South African Retail trends in 2022 and beyond

In a consumption economy such as our own, retail sales are a key component of economic growth. South Africa’s retail sales growth has, however, been lacklustre at best in recent years. But what factors drive consumers to spend?

Key Drivers of Retail Sales

The key drivers of retail sales are economic growth, which in turn drives employment growth and real wage growth. These, in turn, influence consumer confidence and their propensity to spend. Consumer confidence also motivates consumers to augment their spending power by drawing on savings and/or taking on credit. Social grants also support retail spending.

Finally, retail sales are also influenced by the level and movement of interest rates and inflation. For some time now we’ve been concerned about the health of the drivers of retail spending, which has informed;

1) Our underweight retail portfolio positioning,

2) Our preference for less discretionary food & grocery retailers,

3) Retailers with some international exposure and/or self-help turnaround potential.

In this article, we will limit our discussion to the latest dynamics around the economic growth outlook, employment and retail sales.

Economic growth outlook

At least 4%, but ideally above 6%. That is our ‘back-of-a-matchbox’ estimation of the economic growth rate required to meet the long list of demands on the fiscus.

These include;

That’s not to mention the additional growth required to;

In light of the abovementioned (by no means exhaustive) list of financial demands, it is disappointing that over the past five years to 2021, the South African economy has grown by a mere 0.2% per annum in real terms (nominal 5.5% p.a.). Furthermore, it is overwhelming to grapple with the paltry medium-term growth rate of between 1.3% and 1.5% p.a. expected by most economists and the Reserve Bank. Such a low growth rate will do next to nothing to sustainably drive an improvement in consumer wealth and an increase in retail sales.

Employment

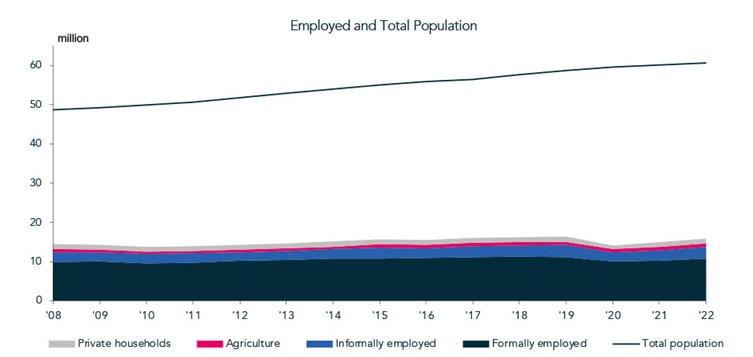

The latest Quarterly Labour Force Survey for Q3 2022 recently published by Statistics South Africa was encouraging at face value. Over 1.6 million people have been employed since the trough of the pandemic lockdown in June 2020. However, the total number of employed people is still over 600,000 fewer than pre-pandemic (1Q2020).

In fact, since 2008 (the start of this data series) the employed population has grown by 9.2% to 15.8 million, but the total population has ballooned by almost 25% during that same period to 60.6 million according to Statistics South Africa’s latest mid-year population estimate. This places an enormous burden of support on the pool of employed individuals.

Source: Statistics South Africa, Sasfin Wealth

Retail Sales

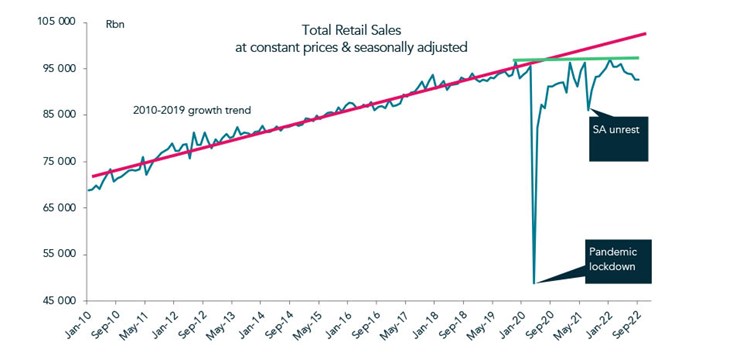

In order to assess the impact of the drivers of retail spending amid the extreme recent disruptions, we believe it would be instructive to consider the retail sales at constant prices and seasonally adjusted.

Source: Statistics South Africa, Sasfin Wealth

Evident from the graph above, is that while retail sales recovered sharply from the pandemic, on aggregate, they have failed to breach the 2019 pre-Covid level (green line). Of even more concern is the increasing divergence of retail sales below the average growth trend recorded from 2010-2019 (red line).

What's clear though is that there has been minimal real retail sales growth on a compound growth basis across all the retail categories against pre-pandemic levels. This speaks to the fact that South Africans are becoming poorer (demonstrated in negative GDP per capita...down 6.6% since 2013, or -0.9% p.a.).

Furthermore, a shift in spending between the various retail categories in recent years is also evident.

Source: Statistics South Africa, Sasfin Wealth

Essentials (food, pharmaceuticals & toiletries) currently accounts for 62% of nominal retail spending, up from 51% in 2008. This has largely been driven by higher average inflation (6.6%) in these categories, together with relative demand inelasticity - consumers don't buy fewer items in response to the higher prices.

On the other hand, spending on more discretionary categories (clothes, furniture, hardware & other) has shrunk their collective share of wallet to 38% from 49%. Lower average inflation (4.2%) has supported spending on discretionary items.

Conclusion

It is for the abovementioned reasons that we are underweight Retail in our model portfolio and we believe that the food & grocery retailers and pharmacies are in a better position to grow their sales and profits during the prevailing high inflation period.