First, just to re-iterate our key observed differences between Anheuser and its key international peers, Heineken and Carlsberg, which on a net basis balances strategic positives and negatives. Of these, only Anheuser (ANH) is listed on the JSE, so the strategic positioning will be used to assess the value of the SA-listed instrument.

- Positives on scale and diversification (operations, geographically and product portfolio) are weighed by negatives of double-edged Emerging Market (EM) bias (heightening foreign exchange sensitivity to costs and financial translation, volatile, but generally higher volume growth), greater debt-induced financial pressure, and over-indexing in mainstream and discount beers in its largest markets, relative to peers that over-index in Premium and Super-premium segments. In the almost decade to 2019 volumes have consistently declined in the Discount and Mainstream categories and grown in the Premium and Super-premium categories. While to focus to re-balance its portfolio is moving the needle in certain focus markets, notably the US (about 30% of sales), there is still a way to go.

- Anheuser has number one positions in a number of mainly EMs. Heineken also has a diverse geographic spread, albeit more matched between Developed (DM) and EMs. Carlsberg has the least geographic diversification, with a European/Developed market bias...and, topical at the moment, exposure to Russia (10% of sales).

- While generally higher than developed markets, emerging market volumes and more importantly revenue growth, has disappointed expectations. This is particularly relevant for ANH since the SABMiller acquisition, and particularly in Africa, and in-so-doing raising financial pressure and returns by severely delaying acquisition debt reduction.

Now for the main event, our current thoughts on Anheuser in a minute or more...

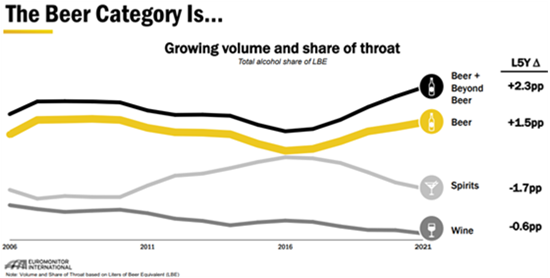

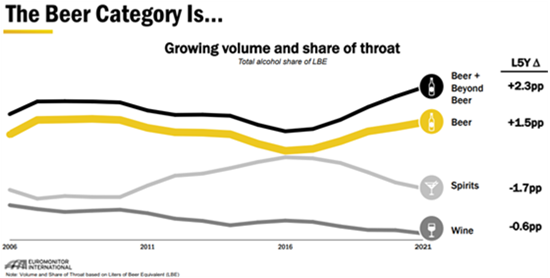

Post-pandemic (2021) market share momentum appears to be positive for beer (versus spirits),

Source: Anheuser-Busch 2021 Investor Seminar

...and pandemic and post-pandemic (2020-2021), positive for Anheuser (versus peers). To the extent that this is very different to the pre-pandemic trend, one must ask how sustainable this momentum is. On the positive side, we note that the group has been focussed on re-balancing its portfolio towards the substantially faster growing ‘Beyond Beer’ segments of premium, healthier alternatives such as low/no calorie/carb and hard seltzers, particularly in the key US market. ‘Beyond Beer’ currently accounts for only about 3% of sales for Anheuser. However, momentum may be weighed by adverse weather in Brazil (about 12% of sales) since Q3 2021 and rising pressure on consumer discretionary spending as intense inflation raises the cost of living.

|

Organic revenue growth (%)

|

Anheuser

|

Heineken

|

Carlsberg

|

|

2021

|

15.6

|

12.2

|

10.0

|

|

2020

|

-3.7

|

-11.9

|

-8.4

|

|

2019

|

4.3

|

5.6

|

3.2

|

|

|

|

|

|

|

Total beer volumes 2021 (m hlr)

|

509

|

231

|

120

|

Source: Company reports, Sasfin Wealth

Note: Heineken and Carlsberg’s underperformance since the pandemic reflects their greater exposure to the heavily pandemic lock-down impacted European regions, with 42% and 61% versus Anheuser’s estimated 5%.

- The group’s recent upbeat outlook for 2022 is supported by recent positive momentum behind two of its shifted strategic priorities announced at its Capital Markets Day in December 2021, namely 1) shifting the focus from being the category leader to leading the category growth through organic category expansion with occasion-development, premiumisation and ‘Beyond Beer’, and 2) driving growth through its digital business-to-business (B2B) and direct-to-consumer (DTC) platforms (BEES and Ze Delivery), which have shown quick payoffs in the markets in which they have been introduced thus far.

- In contrast to this positive sales momentum, the start of 2022 suggests a challenging year for profitability, with higher input costs (exacerbated by further expected transactional foreign exchange headwinds) and ‘re opening/normalised’ operating expenses, only partially offset by higher pricing considering volumes hold up against consumer inflationary pressures.

- While the group made good progress in de-leveraging in 2021 - net debt to EBITDA (earnings before interest, tax, depreciation & amortisation) decreased to 4.0x from 4.8x in 2020, it is still well off its targeted level of below 2x, and consensus expectations are that it unlikely to achieve this goal before 2026. The ongoing elevated interest charge will also exert financial pressure and weigh heavily on the bottom‑line profit.

- In conclusion, positive momentum will come up against headwinds as Anheuser’s emerging market/ mainstream/discount category biases will mean it will have more forex headwinds and be more volatile than peers, especially as inflation severely pressures consumers’ discretionary spending the bulk of its markets.

- Following Anheuser’s multi-year share price under performance and its strong recent relative operational outperformance to its international peers, the JSE-listed instrument does appear to offer value at the current price...with downside risk on momentum sustainability.