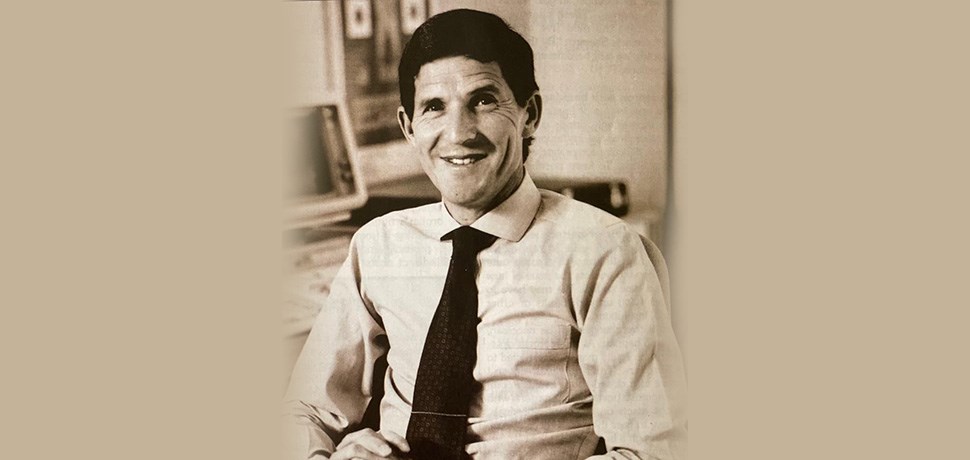

David’s journey has by far been one for the books, a great thought leader both to domestic, global audiences and the ABSA Jewish Achievers Awards have nominated him for the Lifetime Achievement Award in honour of Helen Suzman. This is awarded to a Jewish person who has served the Jewish community with remarkable distinction. This would be an opportunity for me to have a coffee chat with the man behind this noteworthy acknowledgement.

An avid Arsenal supporter, traveller and very much outspoken maverick, David Shapiro has over the years built his brand across communities, stakeholders, and clients. He attributes his success to his readiness to engage with people, “I was always available to people, whether they needed market commentary or advise on how to invest. I made myself available.”

“I was always available to people, whether they needed market commentary or advise on how to invest"

“Be prepared” he adds, these would be the words to start off my conversation about his experience working as a stockbroker, his contributions to the business media industry and journey at the Johannesburg Stock Exchange (JSE) trading floor.

David began his career on the trading floor at the JSE, were he witnessed the exceptional performance of many companies, and terrible market falls. His father was too a renowned trader something David thought he would never gravitate towards.

In 1972 is when it all began shortly after qualifying as a Chartered Accountant, years later he would serve on the committee of the JSE from 1986 to 1992. He shares some memories on the good times at the JSE. “We were a community, we looked after each other.” One could hear the passion he has for humankind and ensuring each is treated with respect. He went on to share that the trading could be brutal, but the men were always protective of the women if things got too rough.

Speaking on his inspiration, in an article written by Justin Rowe-Roberts for BizNews, David also compliments legendary investor Warren Buffet for his take on life and investing; the down-to-earth Berkshire founder is one of his role models.

After thirty years with the predecessors of Sasfin in the trading game on the stock market and a few years with Corp Capital and Barnard Jacobs Mellett, David re-joined Sasfin Securities in 2005 with the intention of aiding the brokerage business in raising its market presence. I asked him to tell me more about the journey between him and Sasfin since re-joining the business?

“I took a decision that I didn’t want an executive role, I wanted an office and all I wanted to do is build up a client base.” With this David saw the big break when former President Mbeki said he would spend R150 billion on infrastructure. “I said that is a great idea, and I am going to start a fund, called the Twenty Ten fund that would invest in businesses that would benefit from preparations for the World Cup. My idea was met with criticism, because of what came after the World Cup, but I built it up and yes, we had some tough times, but I kept working on the fund this together with building up a client base in the process.”

“I took a decision that I didn’t want an executive role, I wanted an office and all I wanted to do is build up a client base.”

He emphasises the importance of market knowledge and thinks it is crucial to keep your investing strategy simple by sticking with quality businesses and recognised firms. In 2012 the fund would go on to win one Raging Bull award for best value fund and two in 2014 for best general equity fund performance over a three-year period and the finest South African general equities fund on a risk-adjusted basis. This would see Sasfin reinforcing itself in the industry as one of the best.

Speaking to one of his colleagues who has known David from the early days at the JSE and now Sasfin, Gill Scott said “We in Sasfin always refer to David as our Rockstar, when there is a room full of people David comes alive. David has the most beautiful handwriting - we had framed one of the written financials that he did before computers in our Melrose office. David loves his family and his grandchildren.”

“We in Sasfin always refer to David as our Rockstar, when there is a room full of people David comes alive"

This prompted me to ask David what legacy he would like to leave behind? “You got to leave behind some culture, philosophy, and a way of doing things, it is particularly important to have a value system and do things the right way. Leave with a good name. I believe everyone’s role in an organisation is important, from the cleaning lady to the driver, everyone is important.”

David is people centric; I reflect…. More pearls of wisdom were shared during our conversation, his relationship with his in-laws’ who were political prisoners and committed communists, Presidents Ramaphosa’s investment drive, the South Africa political history especially within the mines. “We would go every Sunday to the Crown Mines to watch the mine workers from neighbouring territories come together and celebrate each other through music and dance, my favourite was the gumboots dance. “ he recalls.

He also talks about the trajectory that the country is currently facing, “We must reset, get the basics correct – we have so much to give as South Africa” he concludes as he heads off to a television interview on the day’s market performance.

I can additionally verify that David is very much confident in the young leaders entering the industry and he believes there are great investment opportunities globally to come especially from the technology market. David provides commentary regularly in the media and on podcasts. Follow him on social media @davidshapiro61