Independent investment research company Morningstar Research (Pty) Limited has named the finalists of the 2022 Morningstar Fund Awards South Africa. These awards are known for recognizing outstanding achievement in investment management. The Sasfin BCI Stable Fund, managed by Sasfin Asset Managers’ Errol Shear, is one of the two nominees in the Best Cautious Allocation Fund category. Morningstar will announce the winners on 22 March 2022.

What is Stable Fund investing? Watch the video below for insights on the Sasfin BCI Stable Fund or read the below piece by Errol Shear.

Stability in a time of uncertainty

What is Stable Fund investing? For us it’s about seeking balance, working hard to protect our clients from losses over any year, while still growing our client’s investment above the inflation rate for the longer term. We know that equities have produced the best returns over time, but also some spectacular losses. Over the last 60 years, the JSE All Share Index has fallen 14 times, while the S&P has declined in 18 years. Some years equities produce the best returns, some years it’s fixed rate bonds, or property or other asset classes. We believe it is best for our clients to be invested across all the asset classes, both for diversification to reduce risk, as well as providing more opportunities for our clients to participate in the asset class which offers the best return at an acceptable level of risk. We hold inflation linkers to give us protection against rising inflation. We vary our exposure to the different asset classes, looking for where we see best potential returns, while moving away from areas where we see increased risk. We also focus on lower risk individual assets within each asset class. For example, we held no Steinhoff shares or Tongaat shares when they collapsed, not because we saw the collapse in share prices coming, but because they were considered too risky for our Stable Fund. This didn’t stop us holding MTN or RB Plats shares, which more than doubled last year. We have two methods to reduce risk, firstly by having less exposure to risky asset classes, and secondly by targeting lower risk individual assets.

If we look at stock markets, especially the big USA stock market, there is a belief that any pull back in the stock market is an opportunity to buy more stocks. TINA (There Is No Alternative) is often quoted. And that was true in recent years, as governments pumped huge amounts of cash into the system and kept interest rates low to keep economies growing. For 40 years there has been a structural decline in interest rates. That may be about to change, with the Fed talking about a hiking cycle. If interest rise, there is an alternative to stocks.

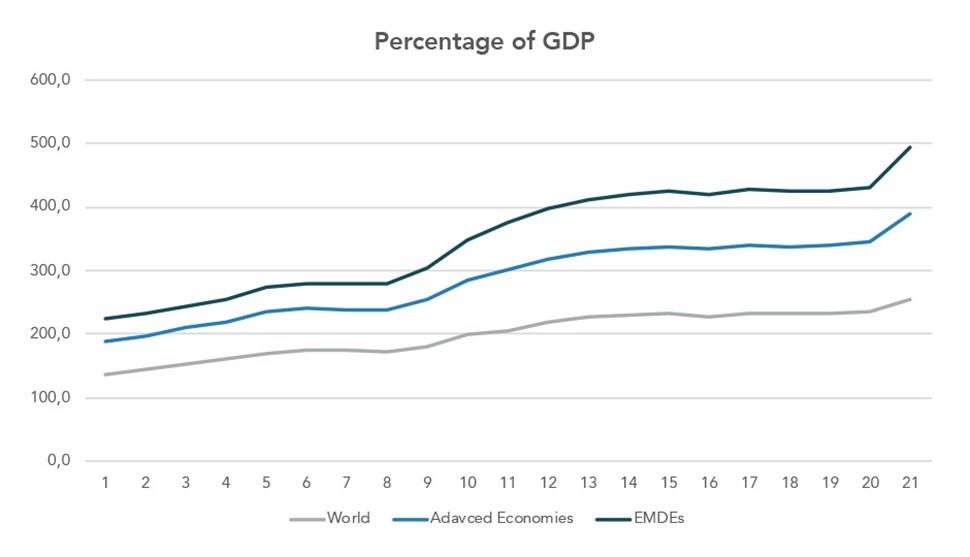

At this point there are huge risks in markets. Maybe that is a truism as there always are risks, but several major long-term trends may be slowing or even reversing. The 4-decade trend of lower inflation and falling interest rates may be coming to an end. The economic miracle of China, the world’s most populous country, also began about 4 decades ago. That too looks like it may be slowing. Chinese economic growth has helped resource rich countries to grow through their growing demand for resources. We also have a question over the huge increase in debt around the world, particularly during the Covid pandemic. Can we wish away this debt, or will it result in higher taxes to repay this debt, and higher taxes are not good for company profits or consumers spending power.

The risks are rising for unstable markets. This is a good time to think of a more stable fund, such as the Sasfin Stable Fund. And stable does not necessarily mean low return, our net return last year was 19.7%.

For event information visit https://go.morningstar.com/Morningstar-Awards.