Monthly economic and market review: November 2023

Investors were reminded in November why “staying the course” and “staying invested” are such key investment principles when trying to grow wealth in the equity market over the longer term.

Investors were reminded in November why “staying the course” and “staying invested” are such key investment principles when trying to grow wealth in the equity market over the longer term. By their very nature, equity markets exhibit substantial volatility in the short-term but that is the exact market attribute that helps investors to grow the value of their equity portfolios over the longer-term. The chart below reflects how the S&P 500 index (in green) peaked at 4,589 index points on 31 July before falling in August, September and October to a low point of 4,117 points on 27 October (a decline of 472 points or 10.2%). The turning point came when the market started anticipating that the Federal Reserve’s next move on interest rates would be down and not up. Markets are always forward looking and despite some tough talk by Federal Reserve Bank members, the market began factoring in a policy pivot. The equity market turned very quickly, and the momentum was fuelled by some slightly more dovish comments from selected Federal Reserve Bank officials. In anticipation of lower policy rates, US treasury yields also began to move lower and that spurred the US equity market to regain almost all of its losses of the previous three months. When November was assigned to the history books, the S&P 500 index had clawed its way back to 4,568 index points (up 450 points or 10.9%). The pattern was very similar on the local market but the JSE’s sharp recovery to 75,534 points in November from its 27 October low of 69,453 points still left the index short of its 31 July peak of 79,878 index points.

Source: Factset

The all-time high closing level of the FTSE/JSE All Share index remains at 80,791 which was recorded on 27 January 2023. The all-time high close of the S&P 500 index was a year earlier on the very first trading day of 2022 (03 January) at 4,797 index points. At the market closes of end-November, the JSE was 7% (5,257 points) shy of its all-time high and the S&P 500 was 5% (229 points) short of its all-time peak.

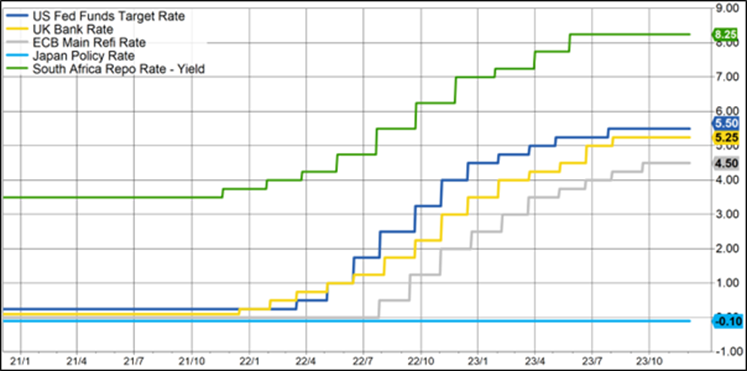

When all was said and done with the third quarter US corporate earnings reporting season, the aggregate earnings were slightly higher than those recorded in the second quarter. Arresting the decline in earnings was an important turning point and was supportive of the market but it was not the major reason why markets improved so markedly in November. Rather, it was changed perceptions (for the umpteenth time) on the future course of policy rates. This was despite central bankers around the world continuously warning that interest rates might have to rise further until inflation was much closer to target levels. US inflation had fallen from a peak of 9.1% in June 2022 to a low of 3.1% in June 2023 and remained below 4.0% up until the most recent reading of 3.2%. Consequently, the target of the Federal Funds rate, which had been increased by 25 basis points to 5.25% in May, has been left unchanged since then (see chart below).

South African consumer price inflation peaked at 7.8% in July 2022, fell to a low of 4.7% in July 2023 and was last at 5.9% (October data published in November). May was also the last time that the South African Reserve Bank adjusted its policy rate and after the 50 basis points increase to 8.25% in May, the repo rate has remained unchanged for six months. The two-year monthly graph below highlights the rapid increase in policy rates in the developed world and in South Africa in response to the rampant inflation of the time and reflects the pause in rates currently being experienced. It’s from these levels that the market now expects policy interest rates to be gradually reduced. The rates are in restrictive territory and even with some anticipated modest easing, policy could still be considered to be restrictive but potentially less harmful for growth. In their quest to find the right balance between doing too much and doing too little, central banks have chosen to wait on more data but there is no doubt that tight monetary policy is hurting households, businesses and overall consumption.

