tools to make portfolio recommendations react to financial markets, as well as testing advanced investment ideas. Whether machine-aided investing makes the market more efficient or gives investment managers an edge, will play out in time. According to a prominent Asset Manager, an advocate of this type of investing is meant to reduce the emotion out of investing where “everything is rational” (sic). But emotions are essentially what makes us human, so should all emotion be disaggregated from investing?

Wealth, its accumulation and enjoyment are intermingled with human satisfaction. Long-term investing is meant to return the accumulated wealth to the investor, such that human satisfaction can be realised – but at what cost and how do they accrue?

What if at the end of the longterm investing, with enough accumulated wealth, there was nothing meaningful to enjoy, as everything had been sacrificed along the way for profit or performance?

“...emotions are essentially what makes us human, so should all emotion be disaggregated from investing?”

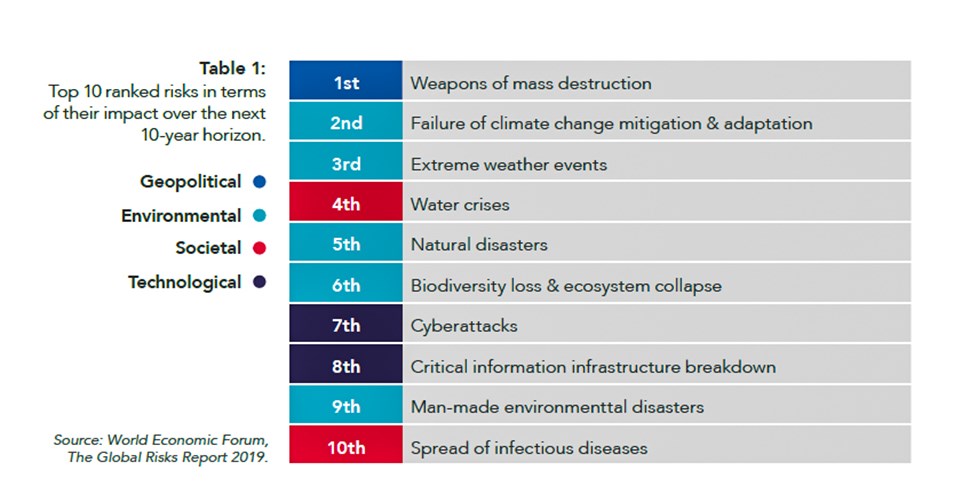

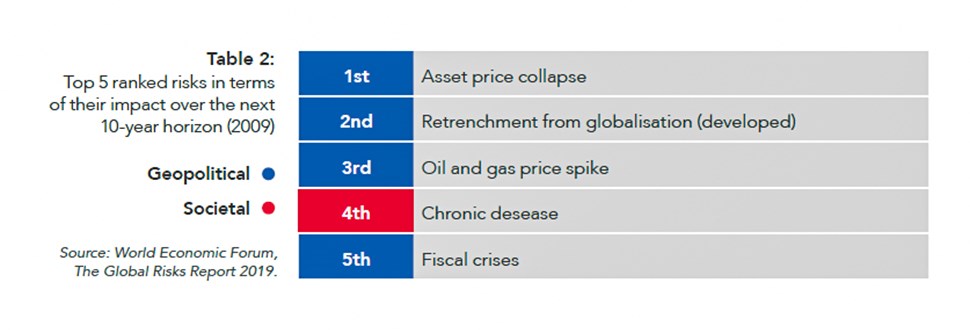

Note that there are no Economic risks listed versus 10 years ago where Economic risks dominated the Top 5.

Whilst continuing to search for the next investment winner, be it an instrument, manager or strategy, what if the bigger picture is missed, if we just consider the main risks in terms of their impact in Table 1 as per the World Economic Forum, The Global Risks Report 2019?

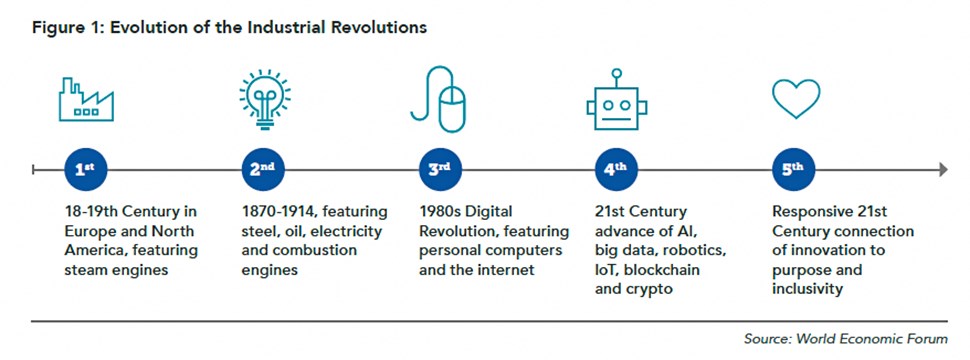

A recent article by the World Economic Forum, stressed that “The advance of the Fourth Industrial Revolution (robotics, artificial intelligence, augmented reality, virtual reality and the like) has produced a developing scenario in which the service of humanity seems too often eclipsed by the momentum of technology and commerce.”

