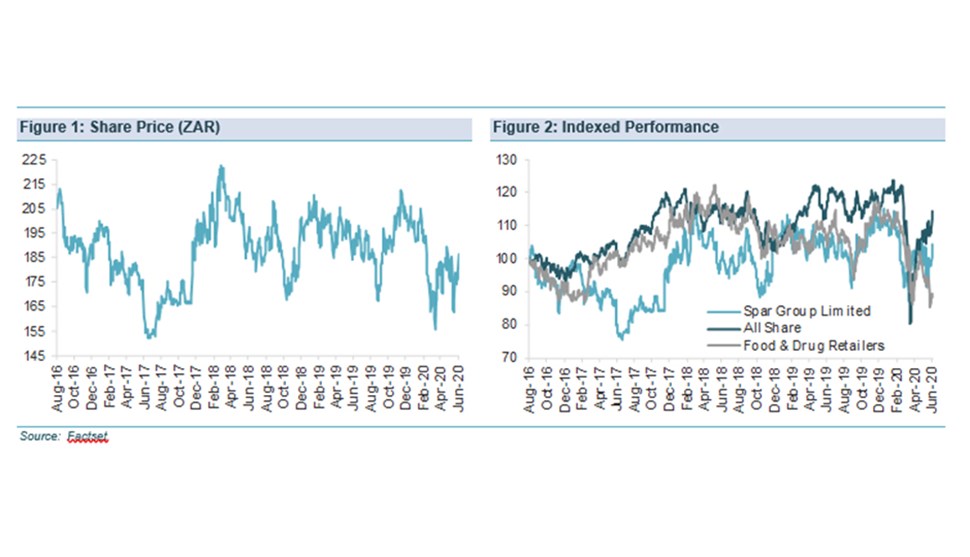

Spar Group remains one of our key defensive SA Inc. counters, to the extent that; a) it operates in the defensive segment of retail, b) has a geographic diversity of earnings sources, c) has self-help levers in the off-shore operations, which provides some earnings growth momentum and finally, d) its ZAR hedge quality.

- Spar Group is a wholesaler and distributor of goods (food, groceries, liquor, building products & hardware and pharmaceutical products) and services to, largely independently owned, stores under multiple banners, including: SPAR, SUPERSPAR, TOPS, SaveMor, Build it and Pharmacy in South Africa and XL, Londis, Mace, Maxi & TopCC in Ireland & Switzerland and very recently Poland.

- It executes these functions through its distribution centres, which are strategically located close to the major metropolitan areas.

- The group’s multi-decade success has been built on generating economies of scale off its distribution centre infrastructure by consolidating the buying requirements of, distributing to and providing operational and marketing support services to the highly fragmented independent food & grocery, liquor, building & hardware and more recently, the pharmacy segments.

- One of Spar’s key competitive advantages is its expertise in operating a highly efficient distribution operation: Spar has built up a competitive advantage in distribution, considering it has fifty years of experience as a wholesale distributor in South Africa and leveraging off the eighty years of diverse wholesale distribution experience of the broader international Spar organisation.

- Spar's robust business model in which it effectively enjoys large retail market shares, but only operating 15 distribution centres (8 in SA, 3 in Ireland & United Kingdom, 1 in Switzerland and now also 3 in Poland), which has certain inherent advantages over pure‑play wholesalers, pure-play retailers and 3rd-party logistics operators.

- Location and convenience advantage: The group has historically been well-positioned in convenient neighbourhood locations as many of the historic ‘corner café’ owners have upgraded to the Spar banner. This has fuelled Spar’s market share growth as modern lifestyle dynamics such as smaller housing units and time-starved dual income households, among others, that have driven a trend towards more frequent shops and emphasising convenience.

