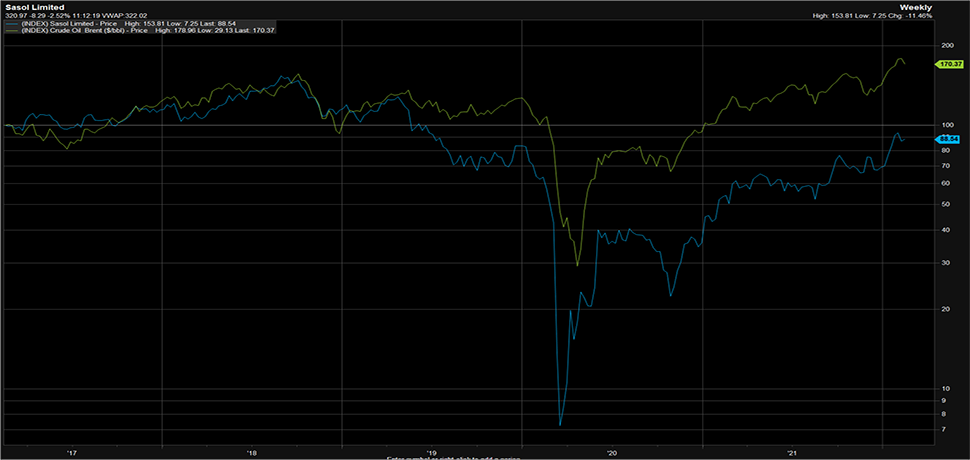

The question whether Sasol’s share price will reach R500 a share is not a straightforward or simple one to answer. Sasol’s business model is extremely complex and is driven by numerous moving parts, which makes it more complicated to forecast than other companies in its sector. The ‘rule of thumb’ that the market has been using to track its share price performance has been through tracking the price of Brent crude oil due to the strong correlation that exists between the two metrics (refer to chart).

Looking over the past ten years, Sasol’s share price reached R500 a share in mid-October 2013 and even crossed over the R600 a share level in 2014. During this period, the price of Brent crude oil traded between $100/bbl and $112/bbl. Notable, was the ZAR to USD exchange rate, which averaged R10.57. Today, Sasol trades in a completely different environment with a current share price of around R330 a share and a Brent crude price of $95/bbl, which is almost half its peak value over the past ten years. The discount to its share price has resulted from a number of factors.

Firstly, Sasol’s investment into the LCCP (Lake Charles Chemicals Project) resulted in a stretched balance sheet, leaving the company with a total project cost of $12.6bn. Consequently, its weak balance sheet has prevented it from prioritising shareholder returns.

Secondly, the COVID-19 outbreak had a negative impact on the oil markets, resulting in a complete crash in the oil price due to the restrictions imposed in order to curb the spread of the virus. Both these factors created the perfect storm for Sasol’s share price, which saw it fall to R36 a share in March 2020. The company has since put in new management and embarked on a transformation programme dubbed “Sasol 2.0” with the purpose of addressing its elevated gearing as well as its carbon footprint.

Under Sasol 2.0, the company aims to transition away from coal to gas and into renewable energy and green hydrogen, to turn it into a lower-carbon business. Therefore, not only is Sasol currently trading under different market conditions versus history, but the business itself in undergoing an evolution into a completely new business. This has implications on the investor sentiment around Sasol which has direct implications on its share price performance.

That being the case, my view is that Sasol reaching R500 a share will be dependent on the success of its transition and the market’s view thereof, as well as a rally in the company’s primary drivers (be it oil, chemical or hydrogen prices). Currently, its share price still tracks the oil price, and it is my view that the current rally is on the back of a recovery in chemical and oil prices. Sasol’s moat over other energy companies has always been its low-cost feedstock advantage.

Through integrated value chains, it uses coal from its own mines in South Africa for its CTL (coal-to-liquids) processes as well as gas from its operations in Mozambique for its GTL (gas-to-liquids) processes. This has historically given it an edge over its global peers due to it achieving better refining margins. It is my view that the company’s ambitions to transition out of fossil fuels into renewable energy poses a significant risk on its main competitive advantages which could possibly have a negative impact on its future earnings. This makes it difficult to see the share price reaching R500 a share anytime soon, in my opinion.

Views on a possible spin off its Offshore (Chemicals) business

As I have mentioned above, Sasol’s market dominance was premised on its low-cost feedstock competitive advantages. Apart from the cost overruns that resulted from the investment into the LCCP, one of the other concerns was that at the time of its construction, there were eight new other ethane crackers under construction in the US. This presented the risk that Sasol would be moving into an oversupplied market which would reduce the LCCP’s future competitiveness and result in a possible dilution of its group earnings. In its latest trading statement, Sasol guided to core headline earnings per share of R22.13-22.91 a share, up on the R7.86 a share reported in 1H21. The increase in earnings was driven by strong oil and chemical prices. Albeit macroeconomic conditions are favourable to Sasol currently, one cannot dismiss the risk of the Chemicals business being a drag on Sasol’s future competitiveness and true advantage should market conditions be unfavourable. Additionally, the company’s Energy and Chemicals businesses have a combined total of 62 million tons of annual greenhouse gas emissions. The pressure from environmental activists and ESG investors is what has resulted in the company’s ambition to transform it into a lower-carbon business, therefore I believe a spin off from its offshore Chemicals business may result in a possible improvement in the company’s ESG credentials which could make it more attractive to investors.