On the scheme benefit front key concerns are the escalating cost of contributions, inadequate benefits and a confusing range and depth of services covered. In combination, this translates into higher out-of-pocket expenditure by beneficiaries and makes trying to compare the various Medical Scheme options difficult to understand. These features are likely to continue, as South Africa finds its way towards National Health Insurance (NHI).

In the open scheme industry, the sustainability of the top 10 larger schemes has improved since 2006. This means that the industry has become stronger and has sufficient reserves to meet commitments. The scheme sustainability analysis considers a combination of critical factors such as the size of the scheme, membership growth, the change in the average age of beneficiaries, operating results, accumulated funds and solvency trends relative to the statutory requirements.

Despite the decrease in the number of Medical Schemes, due to amalgamations amongst the smaller less sustainable schemes, the industry has grown by 1.47 million principle members and 2.28 million beneficiaries since 2000. However, during the last couple of years, these numbers have virtually flat-lined.

The average age of open scheme beneficiaries increased to 34.9 years at the end of 2017 (2016: 34.0 years), with the pensioner ratio rising to 10.0% (2016: 9.2%). This trend is indicative of the industry’s claim profile and is one reason why members’ contributions increase in excess of CPI. For each year a scheme ages, the expected increase in average claims is 2%. Other reasons influencing contributions can be attributed to provider fee increases, increasing hospital admissions and rising disease burden.

Going forward, the Medical Scheme environment will indeed face challenges with the continued consolidation of schemes during the transitional period leading up to the full implementation of the National Health Insurance (NHI).

During 2018 we witnessed the publication for consideration of the NHI Bill and the preliminary Medical Schemes Amendment Bill (MSAB). At the heart of SA’s healthcare system and serving 84% of the population, is a public sector struggling to function. Essentially, NHI is a health financing system designed to pool risk and funds, and administer healthcare services for all South Africans so that equality can be achieved. It also aims to strengthen the under-resourced and strained public sector to improve performance as a whole.

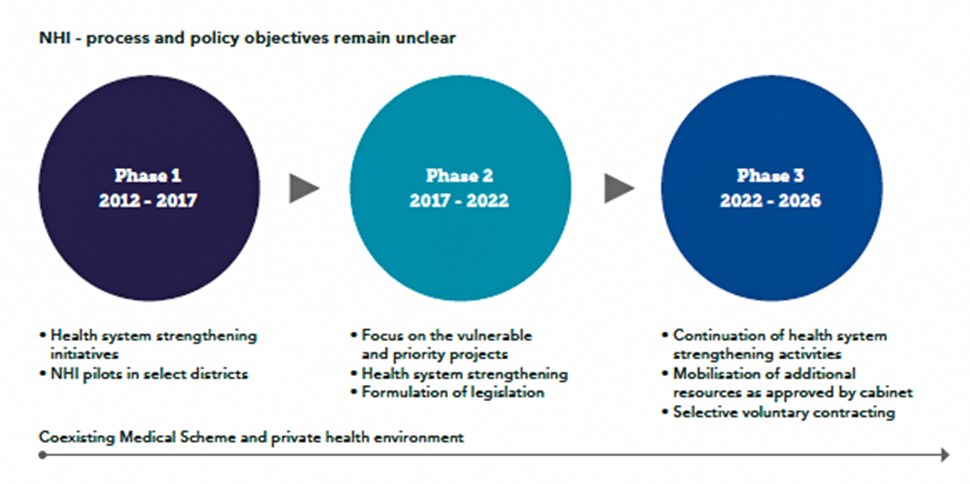

The prevailing narrative is that NHI, as a key healthcare topic, will progressively become more dominant led by uncertainty and the attendant risks of indecision – the main characteristics of which are outlined as per the infographic above. Beneficiaries will also be faced with many messages around the future of healthcare, some of which may be confusing with stories and opinion pieces.

The general consensus is that the goal of universal healthcare will require strong partnerships between public and private shareholders, whilst creative solutions are sought. Leveraging off the best from the public and private sector will provide opportunity to significantly improve healthcare access and affordability in the country. In the meantime, and while the NHI remains a work in progress in terms of policy and planning, nothing changes as it relates to Medical Schemes.

As alluded to earlier, out-of-pocket medical expenses have become the norm and because of this, the option available is that Medical Scheme members can lessen the burden by purchasing Gap cover insurance that provides cover for shortfalls resulting in hospital related bills.

“To ensure peace of mind, the solution is for members to insure themselves against the deficit through a relatively inexpensive Gap Insurance Policy, which extends cover of up to 500% of the Medical Scheme tariff.”

All Medical Scheme members face the problem, when hospitalised, that surgeons and other specialists frequently charge more than the amount covered by their Medical Scheme. When this occurs, members become liable to pay the shortfall. To ensure peace of mind, the solution is for members to insure themselves against the deficit through a relatively inexpensive Gap Insurance Policy, which extends cover of up to 500% of the Medical Scheme tariff.

All Medical Scheme members face the problem, when hospitalised, that surgeons and other specialists frequently charge more than the amount covered by their Medical Scheme. When this occurs, members become liable to pay the shortfall. To ensure peace of mind, the solution is for members to insure themselves against the deficit through a relatively inexpensive Gap Insurance Policy, which extends cover of up to 500% of the Medical Scheme tariff.

With an increase of members being diagnosed with cancer, coupled with a significant increase in the cost of this treatment, members are experiencing shortfalls concerning their oncology benefits. Depending on the policy selected, members are covered when they have exhausted their oncology limit and are exposed to co-payments or deductibles, which includes both traditional and biological cancer drugs.

Navigating the current system as a consumer can be extremely complicated and as this won’t change under the new proposed legislation, we believe, more than ever, people will need professional advice in order to make informed decisions on their healthcare requirements. Unless this process is carefully managed and properly coordinated, administrative difficulties and increased frustration will be unavoidable.

In this regard, our business model is to assist both individuals and employer groups with their healthcare strategies, and to provide ongoing consulting to ensure the plan adopted remains current and relevant. In addition to analysing the financial viability of all the major schemes, we also undertake the important task of comparing their benefit options. A blend of size and staff skills places us in the unique position to be able to match our resources and expertise to the needs of our clients.

It is this boutique serviceoffering that is regarded as a key differentiator linked to a diverse client base of both private and state-owned entities. With over 20 years’ experience in the medical healthcare industry and being contracted to all the leading Medical Schemes, we are suitably equipped to provide impartial advice.

Organisations need to strive to be employers of choice and offer their employees competitive and relevant healthcare benefits. Members for their part, are faced with a vast range of healthcare benefit options and making the appropriate decision can be overwhelming. As consultants, our role is to ensure that both employers and members get independent professional advice. Our approach is that of a holistic healthcare management offering.

If you would like more information, please contact: Deon Steyn | 011 531 9200 | deon.steyn@sasfin.com Mohammed Jajbhay | 011 531 9128 | mohammed.jajbhay@sasfin.com Zanele Matipwili | 011 531 9150 | zanele.matipwili@sasfin.com

Source:

• Council for Medical Schemes Annual Reports (2000 to 2017)

• Audited Annual Financial Statements of Medical Schemes

• Courtesy Discovery Health