Negative household savings rate, high levels of personal indebtedness, low levels of financial literacy and high levels of unemployment are some of the key contributors to this reality. The Covid pandemic has once again highlighted the vulnerability of so many individuals and households and the need to have the necessary financial plans and structures in place. It's for this reason that all the elements and parties involved on this savings journey towards a comfortable retirement is critical to understand.

Saving for retirement should start with the first salary cheque you earn. This could be in the form of a compulsory contribution to your employer’s retirement fund or a voluntary contribution to a tax-free savings or retirement annuity of your choice. Never before have there been so many options for individuals to provide for retirement in a cost and tax efficient manner. The most important part is to make all your savings options work together in a synchronised way as part of an overall financial planning strategy.

When it comes to your retirement the Trustees or Management Committee and the advisors to the fund would largely be concerned with the risk and investment benefits related to you as a member of an employer’s retirement fund. Whatever advice or benefits are provided would not necessarily consider your complete personal financial picture which could result in the ineffective allocation of your monthly retirement fund contributions.

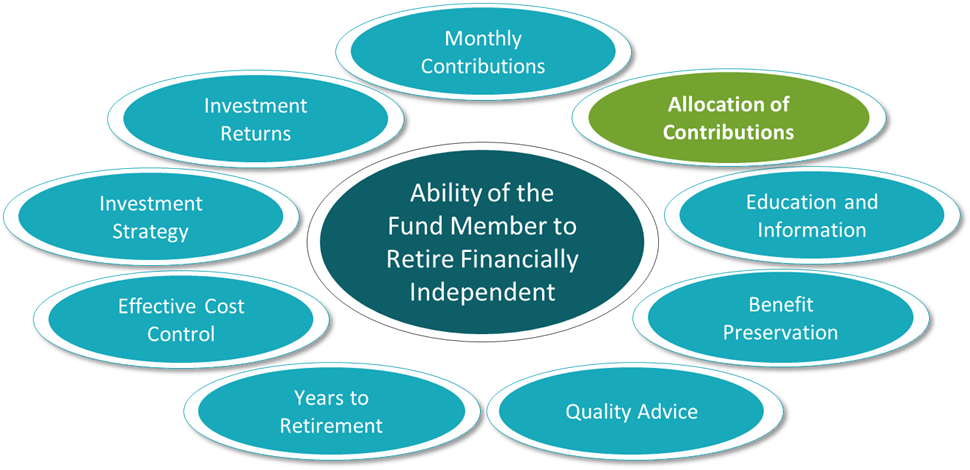

In order to ensure that your monthly retirement fund contributions are speaking to your personal needs and long term financial objectives the key elements of your risk needs, medical aid cover and investment need to be considered. Given the limited financial resources of most employees a trade-off is required between each of these elements. Depending on your life stage, your health and your financial situation you may need to allocate more of your monthly contributions to your risk needs or your investments or medical aid plan.

