The Sasfin BCI High Yield Fund was launched in July 2019 as an investment vehicle for investors looking for a consistent high-income, high-liquidity fund. The investment objective of the fund is to provide significantly higher yields than cash and money market funds over the medium to long-term whilst also preserving capital and limiting capital volatility. The fund is categorised as a Short-Term Interest-Bearing Portfolio, and may invest in bonds, fixed deposits, and other interest earning securities. The weighted average modified duration is limited to a maximum of 2.

Watch the video below to learn more about this fund:

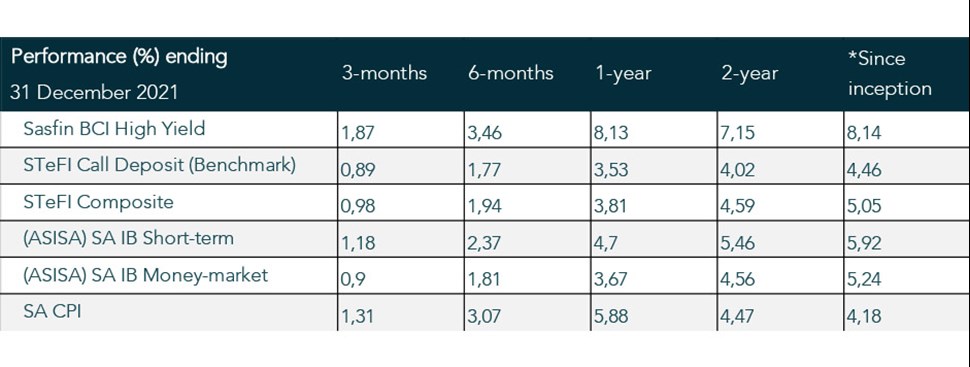

The fund has achieved excellent returns since inception and ranks in the top quartile in its category. Noticeably, the fund was best performing in its category for 2021 and ranks 1st since inception. The fund has consistently outperformed its benchmark and peers in its category (See Performance Summary table below).

The fund primarily invests in high credit quality Floating Rate Notes, which generally provides minimal volatility and capital risk. As at end-January 2022 , over 90% of the fund’s assets are invested in assets with a credit rating of AA or above, and 68% of the fund is invested in high quality, liquid bank assets. Over the past year, the average traditional Money Market Fund yielded only 3.67%, earning a below inflation return. During this period, within the High Yield Fund we were able to take advantage of the steepness in the yield curve and attractive swap rates, investing in a variety of assets that on average yielded above 8%. Importantly, we were able to achieve this while reducing the overall credit risk in the fund, and further diversifying our asset base.

This year we expect the SARB to continue normalising rates, as global interest rates also rise, but we see little room for them to hike rates aggressively, and we will position the fund accordingly. In this period of rising rates though, we do expect to continue to provide our investors with similar if not better returns than what was achieved over the past year.

Current Fund Yield and Duration (end-January 2022):

Fund factsheets can be found here.