If January could be considered “the best of times” then February turned out to be a little of “the worst of times”. The first two months of the year could not have been more different with the optimism of the new year giving way to more caution and circumspection in February. The catalyst that swung the markets from a “risk-on” January to a “risk-off” February was a more hawkish tone from central bank chiefs as they raised policy rates at the start of the month. The Federal Reserve Bank increased the target of the Fed Funds rate by 25 basis points as expected on the 1st on February and that was followed by the Bank of England and the European Central Bank both hiking rates by a more aggressive 50bp on the 2nd of February. With the increase in policy rates came the warning that inflation would be sticky and take some time to approach target levels (a 2% target for the US, UK and Europe). Monetary policy committees stated that they were more comfortable with raising rates by too much than raising them by too little. Expectations of a Fed pivot (the turning point in interest rates) in the second half of 2023 were quickly pushed out into the mists of 2024.

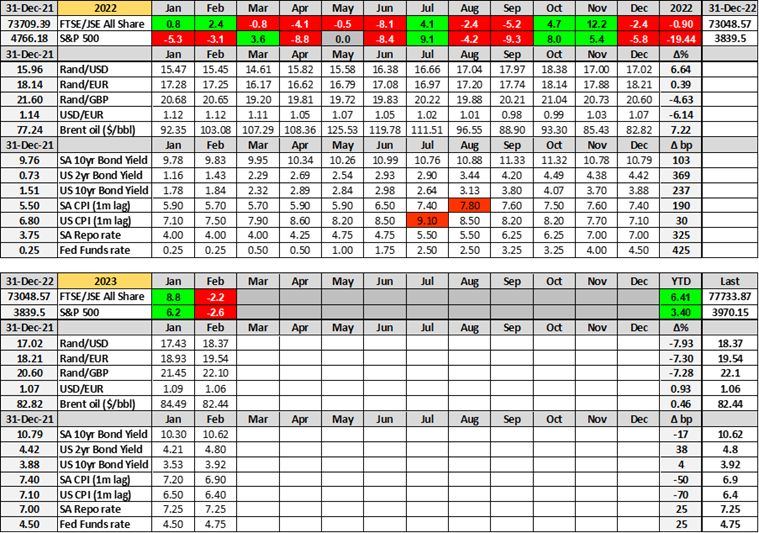

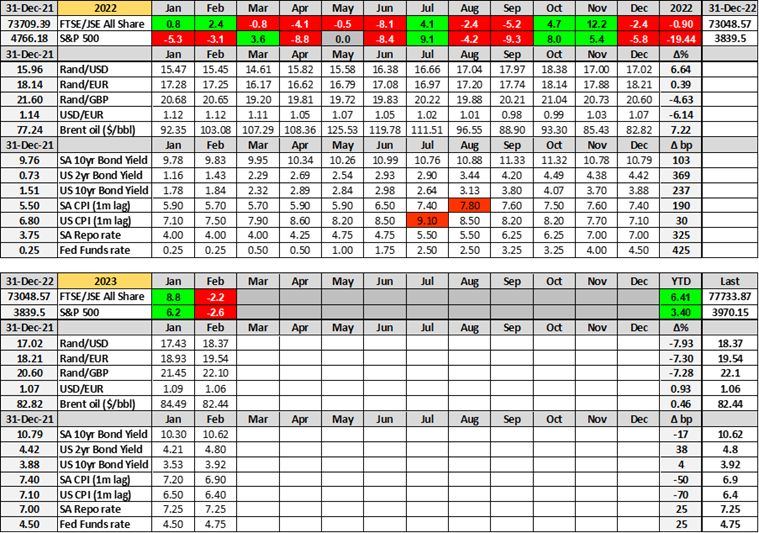

The yield on two-year US treasuries that had rallied from a 05 Jan peak at 4.45 bottomed out at 4.08 on 02 Feb before closing February out at a new high of 4.80 (up 72bp). Similarly, the yield on the US 10-year bond that had fallen from a 02 Jan peak of 3.88 to a 3.40 low on 02 Feb ended the month 55bp higher at 3.95 (see chart below). The US dollar, the best barometer of market risk sentiment, which had weakened from $1.07/€ to $1.10/€ as markets rallied in a “risk-on” environment over January, reversed course over February and appreciated to below $1.06/€ as the market appetite for risk waned. The rand depreciated steadily over the course of February with a best level of R17.04/$ on 01 Feb and a closing level of R18.36/$ on 28 Feb – a decline of 5.4% over the month. Quite apart from the risk-off environment impacting all emerging market currencies, the rand had to negotiate the State of the Nation Address, the National Budget and most severe period of loadshedding to date. The US benchmark S&P 500 index, which had enjoyed a 6.2% rally in January and closed out that month at a level of 4076 index points, had a last hurrah to a 02 Feb peak at 4,180 points before slipping to a close of 3,982 points at the end of February (-2.6%). The local equity market was a hapless victim in all of this and the January market gain on the FTSE/JSE All share index of 8.8% was followed by a loss of 2.2% in February. That left the JSE up 6.4% for the year in rand terms but down 1.4% for the year in US dollar terms. The equity, bond, currency and commodity indicators of 2022 and 2023 year-to-date are summarised in a table at the end.