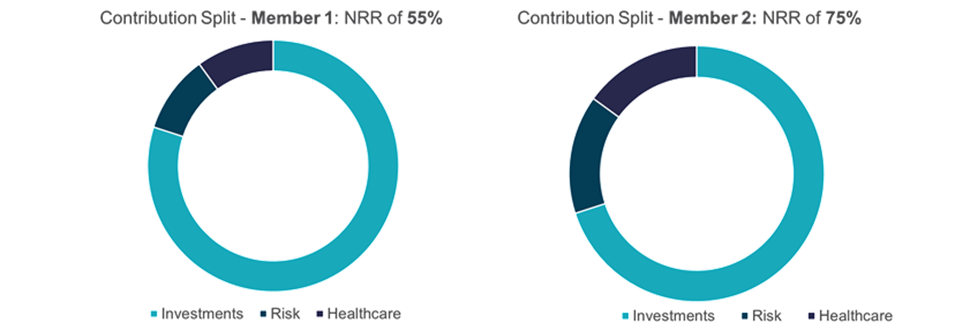

Every year you receive your benefit statement that shows you how much risk cover you have and how much you have saved towards retirement based on your monthly contributions and the market growth on your contributions over time. Knowing how big your retirement savings pool is still does not tell you how much income your savings pool will be able buy you and for how long in retirement. To try and fill this gap many funds also provide members with their Net Replacement Ratio that accompanies the benefit statement. The limitation of this exercise is that it only considers the retirement savings that the member holds in the fund, ignoring any preserved benefits accumulated with previous employers or voluntary savings in the form of a retirement annuity. Member 1 and member 2 below clearly have different priorities in terms of their contributions given the difference in their readiness for retirement. Member 1 needs to start allocating a greater portion of the monthly contribution to the investment component of their financial plan in order to achieve the required 75% industry benchmark for financial independence during retirement.

To overcome the constraints and limitations posed by the fragmented savings model of retirement funds we need a new model that truly puts the interest of the member at the centre of the fund. Members need to be empowered through the necessary flexibility in the allocation of their contributions, be able to see their fund benefits as part of their bigger personal financial picture and have access to relevant tools and information that allows them to make more informed financial decisions.

It was with this purpose in mind that the Sasfin Wealth Umbrella Retirement Fund (SWURF) was designed. The SWURF offers the members of participating employers a flexible and integrated retirement savings solution. Not only can members custom make their contribution splits to meet their unique personal risk and investment splits but they can also preserve any benefits accumulated with previous employers and make additional provision for retirement through a retirement annuity. Members are able to view all their risk and investment benefits through the Member Web portal or SWURF App on their smart phones on a consolidated basis.

The SWURF App allows a member to perform a Net Replacement Ratio exercise at any time and to construct different scenarios based on their life stage and years to retirement. Members are also able to include any benefits that have been saved up outside the fund in order to get a true reflection of their level of financial readiness for retirement. Based on these results the member can have a more informed discussion with their financial advisor when it comes to determining their financial planning priorities, be it risk, investment or health.

Participating employers and fund members of the SWURF have access to supplementary service offerings such as healthcare consulting, financial planning and estate planning. In addition SWURF fund members also have access to benefit counsellors who can assist them with information in order to make a more informed investment decision when moving jobs or at retirement. This service is offered free of charge and is available to all members at any point in their retirement journey.

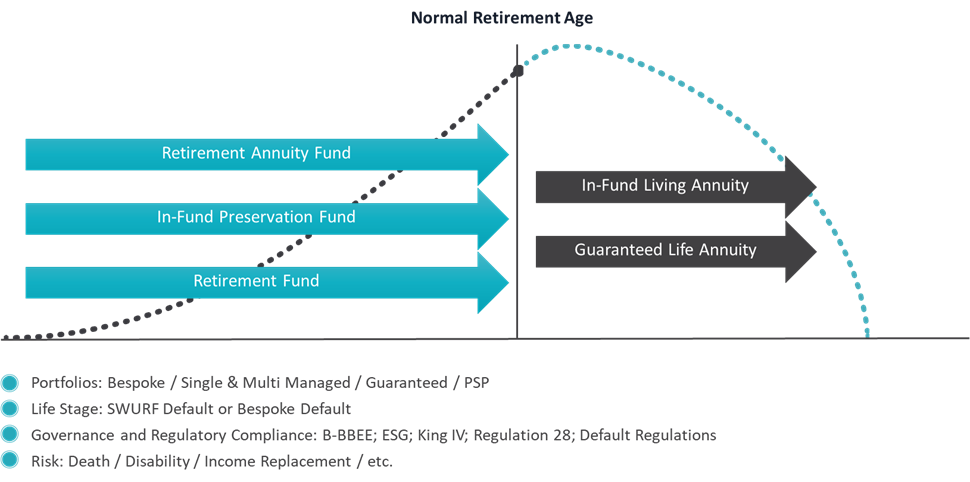

Members of participating employers in the SWURF are able to transfer benefits from a previous employer to the preservation fund or to the retirement fund of their new employer. Any additional savings over and above their monthly retirement fund contributions can be made to the Retirement Annuity option. The same investment fund or strategy can be used by a member across any of the pre-retirement savings vehicles in SWURF. This allows for a co-ordinated investment strategy and consolidated member investment reporting.

