Market Commentary: 31 January 2023

It was not only developments in China that gave the markets positive impetus but also an evolving view that global inflation was peaking and that monetary policy tightening would find its end during 2023.

As bells rang in the new year and the world’s cities attempted to outdo each other with their fireworks displays, the Chinese authorities were quickly moving away from their strict zero-COVID policy. That positive development, which China’s own residents had been petitioning for, set the equity markets up for a very welcome January rally. It was not only developments in China that gave the markets positive impetus but also an evolving view that global inflation was peaking and that monetary policy tightening would find its end during 2023. Individual central banks continue to tweak their interest rates but expectations have turned to a peak Fed Funds rate during the first half of the year with the European Central Bank and the Bank of England aggressively raising interest rates in the shorter term but relenting and at least holding fast at some point during the year. The South African Reserve Bank slipped in a 25 basis point (bp) rate cut at the end of January but the slowdown in the rate of increase of the repo rate along with some consumer price disinflation in recent months augurs well for an end to domestic rate hikes fairly soon – if we have not reached that point already. Central banks loom large in February with the Federal Reserve expected to raise the Fed Funds rate by a smaller increment of 25bp on the 1st and the Bank of England and the European Central Banks expected to each hike by a more aggressive 50bp on the 2nd of February.

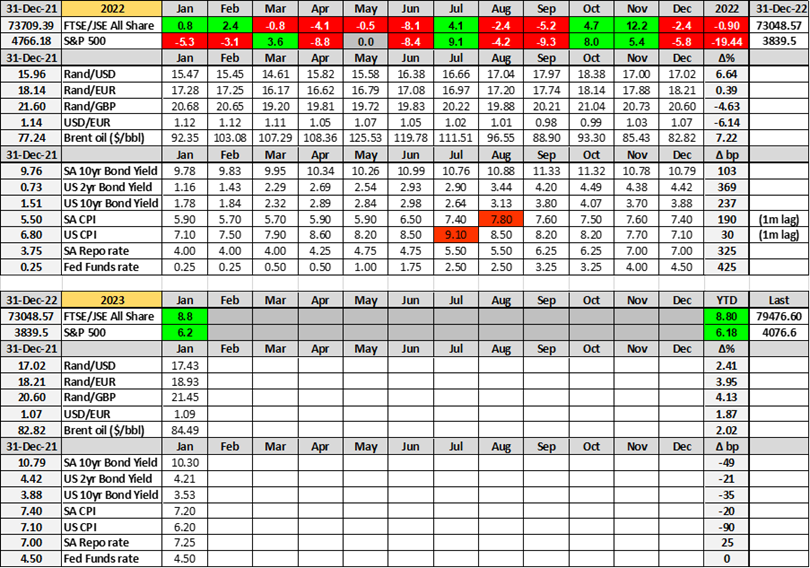

With a “risk-on” tone permeating markets, the US dollar weakened and over the course of January from $107/€ to $109/€. Notwithstanding dollar weakness, the rand gave up ground against all of the major crosses, finishing January at R17.43/$ from a start at R17.02/$ (see table below). The peak inflation and interest rate narrative, both locally and abroad, helped to buoy global bond markets. At home, the benchmark 10-year bond yield drifted almost half a percentage point lower from 10.79% to 10.30%. The US 10-year note, in turn, saw its yield fall from 3.88% to 3.53% over the first month of the year.

When the equity markets closed at the end of January, the FTSE/JSE All Share index found itself 8.80% higher, having reached new all-time highs above an index level of 80,000. The S&P 500 index in the US closed 6.18% higher at the end of January to leave the global benchmark back above the 4,000 points level. As the month drew to a close, the US earnings reporting season for the fourth quarter was just hitting its straps. Results to date have been mixed with both positive and negative surprises but nothing significantly untoward or outstanding. Earnings have been softer as the global economy has slowed and the past quarter has been marked by the start of significant job layoffs, particularly amongst big tech companies suffering from a lockdown staffing overhang. Future market direction will continue to be dictated by expectations around growth, inflation, interest rates and earnings and market perceptions on valuations. While the market view on some of these variables may have improved modestly over the course of January, there is still too much uncertainty for the market to make a sustained push higher.

The IMF’s World Economic Outlook update published in January entitled “Inflation peaking amid low growth” reflected the expectations of declining global inflation in an environment of slowing economic activity. Global growth is forecast to slow from 3.4% in 2022 to 2.9% in 2023 before picking up modestly to 3.1% in 2024. Global inflation is set to fall from 8.8% in 2022 (annual average) to 6.6% in 2023 and 4.3% in 2024 – still higher than pre-pandemic (2017–19) levels of about 3.5%. Against this backdrop, the green look to the market boards in January is an encouraging and very welcome start to the year but investors still need to keep a cool and rational head. Expectations of an interest rate pivot have increased but central bankers are still going to be gruff and talk tough for as long as reported inflation remains significantly above official target levels. The markets will have to digest those central bank soundbites along with improving but almost certainly erratic, inflation data prints.