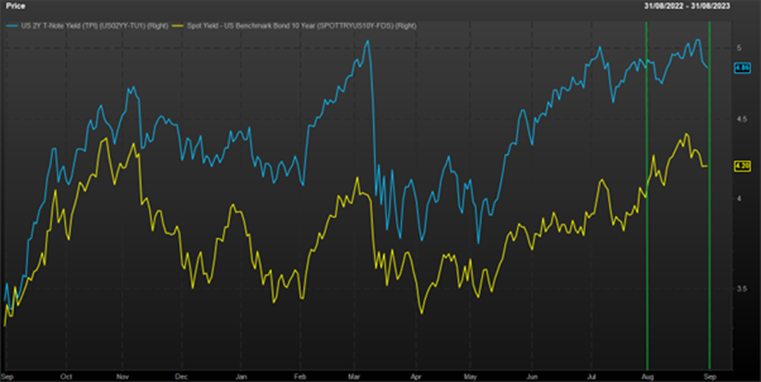

The paint had hardly dried on the “US rates have peaked” headline when the market began to second guess itself for the umpteenth time in the cycle. Strong labour market reports and unrelenting tough talk by Federal Reserve Bank officials outweighed the declining trend in inflation in August. It was only following the meeting of central bankers later in the month in Jackson Hole, Wyoming, that the equity market began moving positively once more. At close on 18 August, the S&P 500 index was down 4.8% for the month so far while the FTSE/JSE All Share Index was down 7.5%. In a very short space of time, the market had suddenly swung back into “risk-off” mode with the US dollar finding strong support and appreciating from just over $1.10/€ to below $1.08/€. US treasury yields started rising again as speculation mounted that US policy rates had further to go and two-year treasury yields (blue line below) topped 5.0% once more (the August period is between the green lines in the graph below). The 10-year yields (in yellow bellow) also moved higher to levels last seen in November. Higher bond yields translated into lower stock valuations, particularly for companies such as those in the technology space, where stronger cash flows are expected in later years (the so-called “long duration” stocks). As the US second quarter earnings season wrapped up over August, earnings misses were punished heavily while in-line earnings and even good earnings beats were largely glossed over. Market darling Nvidia was a case in point. The company published earnings well beyond expectations and provided an outlook and guidance that shot the lights out yet the share was almost unmoved on the next trading day.

