Equity Research – Glencore Plc (GLN) Investment Case

Glencore Company Overview

- Glencore is one of the world’s leading integrated producer and marketer of commodities.

- It was founded in the 1970s as a trading company.

- The company employs 135 000 people around the world with operations that comprise around 150 mining, metallurgical and oil production assets.

- The marketing operations directly or indirectly employ over 2 700 people worldwide.

- Its operating model involves the production, sourcing, processing, refining, transporting, storing, financing and supply of metals and minerals, energy products as well as agricultural products.

Glencore’s operations include mines and oil fields in Kazakhstan, DR Congo, Zambia, Columbia, Australia, Equatorial Guinea amongst others.

Key Investment Drivers

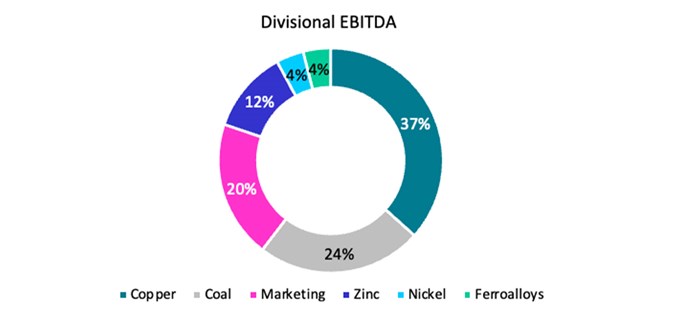

- Commodity Diversification: Glencore offers a diverse asset portfolio, with its own sourced production comprising of copper, cobalt, zinc, lead, nickel, gold, silver, ferrochrome, coal, and oil. This places the company in the top 3 most diversified mining companies listed on the JSE.

- Supplier of Energy Transition Metals: Glencore is a significant global supplier of energy-transition metals, including copper, cobalt, nickel, zinc, and vanadium. As the world shifts to future carbon-neutrality, renewable energy infrastructure and EVs (electric vehicles) are requiring larger intensities of ‘green metals’ than traditional methods. The growing demand presents upside risks for companies that produce low-carbon advantaged commodities such as Glencore.

- Exposure to Energy Commodities: Albeit a growing theme, the journey to Net Zero Emissions follows a non-linear path. Most of the world still relies on fossil fuels such as coal and oil for power generation. Glencore’s coal portfolio will supply critical regional energy needs as the transition evolves through time and geography, in line with the company’s climate strategy which targets total reductions of 50% by 2035.

- Robust Balance Sheet: Glencore’s diversified business model helps support a strong balance sheet. The company’s FY21 Adjusted EBITDA was reported at $21.3 billion while its net debt was $6.0 billion, giving a reported net debt to EBITDA ratio of 0.3x. this has come down from its 5-year average ratio of 2.8x. Its balance sheet strength helps enhance shareholder returns.

- Net Zero Emissions Strategy: The company recognizes its responsibility to contribute to the global effort to decarbonize the world. As such, Glencore has committed to achieving a 15% reduction in its total emissions (Scope 1+2+3) by 2026 against a 2019 base. It targets a 50% decline by 2035 and net zero emissions by 2050.

- Good Capital Allocation: Glencore is currently prioritizing capital expenditure towards transition commodities, including copper, cobalt, and nickel. These are metals that could become substantially more important given their role in the technologies/infrastructure that underpin low, or no-carbon energy sources.

- Vertically Integrated Marketing Business: Glencore leverages its marketing business to meet customer-specific requirements, taking advantage of demand and supply imbalances.

Key Risks

- New policies associated with the global goal to achieve net zero emissions will likely increase the cost for fossil fuels, impose levies for emissions and increase the costs for monitoring and reporting.

- Over-investment in transition metals could potentially create over-supply and prolonged periods of low commodity prices.

- Lower sustained commodity prices which could result in lower revenue and earnings for Glencore.

- Higher operating costs due to persistently high inflation.

- Production/volume downgrades.

- Poor project execution on growth assets.

- Regulatory and financial risks due to company’s history of investigations associated with bribery and market manipulation.

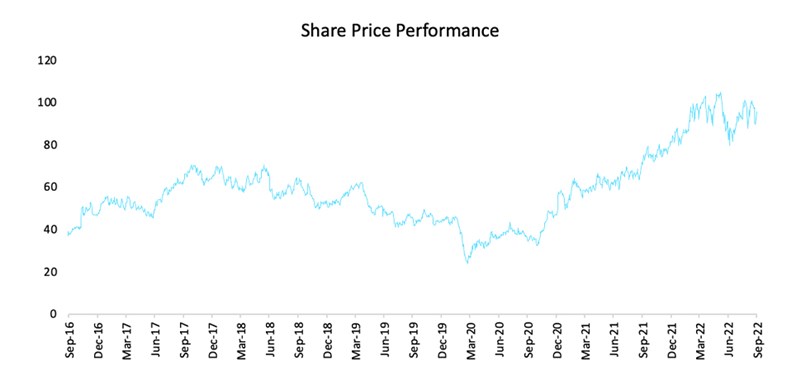

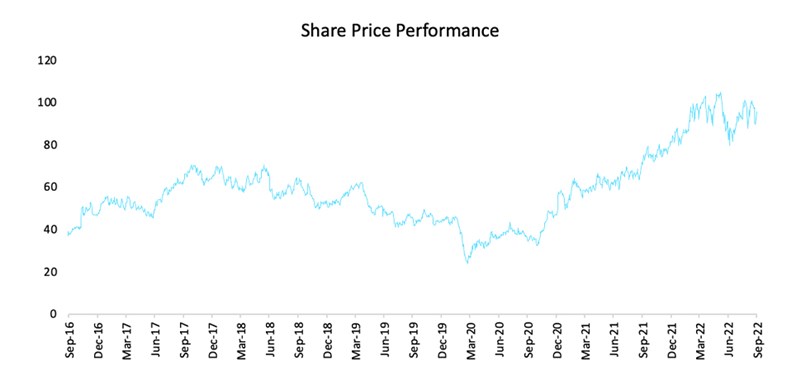

Share Price Performance

Figure 1: Share Price (ZAR)

Get more Innovative insights on current affairs

We leverage off established independent company-specific research, which is interrogated by our in-house research division and shared with you. Click here for more information.