- Anheuser-Busch InBev (AB-InBev) is the largest global brewer by beer volume, with number one positions in the United States, Mexico and Brazil, three of the top five most profitable beer markets in the world, as well as South Africa and Columbia.

- The group produces a wide range of beer spanning lower cost regional brands to premium global brands and non‑beer beverages, including rapidly growing hard seltzers and low- and non-alcoholic products across lower-priced regional, to craft and premium, globally marketed brands.

- The mantle of the largest brewer in the world following a series of acquisitions and especially since the acquisition of SABMiller in 2016, has augmented a number of key advantages, namely,

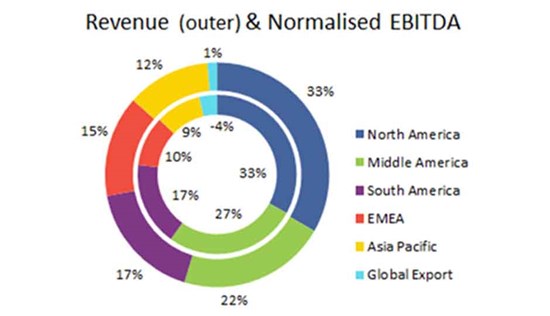

- The most diverse geographic exposure of any brewer,

- Strong or dominant market positions in multiple emerging (EM) and developed markets (DM),

- An extensive portfolio of brands across the pricing spectrum,

- And particularly with the acquisition of SABMiller, enhanced category expansion and brand development capabilities and robust market trend intelligence as well as,

- Scaled sourcing, production & distribution capabilities and best practice category know how, especially in developing markets,

The latter factors have enabled the group to leverage its positions in low/no alcohol beers, craft & pure malt beer and hard seltzer innovations as well as its premiumisation and category expansion framework strategies.

- The abovementioned company factors have proven critical in retaining pricing power and allowing management to achieve their key goal of delivering organic revenue growth despite erratic and at best flat volumes. AB-InBev has maintained average organic revenue growth over the decade to 2019 of 4.8%. This against a background of flat beer volumes over the same period. In the unusual and lockdown-fraught 2020, organic revenue declined by -3.7%, but that was better than the ‑5.7% decline in volumes.

We expect beverages to recover to their pre-Covid growth trajectory because the pandemic was more a temporary shock (where spending behaviour does not change materially, especially where governments supported incomes) rather than a more protracted recession, where consumers do in fact change behaviour in light of negative outlooks.

Furthermore, we were surprised, as reported by Morgan Stanley, that “downtrading [to cheaper brands] was limited to a handful of markets - in fact, premiumisation has accelerated in key markets like the US as consumers shifted their spending to at-home consumption of 'affordable luxury' items and likely supported by excess savings”.

- One of the key findings of the empirical study into the determinants of the demand for beer in ‘The Economics of Beer’ by Johan F. M. Swinnen, is that there is appears to be a strongly significant “inverted-U shaped relation between income and per capita beer consumption”. Essentially, countries with rising levels of income initially consume more beer then from a certain income level onwards, higher incomes lead to lower per capita beer consumption. That turning point is calculated to be approximately 29 000 international dollars per capita. So, with per capita incomes in AB-InBev’s key EM markets (Latam & Africa) still below this level and together with their large populations, in theory, the group has substantial volume growth prospects.

AB-InBev has experienced management with a proven track record of substantive M&A activity (Interbrew and Ambev merger, Anheuser‑Busch, Grupo Modelo and SABMiller) and delivering synergies thereon, as recently re-affirmed by the over‑delivery of the over US$3 billion of cost savings ‘promised’ from the 2016 SABMiller acquisition.

