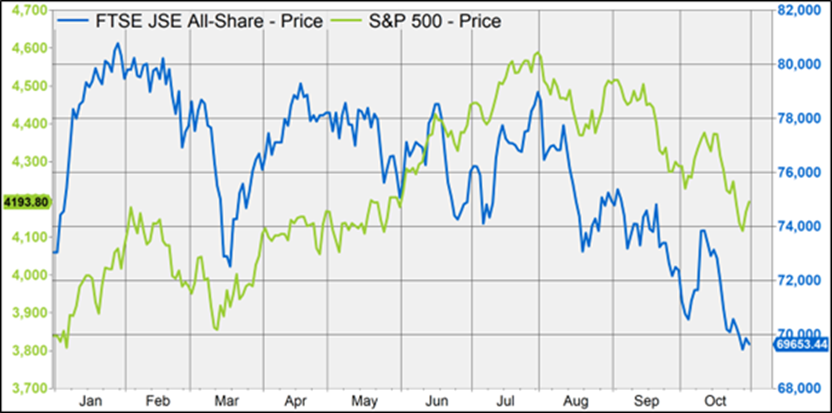

Investors looking for a reprieve in October after the market declines of August and September would have been bitterly disappointed. There was no market bounce in October and both the FTSE/JSE All Share index and the S&P 500 index traded lower for the third consecutive month (see graph and table below). The local index lost 3.8% in the month to be down 4.65% for the year while the S&P 500 lost 2.2% in October to leave market gains at 9.23% for the first 10 months of 2023. From a 2023 peak of 4,589 points on 31 July (+19.5% YTD), the index retreated 10.3% to the 4,117 close on 27 October, sufficient to label the move a market “correction”. The JSE, on the other hand, jumped out of the blocks to be 10.6% up before the end of January at an all-time high index level of 80,791. The joy was short-lived, however, and the market slipped into a weakening trend that left the index down 14.0% at its low point of 69,451 points on 27 October.

FTSE/JSE All Share index (blue, RHS) and S&P 500 index (green, LHS) in 2023

Source: Factset

The US third quarter earnings season began with a bang in mid-October as the early corporate reporters handsomely beat expectations on both the revenue and earnings lines. The momentum slowed though and while results were still largely beating expectations, it became more and more apparent that Q3 earnings growth could still be modestly negative. The market had been expecting that Q3 would be the turning point, with earnings returning to a positive growth trend. That expectation, however, was pushed out to the fourth quarter and provided an additional headwind to the market. While the earnings results did provide a modest drag on the market, the going was mostly made difficult by the macro environment and the “higher for longer” interest rate narrative. The policy rates of the Federal Reserve Bank, the European Central Bank and the Bank of England were all believed to be at a peak but the bank governors continued to warn on the risks of inflation flaring up again and the consequent need for still higher rates. They all noted that while inflation had fallen from multi-decade highs, it was still too far from the 2% target level. Nevertheless, the central banks all paused on raising rates further, opting rather to collect more data on the inflation trajectory before enacting the next policy adjustment. Central bank governors were equally concerned about hiking rates too much and hiking rates too little and opted to wait for more information on the effects of their policy tightening over the past year to 18 months (which operates with a lag).

The bond market digested the rumblings of the central bankers but the governors’ hawkish talk only served to push out expectations of rate cuts late into 2024 and beyond. US treasury yields kicked higher again in October and after rising 48 basis points in September, they added another 33 basis points in October to close the month at a yield of 4.90%. This after trading at 5.00% for the first time since the Global Financial Crisis, 15 years ago. Higher bond yields were a function of market nervousness and US Treasury auctions were poorly supported – pushing market yields higher. The Federal Reserve did acknowledge that higher market interest rates could well be sufficient to do the central bank’s work and eliminate the need for higher policy rates. With bond market yields above the inflation rate, the real yield (bond yield minus inflation) is positive which makes for a restrictive monetary environment. Should inflation move lower or bond rates rise further, then the real yield would increase and effectively leave market rates more restrictive. Sharply higher bond yields in October were a key reason for the equity market weakness in the month.

