Sasfin BCI Flexible Income Fund - Quarterly Update

The 3rd quarter of 2021 provided markets with much food for thought, as US inflation concerns, some significant policy shifts in China and rising energy prices created an uncertain outlook.

The 3rd quarter of 2021 provided markets with much food for thought, as US inflation concerns, some significant policy shifts in China and rising energy prices created an uncertain outlook. Although equity markets took somewhat of a breather in the quarter - with both the S&P 500 and the MSCI World Index both essentially flat for the quarter, there is still significant risk appetite in markets, as global bond yields remain subdued by historical standards. This narrative is the primary market driver - that of TINA – There Is No Alternative. Although the US Fed has communicated that a tapering of the QE programme will begin – most likely before the end of 2021, actual interest rate hikes are still some way off.

There are some early signs of an economic slowdown in China, and this was also compounded by a shift to what was termed a “shared prosperity” drive, rather than an unfettered capitalist approach. In September a default event by Evergrande, the largest property developer in China gave rise to global worries about a Lehman-style crisis, which could have the potential of developing into another global financial crisis. It does appear though that the fallout will be relatively confined from a financial systemic perspective. However, if it impacts in some way to consumer behaviour in China, a consumption and investment slowdown there will certainly have wider impacts - in particular on commodity producers.

A debate still rages around the inflation trajectory, and whilst most observers see it as being transitory, there are concerns that the global supply-chain issues are going to be compounded by rising oil prices, with spot oil prices continuing to rise. Oil prices are up roughly 55% year-to-date, and are certainly cause for concern, as they may also prove to be a brake on the global economic recovery. Indeed, US bond yields also rose in tandem with the rise in energy prices, with the 10-year bond yield - after testing a low of below 1.2% in July - rising to end the quarter at around 1.6%.

What is surprising about the local markets in the 3rd quarter was the absence of a significant downside move in bond, equity and FX space after a major lapse in law and order during the July riots. Markets appear to be taking the lead from global developments rather than local, although it may be argued that asset prices already reflect a rather gloomy SA outlook.

The JSE All Share Index reflected international indices and was down 0.8% for the quarter. The SA bond market also reflected global moves, with 10-year yields rising from around 9.6% to 9.9% by quarter-end. This, coupled with the steepness of the yield curve, continues to provide income investors with access to very high real yields.

Inflation remains fairly well contained, and with the economy still in the doldrums (albeit recovering from the extreme lows of 2020) the outlook remains favourable from an interest rate perspective, with the SARB holding rates steady at the MPC meeting.

We continue to believe that the market remains too pessimistic about the possibility of rate hikes, and this provides us with ample opportunity to add positions within our funds.

At the beginning of 2021 we indicated that we believe active duration management will be the key performance driver for the year, and certainly this belief has been vindicated. Due to the low point of the short end of the curve persisting, floating rate securities linked to the 3-month JIBAR rate (around 3.7%) have been underperforming relative to longer dated fixed rate securities. Investors have therefore been engaging in a chase for yield in this space, causing credit spreads to narrow over the year.

We believe this is overdone and have a preference for investment in the 10-15-year range of bonds, which average around 9.7% through the year.

As global inflation concerns rose, we reduced duration again towards quarter end, but with bond yields having now risen further we have already started to deploy some cash assets into the 10-year space. Although SA bonds will remain vulnerable to risk-off events, there is sufficient “fat” built into valuations such that the upside in yields is likely to be reasonably muted.

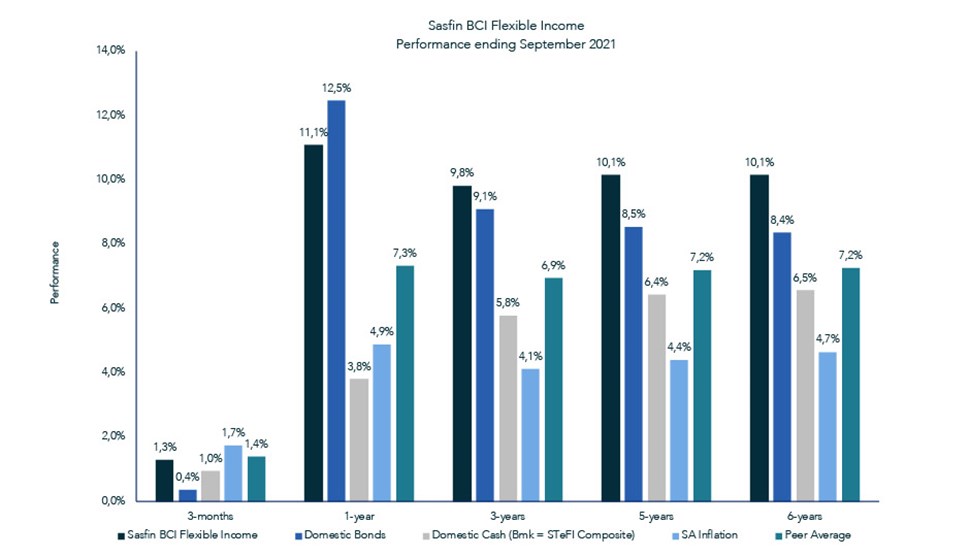

In terms of investment performance, the fund continues to deliver, returning 11.3% over 12-months and consistently remaining in the top quartile on a peer group basis. The fund will continue to benefit from the accommodative monetary policy stance from the SARB coupled with the steepness of the SA yield curve. We expect active duration management to remain key to fund performance, and we note that in the last quarter of 2021, a number of significant risk events lie ahead.

The Medium-Term Budget Policy Statement will likely be bond market positive due to Revenue overruns, whilst on the downside, the local elections may prove to be unsettling against the backdrop of a struggling economy. We therefore expect to lock in gains where possible in order to reduce volatility over this period.

Source: Morningstar Notes: A-class; Inception of 01 July 2015; Peer average refers to the ASISA SA Multi-Asset Income average; SA Inflation lagged. Annualised return is the weighted average compound growth rate over the measured period; Actual annual figures are available are available to the investor on request. Fund highest and lowest calendar year performance (at 31 December 2020); High = 14.22%; Low = 8.42%. Benchmark = STeFI Composite