Key central bank policy rates: 2021-2023

Source: Factset

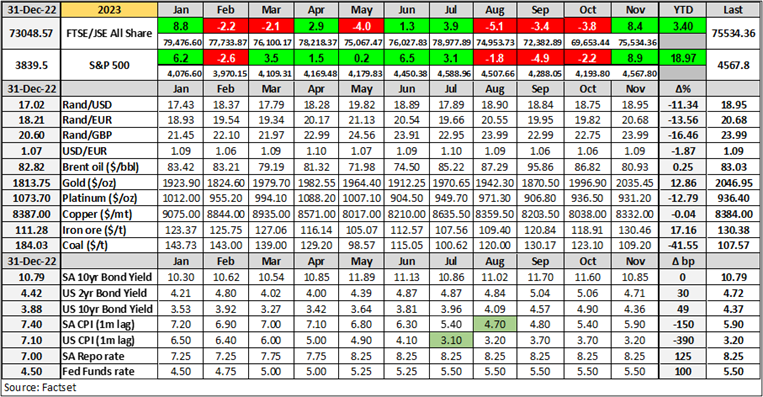

The table below details the monthly moves in the US and South African equity and bond markets in 2023 along with monthly moves in selected commodity prices, currencies, inflation rates and central bank policy rates. The change in sentiment around the Federal Reserve Bank’s next move is clearly evident in the change in the yields of the US Treasuries. Over the course of November, the 10-year treasury yield fell by a massive 54 basis points (4.90% à 4.36%) while the yield on the two-year treasuries fell by 35 basis points (5.06% à 4.71%). Markets have been disappointed many times before after calling the “policy pivot” too early but there appears to be a lot more conviction around that the Federal Reserve will cut interest rates in 2024. The current expectation is for around 100 basis points of cuts in the year, starting as early as May. The expectation in South Africa is very similar and while SA bond yields may have declined in sympathy with those in the US (10-year yield down 55 basis points in November), the market expects at least 100 basis points of cuts domestically, also kicking off before mid-year.

The gain of 8.4% on the JSE in November was second only to the 8.8% gain in January while the index gain of 8.9% in November on the S&P 500 was its best month of 2023 so far. The American market was a smidgen short of being up 19% for the year-to-date and while this is a very impressive move, one must remember that the S&P 500 was down 19.44% last year. The November gain on the JSE pushed the benchmark index back into the green and although it was up 3.4% for the first 11 months of the year, this amounts to a negative return of around 5% in US dollar terms. The expectation of lower US interest rates did hurt the US dollar in the month but the November closing level of $1.09/€ can’t be considered a train smash in the context of the $1.06/€ - $1.10/€ trading range of the year so far.

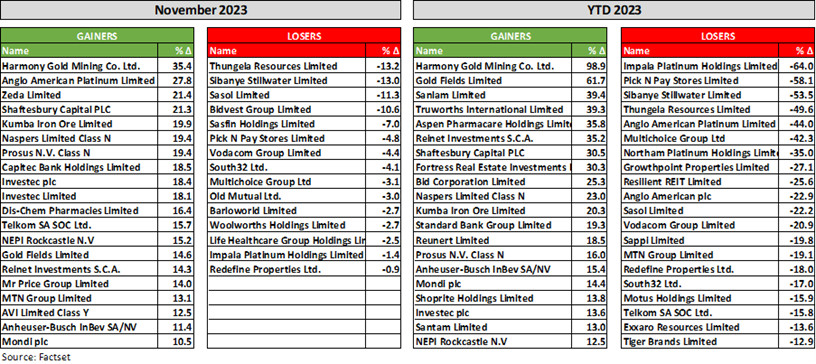

The table below reflects some of the JSE’s biggest winners and losers in the month of November and in the first 11 months of this year. Whereas it was difficult to find 20 gainers on the local market last month, this time around it was difficult to find 20 losers amongst the larger capitalisation stocks. Most of the positive market sentiment was driven by a global “risk on” attitude rather than any local market specifics. At home, investors had to digest the fiscal slippage presented in National Treasury’s Medium-term Budget Policy Statement at the very start of the month and then also negotiate another Monetary Policy Committee (“MPC”) meeting at the South African Reserve Bank. The one positive out of those two key events was that the MPC members voted unanimously to keep the repo rate unchanged. At previous meetings there were dissenters still voting for higher rates. A unanimous decision gave the market more comfort that the next adjustment to policy rates would take the form of a reduction rather than an increase.