A member that resigns and moves to a new employer can remain invested in the SWURF Retirement fund as a paid up member or move to the SWURF in-fund Preservation Fund, which allows for the preservation of retirement fund benefits. Preservation is one of the very critical requirements for members to accumulate sufficient capital for retirement and is one of the reasons for why Default Regulations were introduced as part of retirement fund reform.

When reaching retirement a member can either select the in fund Living Annuity option or a guaranteed life annuity option as a monthly retirement income solution. When selecting the SWURF in-fund Living Annuity option the units of the pre-retirement investment portfolio strategy can be seamlessly transferred from the various pre-retirement savings vehicles into the SWURF Living Annuity. This allows a SWURF Living Annuity fund member to avoid market timing risk or unnecessary investment fees and also for the continuation of the investment strategy that the member knows and trusts.

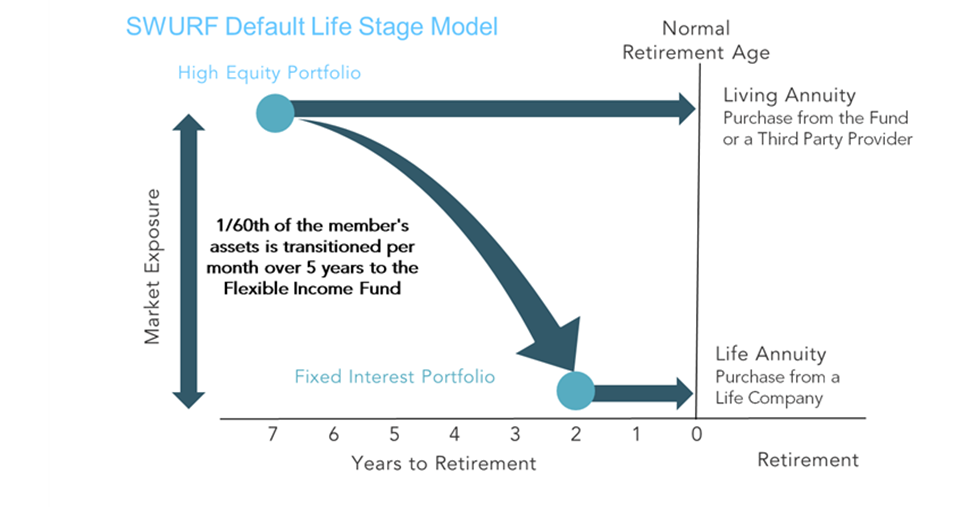

The SWURF default life stage strategy allows for a smooth transition from pre to post retirement where the member is looking to purchase a life annuity at retirement. This allows the member’s benefits to work as long and as hard as possible in the markets for them by taking on the appropriate amount of investment risk during their active working life. The smoothed reduction in market exposure ensures that members avoid any market and capital risk close to retirement and for the maximum monthly income to be purchased by means of a guaranteed annuity.

The SWURF is fully transparent from a cost and service fee perspective with no cross subsidisation of fees between the administration, advice and investment elements. Participating employers can evaluate the fee they pay for the value provided by each service provided to the fund as per the ASISA Retirement Savings Cost Disclosure Standard (RSC).

SWURF is a well governed retirement solution that allows for truly independent and personalised advice. It speaks to the very important guidelines and requirements contained in the King IV Code on Corporate Governance, Default Regulations, TCF and RDR principles as well as Regulation 28. Member and fund data are protected against cyber security risk by means of proper governance, information technology policies, security firewalls, daily data back-ups, a disaster recovery plan and the necessary insurance cover.

Given that retirement funds hold the core of the savings of South Africans during their active working life the employers, Trustees and Management Committees have a critical role to play in ensuring that members meet their personal financial goals. This requires a more integrated approach to retirement that empowers the member. Employers should therefore select a retirement fund solution that offers their employees and fund members the necessary flexibility, choice, consolidation, integration and regular communication as well as the necessary human and technological support.

For more information on the SWURF offering please contact Bongiwe Momoza, Senior Asset Consultant at Sasfin Wealth.