US two-year and 10-year bonds: Jan 2023 – Feb 2023

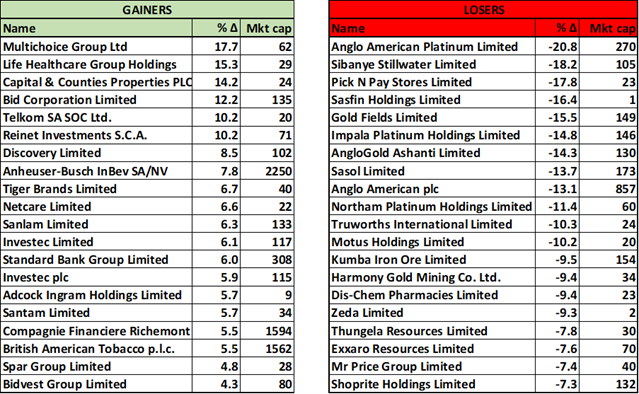

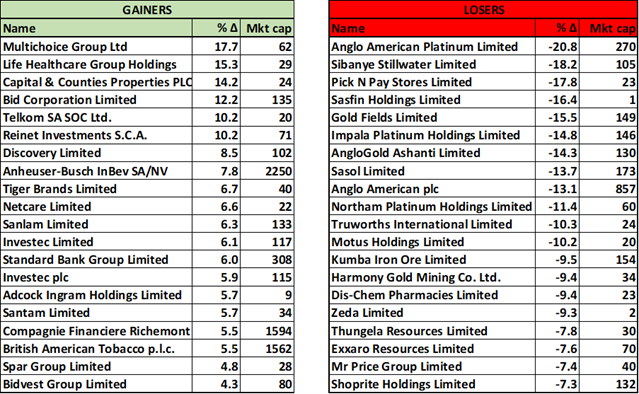

The list of stocks losing ground on the JSE over the course of February was littered with resources and commodity companies. This is a typical market response to a stronger dollar with commodities, priced in dollars, becoming that much more expensive for non-dollar countries and generally falling in price and dragging listed resources stock prices lower. The table below of February losers includes most of the larger precious metals, iron ore and coal companies listed on the JSE. In contrast, the list of winning stocks in the month included an assortment of financial and industrial counters.

Winning and losing stocks on the JSE over the course of February (price change only):

The US equity markets had to negotiate the 25bp increase in the Fed Funds rate in February along with a chunky part of the quarterly earnings reporting season. The direction of the market was, however, ultimately a result of the adjustment higher of expectations around the Fed’s terminal interest rate to a level more around 5.25% - 5.50% than the 4.75% - 5.00% that the market had been contemplating. The equity market retreated in response but underlying stock movements were mixed. Nvidia (18.8%) was one of the bigger winners after it published results with a strong outlook while Tesla also posted an 18.8% gain in the month. Meta lost 17.4%, Alphabet was down 8.9%, Disney and Honeywell each lost 8.2%, S&P Global was down 9.0% and Home Depot gave up 8.5%. Technology stocks posted a 0.29% gain in the month but the energy sector (-7.6%), REITs (-6.2%) and healthcare (-4.72%) were some of the larger underperformers in February. Shell bucked the energy sector trend with a gain of 6.4% over the four weeks of the month.

The market direction will continue to be driven by expectations around inflation and official policy rates and what that ultimately means for economic growth around the globe and what that, in turn, means for corporate earnings (measured against current share price valuations). US-China relations, US domestic politics, the Russia-Ukraine war and catastrophic natural disasters will fill the headlines and play some part in the market outcome but the key question is back to being around the timing of the Fed pivot. Passengers were already boarding the flight to better markets when the pilot announced a delay due to a problem with sticky inflation. Passengers have disembarked that flight while the inflation problem is being resolved. The technicians will continue to work on the issue with their interest rate tools but the flight will be open for boarding again in due course and passengers need to exercise a little patience and not fret about what could go wrong with the plane. It’s probably better that the problem is comprehensively resolved so that we can all enjoy a relaxed flight to higher altitudes. Nobody really wants to be buffeted around the skies by an inflation failure or an unexpected interest rate strike. But as always, it remains good practice to keep one’s seat belt safely fastened at all times.

Index, currency, commodity, inflation and fixed income moves in 2022 and 2023 year to date: