These savings will continue to provide the group with flexibility to 1) buffer earnings pressure relative to its listed peers during the expected difficult trading conditions in the medium term; and/or 2) support volumes (and either hold or potentially gain market share) by investing in price to moderate internal selling price inflation in the face of consumer pressure.

- Pick n Pay operates in the retail sector, focusing on groceries, clothing & general merchandise and additional value-added services, primarily in South Africa, but also with a presence in Namibia, Botswana, Zambia, Swaziland, Lesotho and Zimbabwe.

- The group has historically been well-positioned in its core upper‑middle and upper income largely urban population groups, with a strong store presence in these areas.

- The group’s relative market share and dominance was diluted somewhat over the years as modern lifestyle changes in shopping behaviour was not timeously met with the necessary changes in the company’s operational structure.

- The group’s modernisation, its restored ability to compete effectively in the modern supermarket landscape and a turnaround in its dwindling fortunes began in 2013 when Richard Brasher, the man who was instrumental in the transformation of the UK supermarket group, Tesco, took the helm at Pick n Pay.

- Pick n Pay is a defensive investment, operating in the food and grocery sector. Its defensive nature is enhanced by its more resilient middle to upper income customer bias, and even its exposure to clothing retail is defensively focused on value, basic lines, rather than fashion ranges.

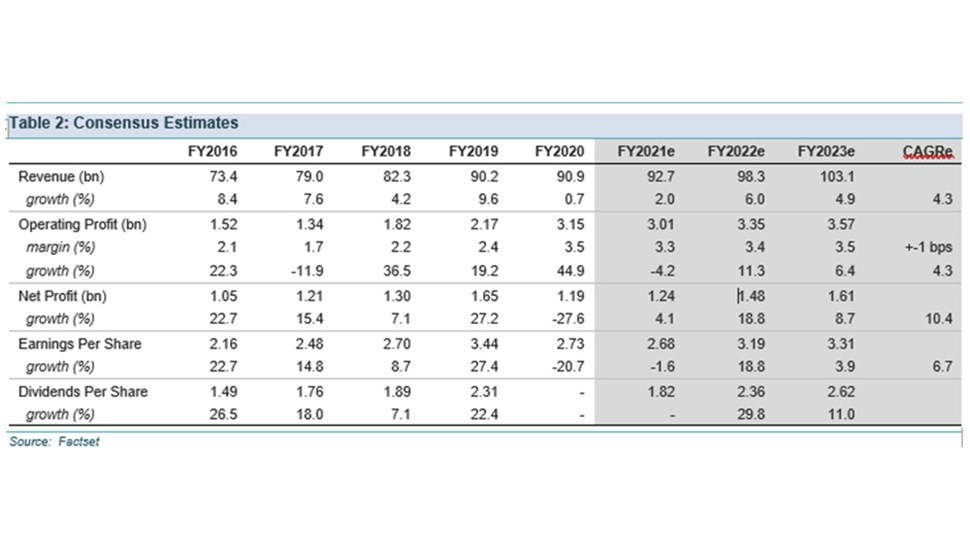

- The transformation of the business, which is nearing completion and included initiatives in centralised support functions, the consolidation of regional buying teams, streamlining the head office and renegotiated employment terms, will continue to provide a boost to the group’s earnings growth trajectory over its domestic peers, as it drives its profit margin back to historic levels of over 4% from the current 3.45% level – peers Shoprite and Woolworths Food arguably have little room to increase from their current levels of around 5% and 7%, respectively.

- In addition to further cost savings (R1bn targeted over the next two years) and operational efficiencies, the key benefit from the transformation strategy, which will have a strong positive impact on the profit margin is the ability that the central distribution model gives Pick n Pay to revise its store estate and stock ranges. This entails reducing its rental area without sacrificing trading space by reducing the receiving infrastructure and stock storage space at store level – typically 40-50% of the total rented space.

- This action also frees up capital to address the group’s historic under-investment in second tier nodes/peri-rural areas and improves distribution to smaller format stores, thus supporting the group’s participation in the convenience segment ‑ a key growth area in the food and grocery retail sector in recent decades.

- The released capital from the existing estate will allow further investment in margin‑enhancing areas such as clothing (estimated 5% of sales) and improving fresh ranges and private label (estimated 22% of sales) innovation initiatives while supporting earnings growth, strong free cash flow generation and dividends to shareholders.

- The more recent development of better‑defined store segmentation and suitably curated ranges will also facilitate volume sell-throughs on products and thus attract keener pricing from suppliers.

- We are somewhat concerned about the imminent departure of the CEO. Richard Brasher, with his superb pedigree as a retailer and flawless execution, has been instrumental in turning around Pick n Pay’s performance. While the ground‑work has been laid, we are a little wary as to the future given that the turnaround is not yet complete and no visibility yet as to Richard Brasher’s successor.

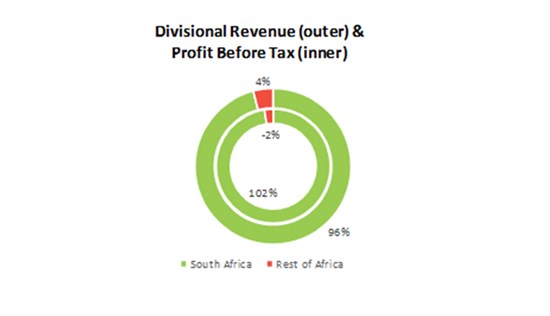

- While Pick n Pay has some exposure to other Africa countries (approximately 5% contribution to sales), which has added a small measure of earnings boosts at times, but more often drags, the group’s exposure is limited and its approach to further expansion, very cautious. We remain dubious that the African region will ever be a significant earnings boost and so prefer a lower exposure.

- Heightened sales and earnings forecast risk in terms of volatility and timing as a result of the disruptions to normal trading patterns and additional costs from COVID-19, both during the pandemic and possible changes in consumer behaviour thereafter.