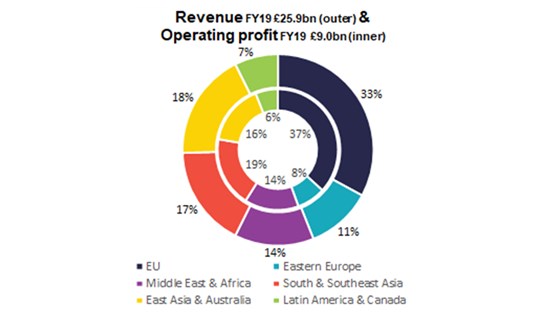

British American Tobacco (BTI) is one of the world's largest tobacco companies, selling tobacco products in over 180 countries. The group has a substantial Combustible business and is growing rapidly in all the Reduced Risk categories, namely tobacco heating products (THP), vapour and oral tobacco. Major markets include USA, Brazil, Canada, South Africa, Russia, and Australia. Key brands are Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans and Newport in the cigarette category and Vuse, glo and Velo in the reduced risk category.

Capital Markets Day Highlights

BTI’s strategy is clear, namely to maximise the profitability of the traditional Combustible business, drive the growth of reduced risk nicotine products and simplifying the business. These are briefly discussed below.

Maximise Combustible business

The global tobacco industry is in decline, with volumes shrinking by approximately 3-4% per annum. However, BTI consistently recorded a lower-than-industry rate of decline in volumes for eight consecutive years to 2019 – pointing to robust market share gains – and consistently achieved positive, single digit revenue growth. The latter has been achieved by effectively leveraging the company’s database of consumer insights to; 1) manage both pricing and the portfolio mix in different countries and the geographic mix of sales between high and low growth cigarette markets, and 2) provide on-trend innovations in different markets .

Furthermore, the Combustible business has been a major beneficiary of BTI’s ‘simplify the business’ initiative, particularly as it pertains to streamlining the brand portfolio into key global brands and substantially reducing number of regional brands and reducing the cost of production further.

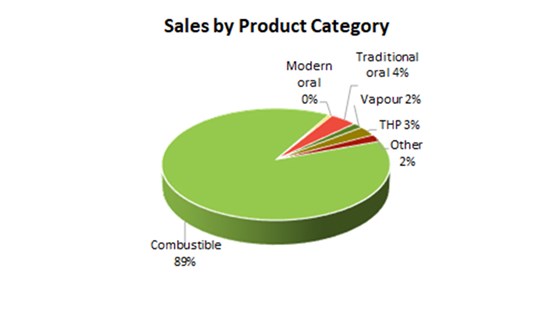

BTI’s sizeable Combustible business is of paramount importance as it provides the cash flow to fund dividends, repay debt and fund the development and marketing of the reduced risk products and investment in the research and development of non-nicotine products.

Reduced risk products

BTI has adopted a multi-category, multi-market approach in the new generation product (NGP) category. We believe this to be a prudent approach considering the evolving nature of this segment with little clarity on which format and delivery mechanism is likely to be the winner in terms of consumer adoption and regulation.

The key points to make on the Reduced risk products include; 1) Sales are dwarfed by the size of the combustible market, for the industry and for BTI, 2) BTI is well positioned in the segment with products in each of the reduced risk categories, namely vapour, THP and oral tobacco and is the number one or two player in each in different world regions with 11 million customers out of an estimated 68m non-combustible consumers globally, boosted by the acquisition of US rival Reynolds in 2017, 3) non-combustible products present the ideal vehicle to recapture tobacco consumption occasions lost in recent years, and 4) the business case for these new category products is enhanced by the higher margins they attract relative to the cigarette business…margins that are increasing further as BTI streamlines the design and production of its devices.

Furthermore, BTI is well-placed the US Pre-market Tobacco Product Application (PMTA) process and expected to see a step-change in the sales of reduced risk products. The PMTA process will essentially usher in the regulation (ingredients, production and marketing) of Reduced Risk nicotine products (previously only cigarettes and smoke-less tobacco products). The PMTA process is expected to result in many smaller, informal vape device and liquid manufacturers being blocked out of the market, thereby opening a £1.5 bn revenue market according to BTI.

Finally, BTI is investing in developing non-nicotine products, which address different needs such as focus, performance boost and relaxation, but that can be leveraged off BTI’s expertise in buccal and inhalation delivery, regional consumer insights and global distribution explore non-nicotine opportunities

Simplify the business

In recent years, with the Reynolds acquisition and SAP implementation, BTI has successfully generated some £900m of efficiencies and cost savings, boosting profitability. In 2019 BTI announced the launch of a far-reaching project to simplify the business and generate another £1bn in identified operational, marketing and supply chain cost savings and efficiencies by 2022. In 2019 alone management delivered £300m of cost savings by reducing headcount, including a 40% head office headcount reduction, streamlining the number of business units to 18 from 28 and undertaking fewer, but more successful product launches.

A digital transformation and deployment across the value chain has in recent years, and will continue to form a critical part of the envisaged improvements in efficiency and marketing focus and effectiveness, thus supporting the group’s financial goals of consistently growing earnings and dividends while deleveraging the business.

BTI has a proven track record of strong cash generation and, supported by the clear strategy described above, BTI’s management re-iterated their commitment to; 1) uphold the debt deleveraging of the company as the top priority – net debt to EBITDA reduced to 3.5x in 2019 from 4x in the prior year, with the goal of <3x by 2021 and then maintained in at between 1.5x and 2.5x, and 2) maintain a 65% dividend pay-out ratio with growth in Sterling terms - 11% CAGR of dividend growth over the last 15 years.

To date, BTI has reported minimal sales and supply disruptions with the postponement of some Reduced Risk product launches. Recently at a UBS briefing, management noted some positive demand effects of the virus outbreak, namely; 1) more people at home generally opened up more moments of consumption, 2) closed borders should reduce the supply of illicit cigarettes – a key issue in emerging markets such as South Africa and Brazil, and 3) less travel meant less cigarette shopping in cheaper markets.

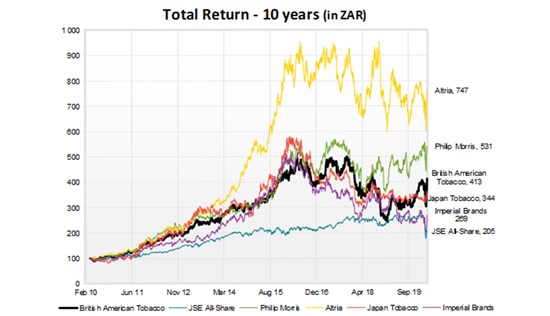

We remain positive on BTI given its ongoing profitability enhancement through active operational optimisation, its continued robust pricing power in combustibles, coupled with a broad reduced risk portfolio, supported by the recent positive evolution of the US regulatory environment

The counter trades at a discount to the global Staples segment and currently offers an attractive dividend yield of 7%, a level that we are confident the group is able to maintain.