Transaction Capital’s (TCP) share price was down over 35% yesterday on the JSE. In this note we will attempt to provide some context regarding the unexpected magnitude of the negative earnings surprise for the group’s interim results update to 31 March 2023. For the sake of brevity, we will concentrate only on the ‘problem areas’.

In the run-up to this trading update, our perception of the reasons for the negative year-to-date price trend (‑15%) were primarily as follows:

-

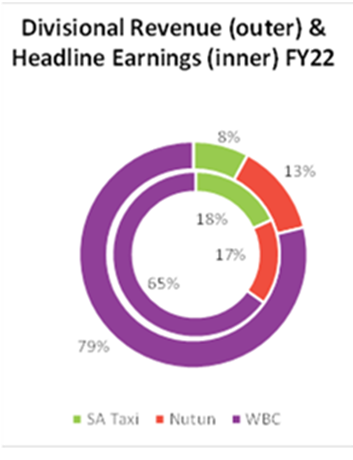

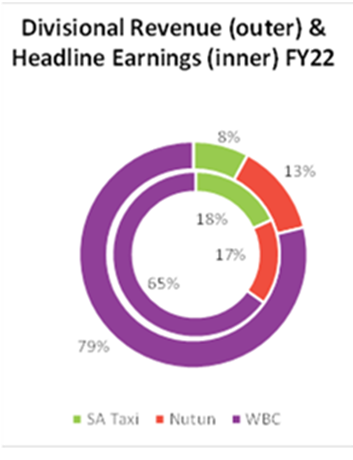

- The acquisition of a stake in WeBuyCars (WBC) in 2021 was immediately earnings accretive and lifted TCP’s earnings trajectory. This was enhanced further by the pandemic fuelled supply chain shortages, which elevated used car sales. During this period WBC more than doubled the number of cars sold to around 12 000 per month. However, with the economic downturn, rising interest rates, rising fuel prices and the severely downgraded GDP growth outlook, market participants have become increasingly concerned that this growth engine may have run its course, at least for the time being.

-

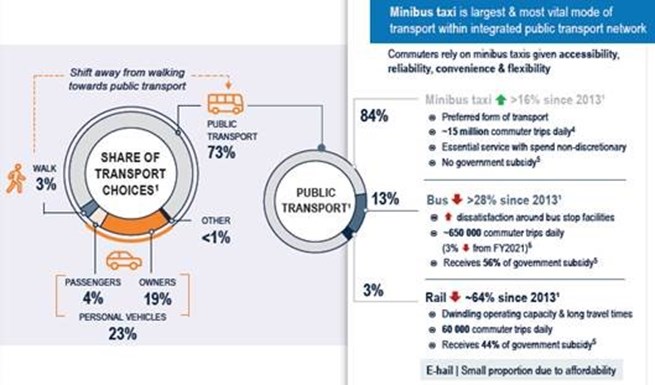

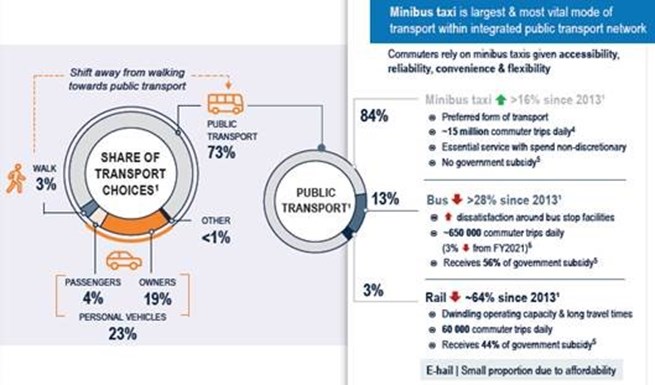

- It is no secret and has been well guided by management, that SA Taxi has struggled to recover to its pre-pandemic state due to the economic downturn and rising costs putting pressure on taxi owners. This in turn, has led to rising non-performing loans. Furthermore, TCP’s taxi sales were frustrated by the extended closure of the Toyota assembly plant due to the floods in Kwa-Zulu Natal. This situation motivated management to invest in expanding the taxi refurbishment facilities from 250 to 600 vehicles per month.

-

- However, considering the failure of the minibus taxi sector to return to pre-pandemic operating levels in the prolonged time frame since the pandemic, management’s conclusion appears reasonable, that a multiple of business environment factors have structurally reduced the sector’s overall profitability, even making certain marginal routes financially unviable for taxi operators to service. The multiple factors that appear to have prevented a recovery to ‘normal’ levels of activity include the “stubbornly elevated fuel prices, vehicle price increases, sharp interest rate hikes, persistently low commuter volumes and the lack of corresponding fare increases. Record levels of loadshedding have adversely impacted economic activity, with a further negative knock-on effect on commuter activity. Loadshedding has also increased traffic density causing longer commute times, resulting in a reduction in the number of trips completed by taxi operators.” These circumstances and this shift in management’s thinking have major accounting repercussions in the treatment of, for instance, doubtful debts, bad debt provisions and profitability. These have increased substantially and are markedly higher than expected.

Now what?

So, to address the question of how we think of this situation and how we should react, we cast investors’ minds back to a similar situation involving the pharmaceutical company, Aspen Pharmacare. In 2019, the company faced a dire ‘debt crisis’, which was a result of bold strategic management decisions, executed in unfortunately timed circumstances. Aspen’s share price sank to a low of R64 (from an all time high of R448 just a few of years earlier). Had management done nothing, Aspen would now be an entry akin to the story of Icarus in financial history books. But no, management assessed the situation, took corrective action, and Aspen recovered to almost R300 just two years later, before the pandemic hit.

Similarly, in the face of severe economic circumstances and on the heels of unfortunately timed investments in scaling the business for further growth, TCP’s management have not stood idly by at the scene of the ‘economic accident’.

In the trading update management outlined the key steps they have initiated to ensure the company’s long-term viability. In our opinion these corrective actions (listed below) are prudent and appropriate to deal with the challenges facing the group.

-

- As mentioned above, management have adjusted WBC’s used vehicle stock profile to the prevailing lower value market bias and heightened the focus on “driving operational efficiencies and greater sales volumes through our existing infrastructure.”

-

- The main thrust of the SA Taxi remedy is to right-size the capital investment in the SA Taxi business to better match the reduced addressable market opportunity, and thereby improve returns on capital over time. This entails disposing “of its auto refurbishment and repairs business and related assets to a strategic partner simplifying operating processes, converting fixed to variable overhead and resizing [the] remaining assets, whilst retaining the strategic ability to refurbish vehicles to protect collateral value.”

-

- Furthermore, management has taken steps to de-risk the business by “securing a symbiotic arrangement with a substantial funding partner that will allow Gomo [it’s fledgeling mobility platform that aims to disrupt and capture market share in an under-penetrated used vehicle Financing & Insurance sector] to write loans directly on the funder’s balance sheet. This positions Gomo as a manager of F&I products, earning fee income and participating in a portion of credit and insurance underwriting profits, but without funding or assuming credit underwriting risk as a principal lender, enabling scale through a capital-light business model.”

Conclusion

Make no mistake about it, notwithstanding the abovementioned remedial actions, the path to growth will not be easy nor short when seen against the backdrop of the poor real GDP growth outlook in South Africa.

On the assumption that the write-offs and provisions are not repeated, with the successful right-sizing of SA Taxi and the underlying strength of the WBC and Nutun businesses, Sasfin will continue to hold TCP in our funds. This is, of course, pending any further information and after a thorough analysis of the interim results, which are anticipated to be released on 10 May 2023.