Fund takes advantage as it benefits from conservative positioning

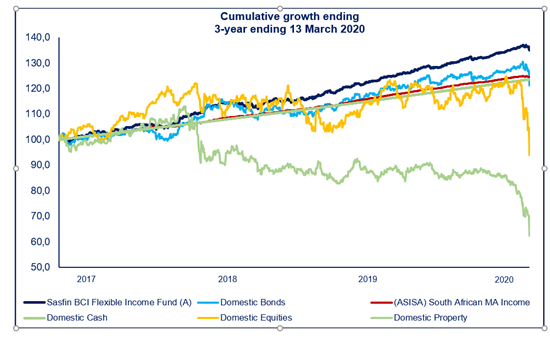

With the current volatility and uncertainty in the financial markets both globally and locally, we felt it prudent to provide an update on the Sasfin BCI Flexible Income Fund.

The objective of the Fund is to provide investors with a high level of income whilst preserving capital. The Fund has a flexible mandate and actively invests in conservative instruments like cash and fixed-rate and floating-rate bonds.

Current Fund positioning:

Going forward:

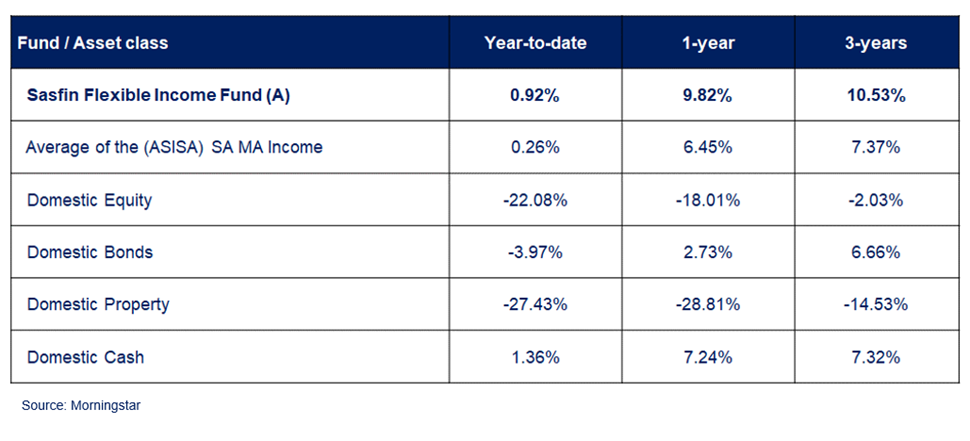

Investment performance summary (to end 13 March 2020) Source:

In summary, the current gross yield on the Fund is still over 10% and we remain confident that we are well positioned to navigate this turbulent time and to continue to provide a high level of income to investors into the future.