- Diageo is the world’s leading producer of branded premium spirits, controlling a quarter of global volume share.

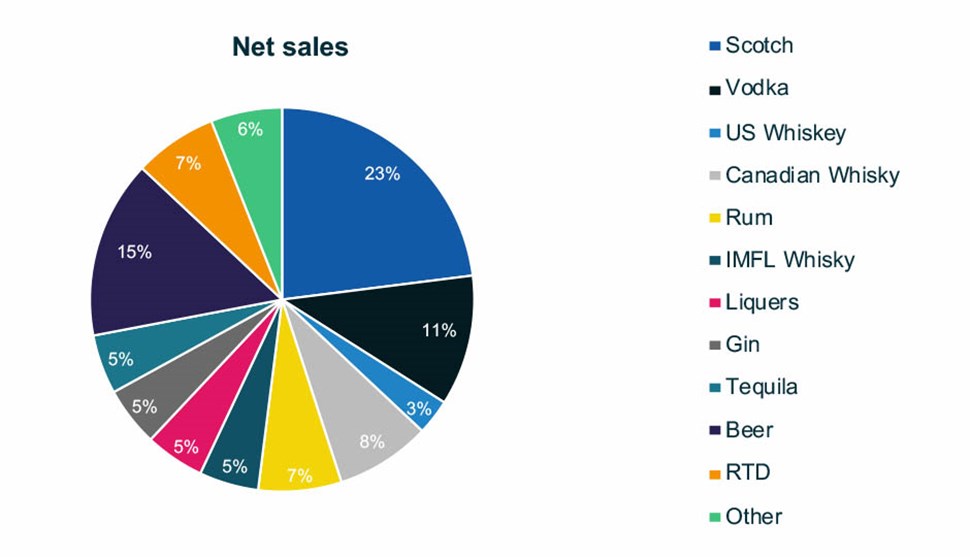

- The distiller’s key brands include Johnnie Walker, Smirnoff, Ciroc and Ketel One vodkas, Bell’s, Captain Morgan, Don Julio, Tanqueray, Baileys and Guinness in a total portfolio of over 200 brands.

- The group distributes its products in over 180 countries.

- Diageo also owns almost 56% of United Spirits, the dominant player in the world’s largest whisky market, India.

- Diageo is well-diversified across spirits with exposure to premium beer and Ready‑To‑Drink (RTD) categories. We believe that a diversified portfolio across categories and price points is beneficial in an ever fragmenting and changing consumer preference environment.

- The group’s focus on innovations not only leverages off the brand provenance, but also ensures that the brand remains relevant with consumer tastes, thus keeping Diageo in a position of market prominence.

- Diageo appears to have executed well throughout the pandemic with high double digit organic sales and EBIT delivery in FY21 Demonstrated by favourable market share dynamics in most key off-trade markets (both emerging and developed markets).

- Add to that strong demand drivers remain intact, namely;

(a) Premiumisation (accelerated during pandemic) – According to IWSR 2020 “Higher price spirits tiers grew nine times faster than the total spirits category volume from 2010 to 2020. Overall, premium and above categories make up 53% of Diageo's Group sales, up +8% points since FY15 with the sale of its US wine (2015) and beer portfolios (2018),

(b) GDP growth recovery – Diageo’s four key markets (US, UK, India and China), which are estimated to account for just under 50% of sales and just over 50% of EBIT, have largely outpaced world economic growth over the past decade, and expected to largely outpace growth over the next five years according to International Monetary Fund (IMF) forecasts.

(c) Emerging market (EM) population growth, and

(d) Consistent shift to spirits from beer and wine. In fact, reports suggest that the increase in spirits penetration in the US was two to three times higher than wine and beer during the Covid-19 pandemic, albeit expect a ‘return to normal’ of mid‑single digit growth. Industry data shows a long-term trend that consumers who drink alcohol are increasingly choosing spirits over beer and wine. Providing further potential future growth, is the fact that spirits penetration is still low in many emerging markets.

According to new forecasts from drinks market analysis firm, IWSR, global beverage alcohol is showing positive signs of recovery, and is projected to grow in volume by +2.9% by the end of 2021 with the expectation that premium-and-above spirits and wine increasing by +25.6% in total volume between 2020-2025 (compared to +0.8% volume growth over the same period for brands in lower price tiers). Furthermore, whiskies are among the fastest-growing sub-categories of spirits.

- In recent months the Indian and British trade ministries have indicated their preparations for a bilateral trade agreement that aims to double the value of UK-India trade by 2030. Both sides have explicitly identified whiskey as a key product for discussion as India is the world’s largest consumer of whisky. Currently, imported alcohol is subject to a 150% tariff on import. Were this to be reduced, scotch producers like Diageo (India accounts for roughly 7% of group sales) will likely benefit. Improved affordability would enable India’s burgeoning middle class the ability to trade up from Indian-Made Foreign Liquor (IMFL) to imported whiskey brands. Depending on the extent of tariff reductions, analysts estimate that this could add up to 7% to Diageo’s profit from the improved product mix (higher margins on scotch) and improved operating leverage from the increased volumes.