Selected winning and losing stocks on the JSE over November and 2023 year-to-date (price):

Gold broke through the $2,000/oz level again in November and that helped lift Harmony to the top of the winners list in November (+35.4%) with Gold Fields (+14.6%) also closing firmly positive. Naspers and Prosus matched each other’s gains of 19.4% for the month with share buybacks continuing and with Tencent releasing fairly positive results towards the end of the month. The market gains were broad-based with selected resources stocks, banks, telecommunication companies, retailers, food retailers and real estate companies all well into the green in the top 20 performers in November. The laggards generally each had their own specific company issues to deal with but the local economy companies suffered specifically under load-shedding, the elevated level of interest rates, the supply constraints due to infrastructure failures at the ports and the broad slowdown in domestic demand.

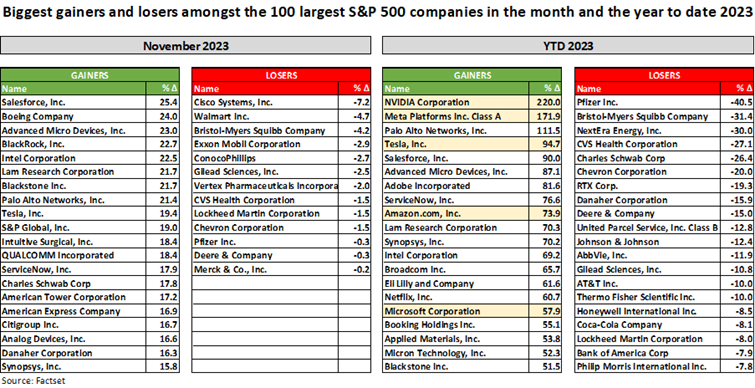

The gains on the S&P 500 were also broad-based in the month with only 13 of the 100 largest S&P 500 companies closing in negative territory. Technology stocks were the biggest gainers in the month and that was evident in the software, semiconductor, cybersecurity and electronic vehicle companies. Tesla (+19.4%) was the only one of the “Magnificent Seven” stocks amongst the top 20 gainers but they all finished higher in November with Nvidia up 14.7%, Microsoft up 12.1%, Apple up 11.2%, Amazon up 9.8%, Meta up 8.6% and Alphabet up 6.8%. Energy and pharmaceuticals companies were the biggest losers in November although the magnitude of the losses was fairly small.

Pharmaceutical companies and medical technology companies have been in something of a post-Covid depression and are working off the very positive base created during the pandemic times. They are all amongst the biggest losers in 2023 so far and have also had to face the headwinds brought about by the new wonder weight loss drugs. The rationale seems to be that a less weighty population would have less need for knee and hip replacements or stents, valves and pacemakers. A healthier population would also have a reduced need for scopes and robotic surgeries. But maybe, just maybe, a healthier population also plays more sports and has more sports injuries that require the use of the wares of the medical technology companies. For now, the likes of Eli Lilly (+61.6%) and Novo Nordisk (+48.3%) are flying high but one shouldn’t write off the very innovative and essential medical technology sector.

Five of the “Magnificent Seven” stocks are amongst the top 20 gainers in 2023 so far (highlighted in yellow below) with Alphabet (+50.1%) and Apple (+46.2%) just bubbling under with their own incredible performances this year. The dominance of technology and innovation in the year-to-date (“YTD”) gainers list is also very apparent.

In last month’s commentary we suggested that the markets would respond very positively should they get a whiff of lower interest rates to come. The frenzy that we did get in November was like a blood hound seeking out a lost hiker in the woods after just a sniff of an old t-shirt. At this point in time, valuations on the local market are generally cheap while those on the offshore markets (the US in particular) are in more expensive territory. The catalyst for the JSE to re-rate is still not quite clear but ultimately the value will come out. In the US where valuations have run hard, companies are still buying back their shares and earnings growth has been restored and that should support further market gains in time, particularly as interest rates start moving lower. We have one more month to go before we close out 2023 so let’s wait and see if the markets are still in a giving mood in December.