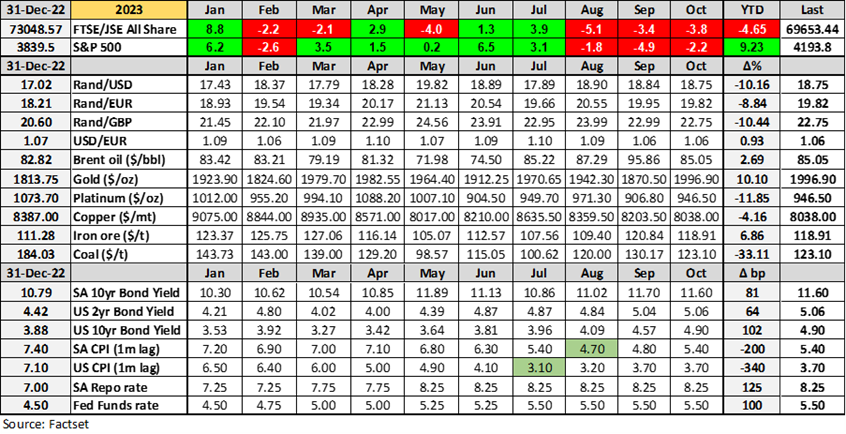

The table below details the monthly moves in the US and South African equity and bond markets in 2023 along with monthly moves in selected commodity prices, currencies, inflation rates and central bank policy rates. The green blocks on the inflation rows points to the recent low points in consumer price inflation – exactly a year after the peaks were reached in each country (and the higher inflation bases established).

Index, currency, commodity, inflation and fixed income moves in 2023:

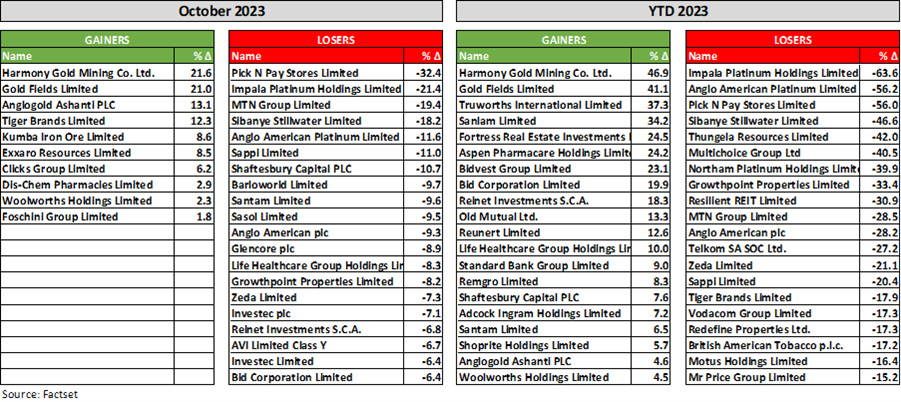

The table below reflects some of the JSE’s biggest winners and losers in the month of October and in the first 10 months of this year. The list of winners was rather abbreviated in October and the $126/oz gain in the gold price over the month lifted the gold miners to the top of the list. Iron ore and coal prices were modestly lower in October but Kumba and Exxaro both managed to eke out a high single digit gain in the month. The bourse’s two pharmacy companies were also on the green list after Clicks posted results that were very well received by the market. On the flipside, the platinum producers continued bending under the weight of higher costs and weaker metals prices and their share prices wilted again in October. The weakness in the sector is evidenced in the share price declines in 2023 with Implats down 63%, Angloplat down 56%, Sibanye Stillwater down 47% and Northam down 40%.

Pick n Pay announced the return of Sean Summers as CEO at the start of the month and then posted results towards the end of the month. Any turnaround in Pick n Pay’s fortunes will take time and while the market might speculate as to the level of success that Sean Summers might have with his second spell at the wheel, the market voiced its displeasure at the results and sent the share price down 32% in October. That left Pick n Pay down 56% for the year and in the company of the beleaguered platinum miners and other commodity stocks. The big winners in 2023 so far have been the gold shares along with a good smattering of financial stocks and a small number of selected recovering retailers, pharma companies and real estate companies.

