Monthly economic and market review: June 2025

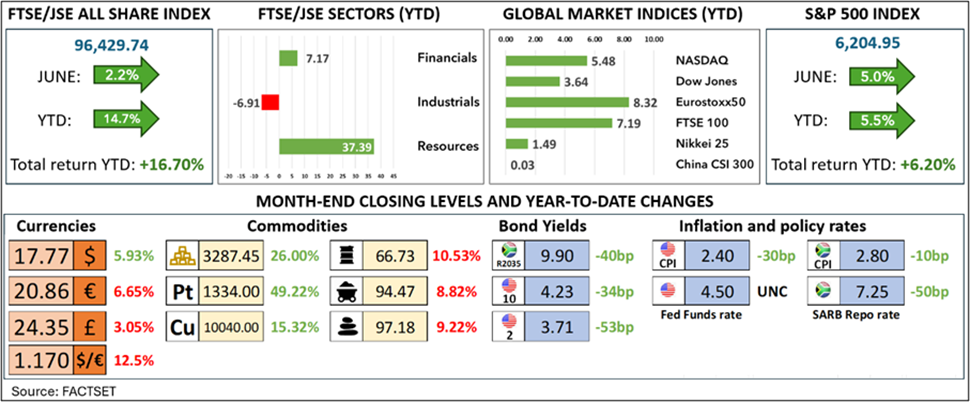

New market highs were the order of the day in June as the JSE, S&P 500, NASDAQ and others scaled all-time peaks, despite many ongoing macroeconomic uncertainties and geopolitical tensions.

New market highs were the order of the day in June as the JSE, S&P 500, NASDAQ and others scaled all-time peaks, despite many ongoing macroeconomic uncertainties and geopolitical tensions. Tariff talk and trade negotiations made the news daily but by the end of the month and with the three-month deadline of 9 July looming, the US had yet to ink any trade deals. President Trump’s “One Big Beautiful Bill Act” was also a daily headline as Democrats fought to halt its progress through Congress. The House of Representatives narrowly passed the bill and sent it to Senate where the vice-president had to cast a deciding vote post month-end. The House then approved the bill with the Senate amendments to get the bill to the president’s desk by his Independence Day deadline.

The month was also filled with “Fed-speak” as numerous US Federal Reserve officials provided their opinions on the state of the economy and their outlooks on monetary policy. Fed chair Jerome Powell also formally addressed the US Senate and House of Representatives in his semi-annual testimony to Congress where he had to endure the usual grilling from politicians. The Federal Reserve Open Market Committee also sat mid-month and left the target of the Fed Funds rate unchanged. The June meeting was accompanied by the quarterly “Summary of Economic Projections” which included the “dot plot” representing committee members’ views on the path of the official policy rate. After all of the formal announcements and Fed soundbites, the market was left with the message that the US economy was in good shape and that the Fed had breathing room to wait and see how inflation and growth play out before adjusting rates for the fourth time in this cycle. Nevertheless, the broad expectation was that the Fed would cut rates by 50 basis points this year, in two 25 basis point tranches. This apparently firmer view of monetary policy easing in 2025 saw bond yields drift modestly lower. The dollar also weakened from $1.14/€ to $1.17/€ to its weakest level since September 2021. The rand benefited from the dollar weakness, closing at R17.77/$, its best monthly close since October 2024.

A big driver of market sentiment in the month was the Israel-Iran war. After a mid-month Israeli attack on Iran and a subsequent Iranian retaliation, the US stepped in with a night-time bombing of Iranian nuclear facilities. The success of the raid on Iranian enriched-uranium stockpiles wasn’t immediately apparent but the agreed ceasefire following the bombing was well received by the markets. The risk-off sentiment that initially weakened the markets quickly reversed on news of the ceasefire, pushing the S&P 500 to new record levels (see the blue line in the chart below). The index gained 5.0% in June to lift the return for the half-year to 5.5% and a total return (including dividends) of 6.2%. Technology stocks led the way higher once more and the sector returned 9.73% against the return of the NASDAQ Composite index of 6.57%. Technology heavyweight Nvidia gained 16.9% in the month on renewed optimism around the demand for semiconductors in the artificial intelligence race. Communication Services (+7.18%), the sectoral home of Meta (+14.1%) also outperformed the broader market this past month. Energy (+4.74%), Industrials (+3.46%), Financials (+3.08%), Consumer Discretionary (+2.12%), Materials (+2.09%), Healthcare (+1.88%), Utilities (+0.08%), Real Estate (-0.49%) and Consumer Staples (-2.21%) all underperformed the S&P 500 index in June.

