Trade Finance: Improving Your Importing Business Performance

Sasfin offers trade finance to boost your import business, with up to 180-day credit terms, expert support, and solutions to manage working capital efficiently.

An Introduction to Trade Finance

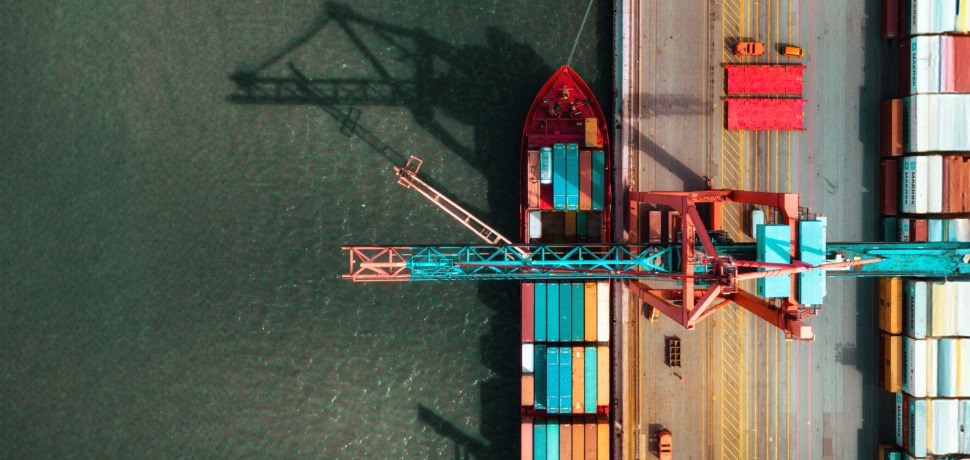

Trade finance is an important instrument for organisations dedicated to international trade, allowing for more efficient cross-border operations. Consider the scenario of purchasing imported shoes from a retail store. These shoes, which were not made locally, were manufactured overseas, and brought to South Africa. The importing company was required to make advance payments to suppliers, shipping agents, logistics companies, and stocking costs.

Importing goods demands significant upfront investment, posing a challenge to businesses. Here, trade finance steps in, offering a revolving facility to manage the financial aspects of international commerce efficiently. This facility allows businesses to pay suppliers, shipping costs, and logistics expenses, deferring payment until after the goods are sold.

Trade Finance Benefits: Increase Cash Flow and Reduce Risks

Trade finance plays an essential role in facilitating global trade because it ensures that exporters are quickly paid for their goods/services and that importers obtain the goods/services stipulated in their contracts before any payment is made. This form of financial intermediation efficiently bridges the trust gap between individuals in different nations, protecting both sides of the transaction. Trade financing considerably improves businesses' liquidity by providing short-term loan solutions, allowing them not only to run their existing operations more effectively, but also to conduct larger trade deals that would otherwise be out of reach financially.

The benefits of trade finance include allowing enterprises to enter new markets with less financial risk. This research is critical for businesses looking to diversify their supply networks, making them more resilient to local and global economic shocks. In addition to market expansion, trade finance allows a company to expand its customer base by offering more appealing payment terms, attracting a broader range of clients.

Furthermore, trade finance is critical in risk management, particularly while negotiating the complicated terrain of international trade. It provides a buffer against the unpredictability of currency swings, protecting earnings and guaranteeing pricing stability. Trade finance provides firms with a secure environment by mitigating numerous risks, including political, counterparty, and currency risk.

Accessing Trade Finance: A Variety of Financial Instruments

Key participants in trade finance include a broad spectrum of stakeholders, each with a critical role in ensuring the smooth running of international trade transactions. These stakeholders include buyers, also known as importers, who seek to acquire goods or services from overseas markets, and sellers, or exporters, who want to distribute their products or services globally. Financial institutions, particularly banks, are at the heart of trade finance. They provide critical funding and play a vital role in enabling trade by providing a variety of financial instruments, including letters of credit and trade loans, that help bridge the gap between buyers and sellers by guaranteeing that payment terms and delivery requirements are satisfied securely.

Additionally, insurance companies contribute to the trade finance ecosystem by providing coverage against a variety of risks connected with international trade, such as political instability, nonpayment, and cargo loss or damage. Export credit agencies, which are often supported by governments, provide exporters with guarantees and insurance, encouraging them to engage in international trade by alleviating some of the inherent risks. Finally, intermediaries, such as specialised trade finance businesses and brokers, help to simplify the complex process of structuring trade transactions while ensuring that all parties satisfy their commitments swiftly and effectively. These essential participants comprise a complex network that supports and facilitates the free movement of commodities and capital across borders, so contributing to global economic growth and development.

Trade Finance Solutions: Invoice, Supply Chain Finance & Credit

Invoice financing, also known as factoring, allows businesses to sell their accounts receivable (invoices) to a bank at a discount. This solution provides immediate cash flow to the seller, enabling them to maintain operations and invest in growth without waiting for the invoice payment term. Purchase order financing, on the other hand, is designed to help businesses fulfil large orders. Under this arrangement, a financial institution pays the supplier directly on behalf of the buyer for the cost of goods, which the buyer then repays once the goods are sold to the end customer.

Supply chain financing, also known as reverse factoring, is a collaborative financing solution where a buyer arranges for their suppliers to receive advance payment of invoices at a discounted rate through a financial institution. This arrangement benefits both the buyer and supplier by optimising cash flow and reducing working capital constraints. Working capital financing provides short-term funding to cover a company’s operational expenses, such as payroll, rent, and inventory. This type of financing helps businesses manage their day-to-day cash flow needs, especially during periods of growth or seasonal fluctuations.

Lastly, letters of credit are a fundamental instrument in trade finance, acting as a guarantee from a bank that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment, the bank will cover the full or remaining amount of the purchase. This instrument significantly reduces the risk of non-payment, particularly in international trade transactions where the buyer and seller may not have an established relationship.

The Sasfin difference

Sasfin is a comprehensive commercial banking institution with significant origins in trade finance. Established by and for entrepreneurs, our primary goal is to support entrepreneurial endeavours. We specialise in developing systems that streamline working capital management, allowing your Business to increase import quantities without depleting its operational cash. Our offers are intended to help your business grow by providing both foreign and domestic trade financing solutions that improve working capital liquidity. With financing terms of up to 180 days, we hope to provide your business the breathing room it requires to develop.

Our team are import experts and we have the infrastructure, products, and services to cater for all the financial and service needs of an importer, allowing you to optimally finance and manage every aspect of your foreign trade, while leveraging our backing and expertise.

Click here to find out more.