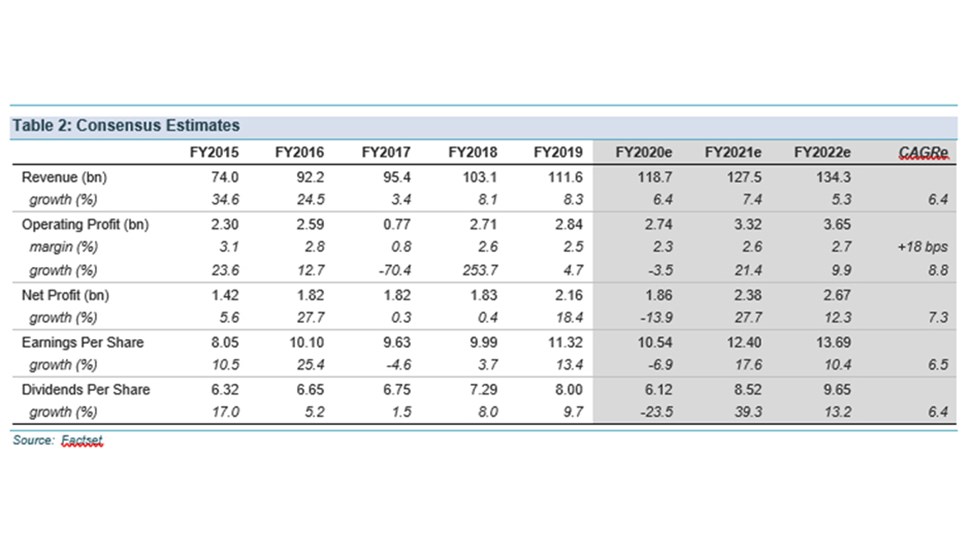

- Historically being essentially a wholesaler also meant margin upside, and hence earnings growth upside, was capped as scale and incremental distribution efficiency benefits plateaued amid the progress of consolidation within the South African independent retail segment and non-participation in the retail margin.

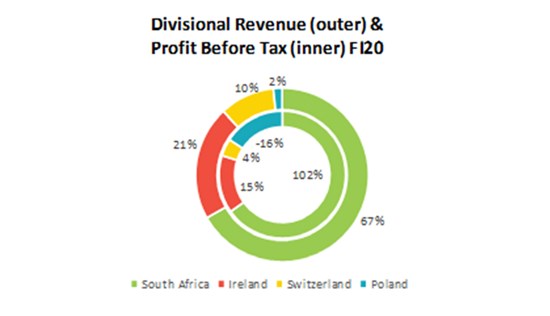

- Management have systematically overcome this margin growth plateau by; a) adding other fragmented independent retail segments where scale benefits could be extracted from consolidation – first liquor, then building and hardware, followed by pharmacy, b) growing the, higher margin, house brand, fresh produce and prepared meals participation in-store and c) with no further related consolidation options available in South Africa, acquired operations in Ireland and Switzerland and recently Poland.

- The offshore acquisitions boosted our assessment of Spar’s potential medium‑term earnings trajectory, due to the fact that these distribution operations were not as efficiently organised as the South African distribution function, presenting an element of margin enhancement from self-help measures such as the insourcing of distribution (Spar SA's forté) and enhancing the level of service to these stores encouraging an increased level purchases from Spar, and thus driving sale benefits.

- The convenience market bias and higher corporate ownership of stores (particularly in Switzerland) of its European businesses results in a merchandise mix that allows the group to generate product higher margins.

- Finally, the offshore businesses introduce a Rand hedge aspect to the group and diversifies its geographic sources of revenue, thus lowering business risk.

- A key risk facing the group is the timing and success of the integration and improvement of the acquired offshore operations. To date the Irish has made consistent progress while the Swiss operations have proven more challenging. With the Polish operation’s effective acquisition date being 1 October 2019, it is too early to judge its progress, but it must be noted that at acquisition, the Polish operation was in a business rescue process.

- Given its historic South African roots and the convenience bias of its stores, particularly in Europe, Spar’s average basket pricing has generally tracked above that of its peers. While this price premium has narrowed in recent years, the high price consumer perception generally remains intact. Furthermore, while shopping convenience has become increasingly more important than pricing, this perception could weigh on market share during periods of heightened consumer spending pressure.

- Heightened sales and earnings forecast risk in terms of volatility and timing as a result of the disruptions to normal trading patterns and additional costs from COVID-19, both during the pandemic and possible changes in consumer behaviour thereafter