What the shrinking JSE means for Retirement Funds

The movements in global and local investment markets during 2023 have again reminded investors how important it is to have a robust investment portfolio solution.

The movements in global and local investment markets during 2023 have again reminded investors how important it is to have a robust investment portfolio solution. A well-constructed long-term investment portfolio strategy must be able to absorb the shocks of volatile markets and capitalise on the opportunities presented by sentiment and uncertainty. This is specifically true for retirement funds that represent the most significant component of the long-term savings of many South Africans.

Long-term capital growth in real terms

Retirement funds in South Africa are required to adopt a default investment strategy for all fund members. This default investment strategy is also known as a life-stage model designed to ensure members are invested according to the investment risk they can afford based on how far they are from retirement. Most retirement funds have adopted a growth or high equity multi-asset portfolio as part of the default life-stage model for members with at least six to seven years to retirement. This portfolio would use the available time that members have until retirement to maximise the growth in value of their retirement benefits and future fund contributions. The investment objective of a growth portfolio would typically be to achieve a real return above cpi inflation of between 5% and 6% over any 5 to 6-year rolling period. To achieve this real growth in the member benefits, the portfolio manager would be required to invest most of the assets in the growth portfolio in growth asset classes such as local and global equity and property.

A shrinking investment universe

The growth portfolios of most retirement funds have close to 75% of their assets allocated to local and global equity, as prescribed by Regulation 28 of the Pension Funds Act. With the holding of some of the larger asset managers of retirement funds being around 30% to 35% in offshore equities, this would mean that these managers are holding about 40% to 45% in shares listed on the JSE. Over the past two decades, the JSE has seen the number of listed companies decline from around 470 listings in 2003 to 287 today. One hundred delistings were recorded in the past 5 years at a net delisting rate, i.e. listings less delistings, of 14 companies per year. Of the remaining listed companies, the trading on various shares has been suspended for different reasons. While the JSE has lost many listed companies during the past two decades, the remaining ones are a stronger and more solid group of companies in which to invest. The growing delisting trend, however, remains concerning as the universe from which asset managers of retirement fund portfolios can select stocks continues to shrink while concentration risk increases. The decline in listed stocks on the JSE also has implications for the local stockbroking industry, the quality of investment research conducted, the investment industry as a whole and South Africa as an investment destination for foreign investors.

Why are companies delisting?

South Africa is not unique when it comes to the delisting trend. However, the relative size and the rate at which delistings are happening on the JSE make the impact on local investors more pronounced. From a macro perspective, global and local economic growth has been affected negatively by the Covid-19 pandemic and the aggressive monetary policies adopted by central banks to fight multi-decade high inflation. Specific reasons closer to home include bad economic policy, corruption, state capture and infrastructure challenges, which have resulted in low business, consumer and investor confidence. The main reasons for the management of South African companies to delist from the JSE can be classified as follows:

All these factors collectively lead to one question for many South African companies: What are the benefits of remaining listed versus taking the business private?

The challenge for local equity managers

With a smaller universe to choose from, the ability of local equity managers to effectively diversify and manage portfolio risk and consistently deliver alpha will be diminished. This is especially true for the more prominent asset managers who are forced to primarily focus their stock-picking activities on the top 40 shares of the JSE. This could be for liquidity reasons or to be able to hold meaningful positions in their portfolios. The most significant risk for these asset managers is that they are forced to hold more prominent positions in a single stock than they are comfortable with, which could lead to concentration and liquidity risk. In addition, their ability to generate consistent alpha becomes more challenging and with it, the case for justifying the fee they charge for active management.

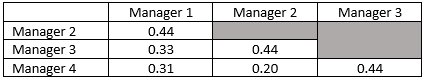

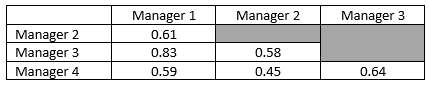

The table below shows how the correlation between 4 large local asset managers by asset size on their local equity portfolios has increased using six-year rolling returns to 30 September 2017 and 30 September 2023 with the FTSE/JSE All Share Index (ALSI) as the reference point.

Table 1: Correlation of local equity managers over a rolling 6-year period to 30 September 2017

Table 2: Correlation of local equity managers over a rolling 6-year period to 30 September 2023

This tells us that retirement funds need to review the local equity component of their investment portfolios to ensure optimal portfolio diversification. It must be noted that all the equity managers showed a lower drawdown rate when compared to the ALSI over the 20 years to 30 September 2023. This supports the case for including actively managed mandates as part of a local equity component of a retirement fund’s growth portfolio.

Investment strategy considerations for retirement funds

Retirement funds have various options available to adjust the investment strategy of the growth portfolio in their default life stage model and to manage the potential risks of a shrinking investable JSE universe. Some of these options are:

The future of the JSE

A well-functioning, growing and tradeable South African stock market is essential for companies to access capital, South Africa to attract offshore investments, the market to reflect the true value of companies, ensuring sufficient liquidity, the trading of derivatives and investment product innovation. The tide can be turned for the JSE if there is sufficient political will for genuine economic reform, which will lead to higher levels of economic growth and the creation of an environment that supports and grows business and investor confidence. The JSE’s listing requirements must be matched to the unique local business environment and balanced with protecting investors like retirement funds from a governance perspective. It is good to see some initiatives by the JSE to understand the reasons for the delistings, relax listing requirements, reduce listing costs, promote itself to offshore investors, target specific industries for possible listings and attract more retail investors. The new JSE Private Placement platform provides an alternative for companies looking for capital, but that is too small to be listed. Specific areas of the local economy where opportunities exist to grow the footprint and influence of the JSE include the mining, information technology and infrastructure sectors. In the meantime, various strategies are available to retirement funds to manage their growth portfolio risk and achieve their long-term real return objectives for fund members.