US 2yr and 10yr Treasury Yields over the past year

Source: Factset

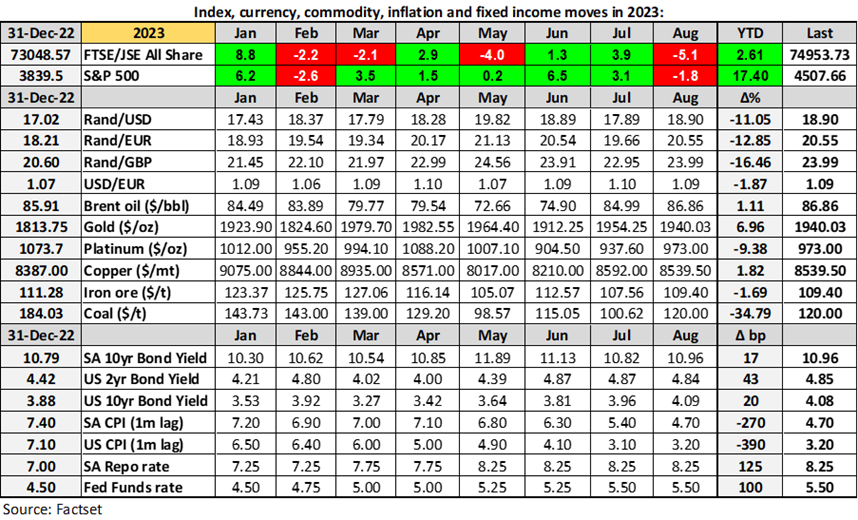

There was a modest market reprieve after the 18 August low point but the markets regained renewed impetus when the address by Federal Reserve Bank Chairman Jerome Powell was considered to represent more of a balanced view on monetary policy. Powell maintained his stern demeanour and bemoaned that inflation was still too high but he did concede that the Federal Open Market Committee was equally concerned about hiking rates too much (and hurting the economy excessively) as they were about not hiking rates enough (and not achieving the 2% inflation target). After reaching its strongest level of the month on the day of the Jackson Hole conference, the dollar immediately began to weaken and treasury yields began to fall. The two-year treasury yield slid from 5.06% to 4.90% in the very next trading day. After posting 13 negative trading days in the 18 days leading up to Jackson Hole, the S&P 500 gathered momentum to close out the month with gains in four of the final five trading days. When the dust had finally settled, the S&P 500 closed down 1.8% for the month. The JSE also experienced a modest rebound in the final part of the month but the local market was still left 5.1% lower in August. With two-thirds of the year done, the S&P 500 was left 17.4% higher for 2023 so far with the JSE up 2.6% in rands but down 7.5% in US dollar terms (see table below).

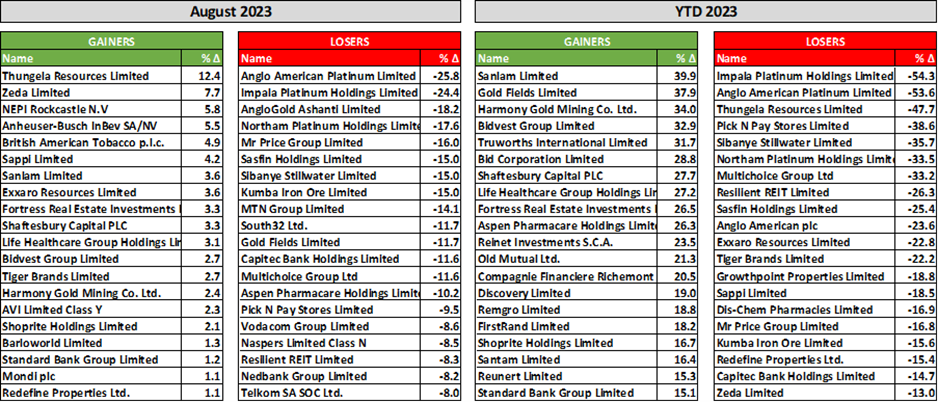

The table below reflects some of the JSE’s biggest winners and losers in the month of August and for the first eight months of this year. Precious metals prices remained stagnant in August but a number of the mining companies reported in the month and the earnings presented for the previous reporting periods showed a precipitous decline. Each mining company has its own unique challenges but they all operate within the same macro-economy and they were all subjected to sharply lower prices for their metal sales. In many instances, production volumes were also lower and costs were higher, compressing margins and reducing bottom line profits (and dividend payouts). The substantial declines in the month for the likes of Angloplat (-25.8%), Implats (-24.4%), Northam (-18.2%) and Sibanye (-15.0%) left those counters amongst the biggest losers for the year so far (Implats and Angloplat having lost more than half of their value). Beleaguered Thungela Resources led the gainers in August (+12.4%) but remained almost 48% below its 2023 starting value. The gold miners were on the back foot in August but despite some backtracking, they remain amongst the biggest gainers on the market so far this year. The slight retreat in the gold stocks left life assurer Sanlam as the best of the large capitalisation gainers in 2023 so far with a gain of almost 40%.