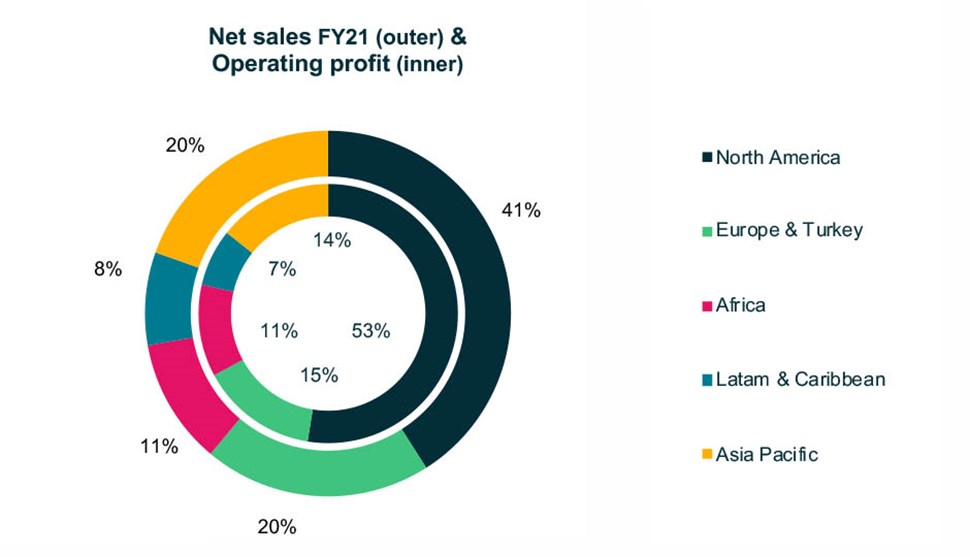

- Diageo carries foreign exchange risk, both transactional and on translation to its financial reporting currency (GBP) from the geographically diverse revenue – approximately 42% of Diageo’s net sales in the year ended 30 June 2021 were in US dollars, approximately 9% were in euros and only approximately 8% were in sterling. EMs accounted for 38% of Diageo’s net sales in FY2021. The group notes that “unfavourable economic, political, social and other risks tend to be heightened or occur more frequently in EMs due to unstable governments, corruption, crime and lack of law enforcement, undeveloped or biased legal systems, expropriation of assets, sovereign default, military conflicts, liquidity constraints, inflation, devaluation, price volatility and currency convertibility issues, as well as other legal and regulatory risks and uncertainties.

- Heightened forecast risk in terms of volatility and timing as a result of the disruptions to supply chains, operations and normal trading patterns and additional costs from COVID-19, both during the pandemic and possible changes in consumer behaviour thereafter. Furthermore, the risk of further waves and potential government lockdowns.

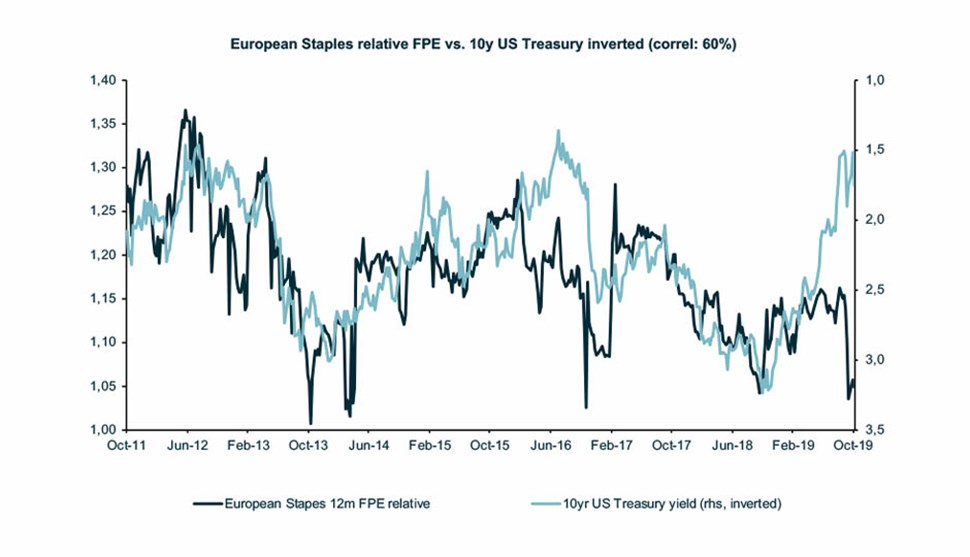

- As we see from the chart below, there is a reasonably good inverse correlation between US bond yields and Staples/Beverages relative P/E. Based on recent statements from the US Federal Reserve regarding the bringing forward of tapering of its bond purchases to as soon as November 2021 (from 2024) and the 2022 timing of an increase in the reserve rate in response to inflation running at double the 2% target rate, we could see some relative multiple compression for the sector over the next 12 months.