S&P 500 (blue, RHS) & FTSE/JSE All Share Index (green, LHS) – last 12 months

Source: Factset

The local market continued its charge in June with the FTSE/JSE All Share index setting six new record closing levels on its way to a 97,029 index point all-time peak on 12 June (see the green line in the chart above). The JSE wasn’t immune to the mid-month global risk-off sentiment but after a brief dip, the index recovered to close the month at 96,429 points, just 0.6% shy of its record high. Financials (+4.35%) just pipped Resources (+4.23%) to be the best performing sector in the month but Resources (+37.4%) have left Financials (+7.2%) in their dust for the year so far. Gold was flat in June but the massive jump in the platinum price in the month ($1,051/oz à $1334/oz) launched the platinum group metals miners skywards with gains of between 12.1% (Valterra) and 26.6% (Northam). Gold and platinum stocks continued to be the main drivers of market performance this year with Sibanye-Stillwater (+115%), Northam (+97%), AngloGold Ashanti (+90%), Implats (+81%), Gold Fields (+68%) and Harmony (+62%) the biggest gainers amongst the JSE’s large capitalisation stocks. These stocks have been ably supported by other large capitalisation names including Reinet (+29%), Anheuser Busch (30%), British American Tobacco (24%), Naspers (+32%), Prosus (+32%) and the telecoms names: Telkom (+54%), MTN (+53%) and Vodacom (+35%). The Industrials sector lost 1.3% in the month to be down 6.9% for the first six months of 2025. The losers list in June was littered with “SA Inc” stocks and the local clothing and food retailers lost further ground in June to remain amongst the biggest detractors from market performance this year.

See the appendix below for a broader list of market movers on the JSE and the S&P 500 during the month and the first six months of the year so far.

Summer has come to the Northern Hemisphere and it’s often a time when investors in those hotter climes focus a little less on markets and a little more on their R&R. From all of the record market highs (buoyed by a good quarterly US reporting season), there is the potential for a bit of a breather as the beach pips the bitcoin and the barbecue beats the bulls. In a world where a Trump tweet can change the course of economies and markets at any time, there are never any guarantees. We still have to see what the White House response will be when the three-month tariff “pause” expires on the 9th of July but in the absence of a catastrophe, there are still numerous factors supporting markets. The US second quarter earnings reporting season will begin in earnest in mid-July and while the year-on-year growth rate in earnings is expected to fall back into high single-digits for the quarter, the growth rate should nevertheless be strongly positive. Where earnings guidance was withdrawn by some companies in the midst of all of the tariff, interest rate and economic uncertainties, we may see guidance being reinstated, even if it is in a measured way. The mega-capitalisation technology stocks have also found favour again as their strong earnings results have eased concerns around their massive capital expenditures. From a macroeconomic point of view, global growth is slowing but monetary policy has become a lot more accommodative. The Federal Reserve looks set to cut rates further this year while we can still expect further policy easing around the globe. That includes interest rate cuts from the European Central Bank and the Bank of England. The South African Reserve Bank could also cut rates again at its meeting at the end of July. We are much closer to the end of the easing cycle than the beginning but there’s still some policy tweaking to be done and that should be good for markets. When it comes to this northern hemisphere summertime, let’s hope that it’s more the kind of Janis Joplin’s “Summertime and the livin’ is easy” than Lana Del Ray’s “Summertime Sadness”.

Appendix: Market Movers