Selected winning and losing stocks on the JSE over July and 2023 year-to-date (price only):

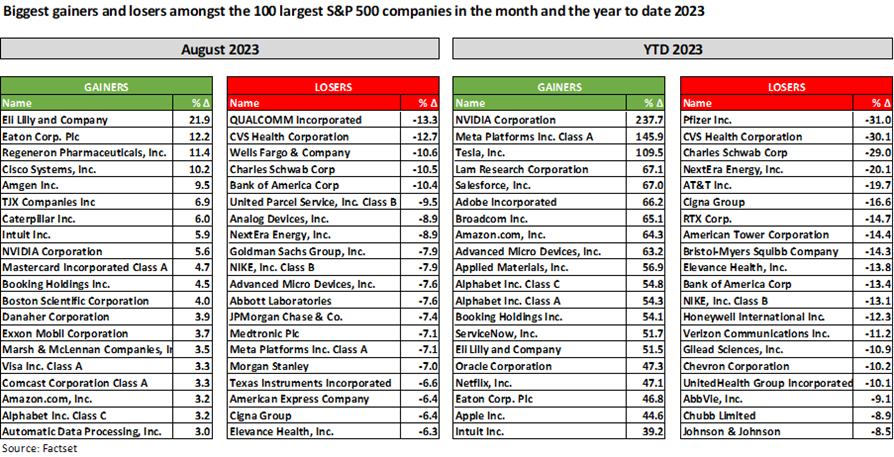

For only the second time this year, the S&P 500 index recorded a negative trading month with a decline of 1.8% in August. A total of 70% of the S&P 500 stocks were lower in the month. The table below highlights the leading winners and losers from the 100 largest S&P 500 stocks in both August and the first eight months of 2023. Artificial intelligence (“AI”) remained a key talking point at results time and companies with any link to AI were viewed in a positive light. Nvidia’s blowout results and guidance helped the company stay in the green in August (+5.6%) and lift it to a new record close just shy of $500. Having a technology bias was no guarantee of success in August though as Meta, AMD, Texas Instruments and Qualcomm found themselves amongst the biggest losers in the month. Nevertheless, the technology and AI narrative has continued to define the market’s year with Nvidia (+237.7%), Meta (+145.9%) and Tesla (+109.5%) leading the gainers list in 2023. It remains to be seen whether Mark Zuckerberg and Elon Musk will actually end up physically slugging it out in the octagon but Meta and Tesla continue to go head-to-head for dominance of the charts this year. They still have a long way to go to catch Nvidia, and its CEO Jensen Huang will likely prefer to let his technology do the talking rather than his fists. Semiconductor-related companies Lam Research, Broadcom and AMD are amongst the top 10 gainers this year with AI programs depending heavily on semiconductor-rich data centers to do their work.

Top winning and losing stocks from the 100 largest S&P 500 companies in July and 2023:

August and September are traditionally weaker months for the equity markets but history and past averages are no guarantee of how the markets will play out over the final four months of the year. With the US second quarter earnings season just completed, news flow on individual companies will be a little bit lighter until the next reporting season kicks off in early October. The market will continue to focus on anticipating central bank policy moves and will be buoyed and buffeted from one key economic print to the next. There is no shortage of employment, inflation, activity and confidence indicators and those should continue to drive short-term market sentiment. For now, the belief is that US policy rates have peaked and should start declining during the course of 2024. European rates still have another tightening leg and UK rates might still be tightened further but globally the hiking cycle is nearing an end. China will remain a key focus as the expected economic rebound post the opening of locked down cities is still missing in action. The Chinese authorities have already moved to try and stimulate that economy through lower interest rates but the policy adjustments still appear too modest and the growth initiatives a little too opaque. The Chinese economy is a key part of the global economy and a growing China is not only good for the world (and commodity demand) but it is key for South Africa. China remains South Africa’s most important single trading partner as the destination of 9% of our exports and the source of 22% of our imports.

Overall, there’s bound to be a lot of short-term market noise as we try and understand and anticipate fiscal and monetary policy moves around the world and as we get more to grips with the real benefits and earnings potential of artificial intelligence, semiconductors and that amorphous entity called “the cloud”. Separating the long-term winners from the fly-by-night wannabees will be key and as always, maintaining a long-term investment view of one’s equity portfolio will be critical. Just ask Siri or Alexa.