Most long-term investors avoid investing in mining companies and view them as a poor investment option, due to the erratic nature of so many factors that are not within their control, particularly Commodity prices relative to onerous capital requirements. However, there are times when the resultant volatility offers opportunity for investors, such as in the recent commodity price boom.

Weiss Ratings even labelled 2018 as ‘The Year of Commodities’. From June 2017 to February 2019, iron ore prices increased by more than 70%, from around $53 per tonne to over $90 per tonne. Other commodities such as oil (+36%), palladium (+61%) and nickel (+48%) all rose significantly over the same period. In the first two months of 2019 the All Commodities Index rose a further 7.4%.

While the listed mining counters’ share prices have generally followed the Commodity price rally, certain counters still offer some value, in an otherwise tough local environment. However, identifying the best Commodity-related share is not as straightforward an exercise as it may be for shares in other sectors, particularly given global growth uncertainties and slowing demand growth across most metal and bulk Commodity markets.

Mining businesses have an inherent uncertainty embedded in them, given the aforementioned industry dynamics. As such, many would argue this sector inappropriate for investors seeking to preserve capital.

Commodities are primarily traded using future contracts – as a result, current commodity prices have very little relation to the return an investor will actually earn on a Commodity futures contract. In contrast, an investor in a mining company invests in sinking a hole (shaft) in the ground to extract specific minerals which they believe will be of significant value over many years in the future.

However, what happens if the Commodity buyers no longer find that mineral valuable after the mining company has spent all that time and money to remove it from the ground? You have technically ‘sunk’ your money down a deep hole. This unpredictable nature of commodities is what often makes longer-term investors cautious of buying Commodity shares.

It therefore becomes crucial to identify the supply and demand of dynamics influencing commodity prices, as well as which companies are best able to protect against these swings or improve their operating margins. It is this appreciation for the longer-term nature of capital intensive mining companies, which face high fixed costs within a short term, more dynamic commodity price market, that makes it difficult to value commodity shares.

Current investor expectations for supply deficits of certain Commodities, escalating US-China trade tensions and potential Chinese stimulus, are likely to be bullish for the Commodity market in 2019. The onus then lies on picking the least-risky Commodity shares that will most successfully leverage the potential upside.

Currently, among mining shares, diversified miners are seen to be the better, more risk diversified option. After the Commodity price crash in 2015/16, mining companies were under pressure, having stretched balance sheets in a depressed Commodity price environment. This gave rise to mine managers reassessing their risk appetites, as well as their tolerance for leverage in their companies, with a greater focus on capital returns to investors and shareholders. This has been much easier to execute for diversified mining companies than for single Commodity ones.

Two companies that have impressively demonstrated this strategy reassessment are BHP Group Plc (BHP) and Anglo American Plc (AGL). Post 2016, both companies implemented new capital allocation frameworks and significantly delevered their balance sheets, bringing their Net Debt to EBITDA (Earnings Before Interest, Depreciation and Amortisation) ratios to approximately zero.

The competitive advantage offered by BHP and AGL is that they are able to benefit from a rally of multiple Commodity prices at once (Figures 1), as opposed to their single Commodity peers. This has allowed them to generate healthy cash flows in the recent Commodity price boom and enabled them to revise their dividend policies to the benefit of shareholders. This shift in management strategy offers investors comfort that they are better able to cushion the negative impacts of any potential downside in the commodity market.

“...identifying the best Commodityrelated share is not as straightforward an exercise as it may be for shares in other sectors...”

Currently, diversified miners screen better compared to their long-term historic average valuation multiples

Historically, BHP and AGL traded at EV (Enterprise Value) to EBITDA multiples of approximately 6-8x and have recently traded at significant discounts to those historic multiples. Current consensus views on spot Commodity prices suggest that the two companies are trading on forward multiples of between 4x and 5x for 2019/20.

In addition, many Commodity shares do not pay dividends, while AGL and BHP do. In fact, the restored strength of their balance sheets is now translating into improved shareholder capital returns. This is evident in recent amendments to their dividend policies. Anglo American’s FY17 report states, “Our clear commitment to a sustainable dividend remains a critical part of the overall capital allocation approach and a dividend policy of a targeted 40% payout ratio based on underlying earnings, paid each half year, has been adopted” – and in BHP’s FY18 report it states.

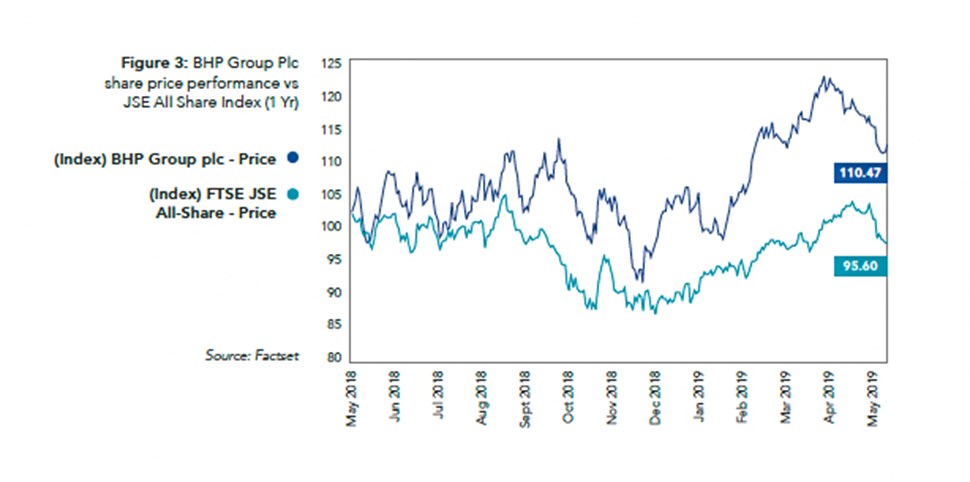

“...it is not surprising that both companies’ share prices have significantly outperformed the JSE All Share Index over the past year...”

“Our dividend policy provides a minimum 50% payout of Underlying attributable profit at every reporting period”.

With such demonstration of commitment to capital preservation, the share prices of the two companies should no longer be penalised for historic capital misallocation. As such, it is not surprising that both companies’ share prices have significantly outperformed the JSE All Share Index over the past year (Figure 2 and 3). In an alpha-seeking environment, where investors may wish to participate in a potential rally of commodity prices, Anglo American and BHP remain the best picks, in our opinion. Even at current spot commodity prices, the shares offer some downside protection, making the risk-reward of the two shares broadly favourable.