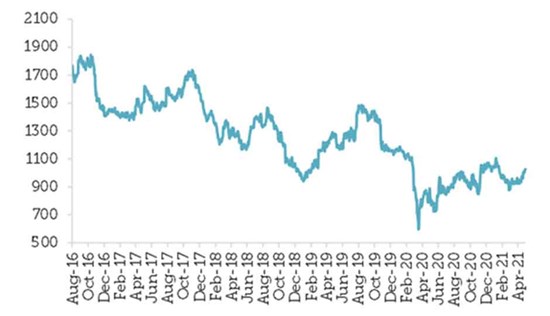

- AB-InBev carries forex risk, both transactional and on translation to its financial reporting currency (USD) from the EM biased revenue (68.1% non-USD in 2020) and earnings base, resulting in above peer average volatility.

- This is particularly negative in the context of the group’s high leverage – net debt to normalised EBITDA increased to 4.8x in 2020, impacted by the COVID-19 pandemic. In our view this reduces M&A optionality and reduces the group’s ability to invest behind brands and trends. While the group maintains that deleveraging to around 2x and prioritising debt repayment remains a commitment, we were disappointed with the mixed signal of opting to pay dividends in 2020.

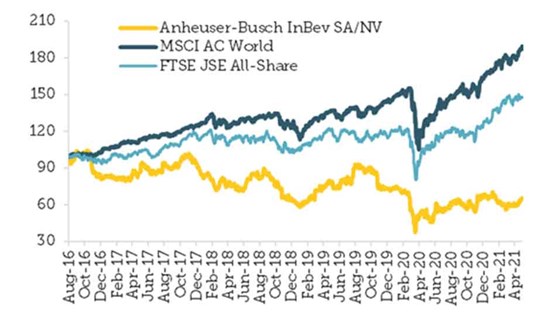

- Notwithstanding management’s track record of over-delivering on their promised M&A synergies, other anticipated benefits such as revenue synergies from rolling out its premium international brands into SABMiller’s emerging markets have not yet translated into a meaningfully elevated financial performance. This is as management has had to contend with slower than anticipated growth, disruptions and elevated competitive pressures in key markets such as Brazil, currency headwinds and higher gearing. These factors together with the exhausted synergy benefits, raised freight and canning costs since the start of the pandemic and the required heavy investment to position in trends such as hard seltzers, motivated management’s recent 2021 “margin pressure” guidance.

- AB-InBev has adopted a portfolio brand approach with a mainstream bias, but according to GlobalData, statistics presented at the RMI 2019 World Barley, Malt & Beer Conference in Warsaw, the trend in recent years has seen declining volumes in the discount and mainstream beer categories (where AB InBev over-indexes) and positive volume growth in the premium and super-premium categories (where AB InBev is growing, but still under indexes). Furthermore, as mentioned above, during the pandemic, premiumisation has accelerated in key markets like the US, as consumers shifted their spending to at-home consumption of 'affordable luxury' items and likely supported by the series of US stimulus packages and excess savings”. While AB‑InBev has increased its Above Core brands as a percentage of its beer volume to 31.3% in 2020 from 22.9% in 2016, it still lags peers such as Heineken and Carlsberg.

- As we highlighted under the key drivers, research shows that countries with higher levels of income initially consume more beer then from a certain income level onwards (29 000 international dollars per capita), higher incomes lead to lower per capita beer consumption. So, with a number of AB-InBev’s markets (Latam & Africa) well below this turning point, on paper the group’s EM bias presents a substantial volume growth opportunity. However, according to IMF data, EM income growth has not only lagged that of DMs, but since the SABMiller acquisition in 2016, as a bloc EM per capita incomes per annum have been stagnant (to 2019) and declined (2020) in real terms.

- The disappointing growth dynamics (ex-synergies the business is estimated to have delivered 1% EBIT CAGR since 2016 vs 7.5% EBIT CAGR reported), under-exposure to the higher growth premium category and competitive pressure in some key higher margin large profit pools, rising costs, growing low‑margin product mix (especially hard seltzers, smart affordability & low or no alcohol) and high leverage, suggest that margin pressures are structural. And with the need to invest more heavily in trends, analysts increasingly arguing that AB InBev deserves to trade at a discount to EU Beverage peers, resulting in numerous broker downgrades post the FY19 and FY20 results.