Transaction Capital remains one of our key defensive SA Inc. counters, to the extent that; a) it supports a critical service, b) its vertical integrated configuration provides a robust operational back-bone, c) leveraging its scale and competitive advantage to drive further market penetration.

- Transaction Capital is a non-deposit-taking financial services company comprising two divisions, namely SA Taxi and Risk Services.

- SA Taxi is fully vertically integrated in all aspects of minibus taxi sourcing, financing, insurance, telematics & value‑added services, maintenance, mechanical and autobody refurbishment and resale. With approximately 43 000 minibus taxis on its books, SA Taxi has an almost 20% market share of the segment and over 50% market share of the insured and/or financed minibus taxi fleet.

- Risk Services is active in the debt collection market. It provides collection services on an agency basis for a broad range of retail, utility and banking customers, among others (45% of TCRS revenue FI20). It also acquires non-performing loan (NPL) portfolios on a heavily discounted basis and collects these on a proprietary basis (55% of TCRS revenue FI20).

- While the SA Taxi business is operational only in South Africa, Risk Services operates in South Africa, Australia and recently, via a joint venture, in Europe.

- The SA Taxi business possesses multi‑layer defensiveness.The first is the fundamental tailwind provided by the critical role that minibus taxis play in the public transport sector in terms of size, affordability and function (69% of households use minibus taxis, which have a critical advantage particularly in first and/or last mile commuter legs to and from other public transport modes).The second level of defensiveness is the non-discretionary nature of public transport expenditure (primarily for work and education purposes).The third level of defensiveness stems from the vertical integration of the SA Taxi business, whereby upon any default, SA Taxi’s repossess, refurbish, salvage parts, resell & refinance model ensures an over 75% loss recovery of non-performing loans versus the estimated 30% recovery of non-integrated repossess & auction model businesses. Thus, SA Taxi manages a 19% non-performing loan ratio down to a credit loss ratio of below 4% typically (FI20 6.1% including COVID19 adjustment).

- Furthermore, the SA Taxi support operation is robust and generate economies of scale by focussing on only three vehicle models.

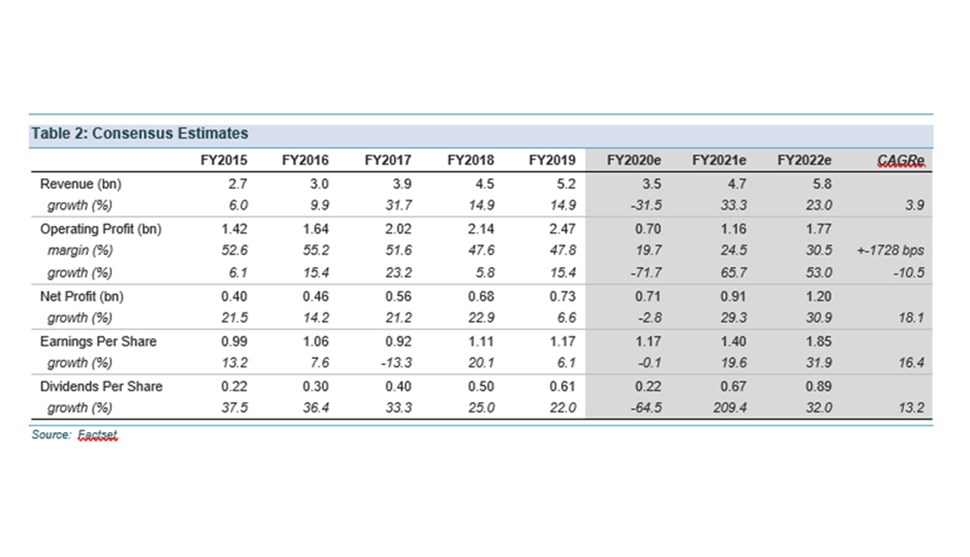

- The key growth initiatives within SA Taxi are; a) increased market share by delivering superior service to owners, particularly the estimated 170 000 unencumbered and aged minibus taxi fleet in need of replacement and recapitalisation and b) the provision of parts, maintenance, financial & value‑added services to third-party minibus taxi operators and associations. With vehicles priced above R450 000, it is anticipated that a growing percentage of vehicle sales will be financed, supporting the group’s consistent track record of roughly 4% loan growth.

- TCRS is the largest outsourced collections player in SA and with multiple, blue-chip clients within multiple sectors (financial services, retail, telecommunications, education, utilities and public sector), TCRS has visibility and analysis of arguably the largest database of individuals’ data and payment behaviour. This sizeable proprietary database provides a barrier to entry and a competitive advantage in its agency collections business and pricing and collection of its own principal NPL portfolios.

- The current weak consumer environment presents NPL portfolio acquisition opportunities at more favourable rates, whereas a more vibrant consumer environment supporting increased agency collection operations.

- While SA Taxi draws substantial benefits from the entire panel and repair process is under one roof allowing for minimal disruption and quicker turnaround times, the single facility also carries significant risk in the event of damage, complete loss or labour disruption.

- Transaction Capital has recently extended its TCRS operations into Europe, targeting specific niches in the fragmented distressed debt and specialised credit mark. While a move to a new territory always presents risks, we believe Transaction Capital has mitigated this risk by co-investing with specialist credit managers in assets that are self‑liquidating and actioning the entry with no initial investment in goodwill with no costs or risks incurred in business integration.

- Heightened forecast risk in terms of volatility and timing as a result of the disruptions to normal trading patterns and additional costs from COVID-19, both during the pandemic and possible changes in consumer behaviour thereafter.