The article further states, “Meanwhile, our economic engines continue to roar and belch proverbial smoke into the air, as the world’s population grows and the ideals of human flourishing are left wanting.”

The Fifth Industrial Revolution (5IR) as shown in Figure 1 (page 14), has a definite differentiation to the Fourth Revolution where degrees of dehumanisation were encouraged. >

“Responsible investing in whatever form needs to remain as part of the future of investing! Whilst it may seem that this is a somewhat of a worn-out topic and that progress has been made, it can be challenged whether it was ever taken seriously, and yet, it’s the right thing to do!”

In the 5IR, technological advancement and innovation are skewed toward the service of humanity by those championing the 5IR cause.

“At first glance one might think that nothing could possibly remain to be said on the topic of responsible investment. At any given moment, hundreds of dissertations, books and conferences are being devoted to the subject,” Philippe Zaouati, Chair, Investment Leaders Group.

Responsible investing in whatever form needs to remain as part of the future of investing! Whilst it may seem that this is a somewhat of a worn-out topic and that progress has been made, it can be challenged whether it was ever taken seriously, and yet, it’s the right thing to do!

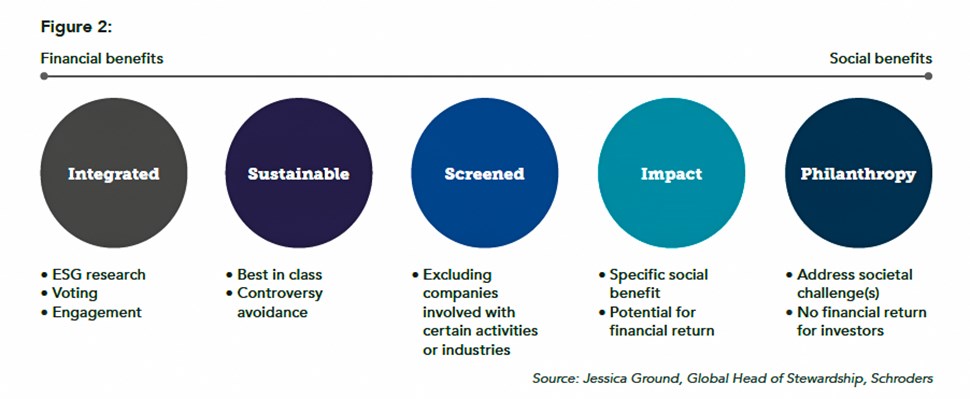

Responsible investing should remain as an evergreen similar to the active/ passive or balanced/ specialist discussions. There are suggestions that whilst the investment research landscape has had minimal change over the last few decades, this will be one of the factors that will be reshaping the landscape. The proper integration in investment decision making process will allow for some notable shift, whilst there have been challenges experienced in responsible investing, including an array of definitions, each targeting some form of responsible-type of investing, as per Figure 1.

There’s also confusion with regards to scoring of companies, where various criteria are used to rank companies, or there is little or no consistency between service providers on the scoring or accepted data-reporting standards leading to this confusion. Whilst there is some variation of descriptions, there remains significant areas of shared interest and purpose (see figure 2).

A common and seemingly valid concern around responsible investing, is whether investors will reach the rate of return required to meet their investment goals. However, the mindset has to shift beyond this, with investors having the ability to engage and affect change in companies’ policies, from the business as usual approach, to drive to seek new forms of value creation.

Investing must place more emphasis on the Triple Bottom Line (TBL), which leads companies away from focusing on just profit and includes two other components, i.e. people and the planet. Profits will remain important in the TBL, but not at the expense of the remaining components and this can equate to the Profits with purpose outcome.

Whilst responsible investing has had its challenges and may continue to do so, what is undeniable is its importance. For those linked in some way to investments, the avoidance of the subject is not an option and must be taken more seriously.

Responsible investing is more than just tree-hugging – it is about insightful and deliberate investments that have the potential to deliver strong and more stable returns, making the world a better place and the sooner this is taken more seriously, the better.

“The investment industry cannot argue that it bears no responsibility for the choices that it makes beyond financial outcomes – to do so would be to ignore its broader social and economic function as an allocator of capital in market-based economies.”