Selected winning and losing stocks on the JSE over October and 2023 year-to-date (price):

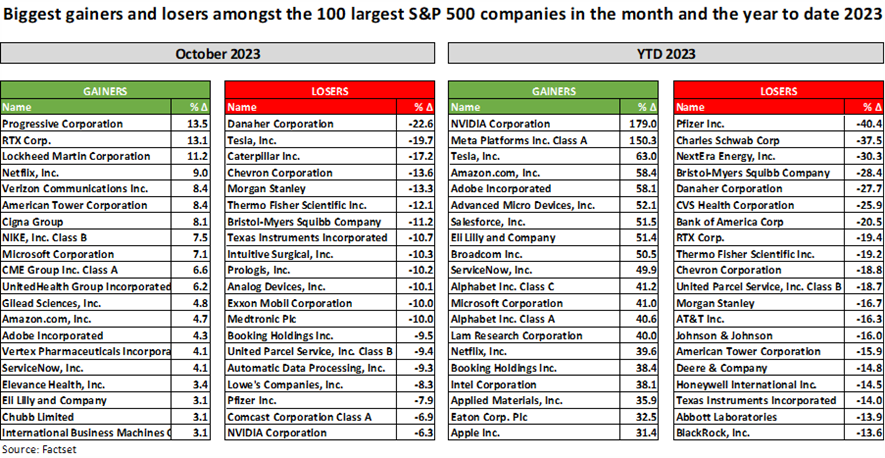

Higher bond yields continued to drive the overall “risk off” sentiment in the US market in October with corporate earnings season adding some individual flavour to those companies that reported. The weight loss drug theme, very much in evidence this year, continued in the month with Danish company Novo Nordisk gaining 6.2% and Eli Lilly gaining 3.1%. The short-term market thinking about these drugs is that they will help reduce the overall level of obesity which will lead to a lower demand for surgeries and the products and services of the medical technology companies. This ongoing story led Danaher to be the biggest S&P 500 loser in the month (-22.6%) with Thermo Fisher Scientific down 12.1%, Intuitive Surgical down 10.2% and Medtronic down 10.0%. Other pharmacare companies such as Bristol Myers Squibb (-11.2%) and Pfizer (-7.9%) were also under pressure in October.

The Generative AI theme took something of a breather in October as the market started questioning how long some of the market leaders could maintain their competitive advantage. Nvidia lost 6.3% in the month but that still left the counter up 179% for the year so far. The marginal revenue and earnings miss for high-flying Tesla disappointed the market when they released Q3 numbers and along with a weaker perceived outlook, the share lost 19.7% in October. That still left Tesla up 63% for the year with the third best price return of the S&P 500 companies in the first 10 months of the year. The Israeli-Hamas conflict initially had investors concerned about the supply and price of oil should the neighbouring territories become involved. Nevertheless, while the conflict continued, the oil market became less concerned about the market repercussions and the oil price gave up $10 a barrel in October. That was enough to see Chevron (-13.6%) and Exxon Mobil (-10.0%) amongst the biggest monthly losers. RTX Corp regained some of its losses in October (+13.1%) as the company announced an immediate $10bn share buyback programme to take advantage of the lower share price. The market liked that support for the share price but the company still faces additional liabilities with its Pratt & Whitney engine recall. After the share price rally, RTX Corp remained 19.4% down for the year.

Despite the August, September and October market malaise, the top winners in 2023 to date still include a substantial number of technology stocks. The top 20 gainers list below includes all of the “Magnificent Seven” stocks: Nvidia (+179%), Meta (+150%), Tesla (63%), Amazon (+58%), Alphabet (+41%), Microsoft (+41%) and Apple (+31%). The tagline for the 1960 movie “The Magnificent Seven” was “They were seven … they fought like seven hundred”. The Magnificent Seven stocks have done something similar and have provided an average capital return of +80.6% in the first 10 months of this year. This compares to a simple average (unweighted) return of -3.2% for all of the other stocks in the S&P 500 this year. They are seven stocks … they have fought like seven hundred!

After a bleak three months, the market could do with a bit of a reprieve. A Santa Claus rally into year-end to lift the markets and the spirits would be predicated on some lightening up of the tough central bank rhetoric. At the time of writing, the Federal Reserve Bank had held its 1 November meeting and paused on hiking rates for the second successive meeting. There is one meeting to come this year on 11-12 December and the Fed will have a little more time to review the economic response to its restrictive policy so far. It may want to wait even longer to see the impact of its higher rates on inflation (and growth) but the market is now leaning towards no further rate hikes from the Fed. That’s also the view for European Central Bank and Bank of England policy rates. Any whiff of lower rates to come would be very well received by the market, especially once we enter 2024 and start believing that easier monetary policy is that much closer. If not, we could always keep faith in the Magnificent Seven stocks – after all, the Magnificent Seven proved their longevity as they rode on to three more sequels.