The image of a bull facing off against a bear, synonymous with stock markets, depicts the ongoing contest between buyers and sellers. Today, you will be hard pressed to find a fiercer battle between the two than the much-maligned debate over Tesla as well as its CEO, Elon Musk. For those unaware, Tesla is a US-based automaker that produces battery-powered or electric vehicles (“EVs”). From its beginnings in 2003, the Californian startup has gone from launching its first production vehicle in 2008 to become the behemoth that it is today, with a market capitalisation that far exceeds the world’s other automakers despite the company producing far fewer vehicles than its legacy competitors.

At the heart of the divide between the two camps is the lens through which the stock market dynamics are viewed. The bears will argue that Tesla is an automaker, a niche one at that, and should be valued on the same basis as other automotive companies. This implies low margins, low returns on capital and low growth, culminating in a low valuation multiple that leaves it worth far less than its current market value suggests. The bulls will argue that Tesla is more than just another run-of-the-mill automaker and is more akin to a technology company and should be valued as such.

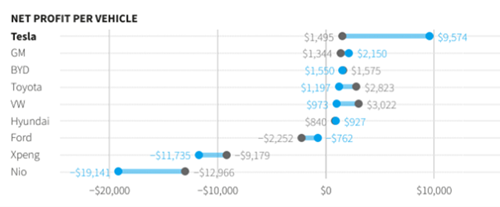

Firstly, they will point to the higher profit margins that Tesla generates relative to its automotive peers (see graphic below). Tesla, as well as its cheerleaders, believe that its superior profitability stems from both pricing power as well as its industry-leading cost structure. From a pricing perspective, there is a high desirability factor associated with Teslas. One might assume that it could be ascribed to the driver’s wanting to transition to a “greener” mode of transport. This certainly may be a contributing factor but the reality is that most Tesla proponents own a Tesla for the thrill and enjoyment that the car offers. Teslas are capable at accelerating at a rate that can only be matched by luxury supercars such as Ferraris or Lamborghinis and even these ultra-expensive vehicles struggle to keep pace with a Tesla.

Source: Reuters

To further incentivise customers to purchase their models and to ultimately control pricing, Tesla can also offer discounts on its services such as cheaper insurance (Tesla offers its own insurance product for its vehicles), free charging for a year and perhaps the most appealing off all, discounted pricing on its driver-assisted software.

From a cost perspective, one area where Tesla possesses an advantage over its rivals is that it spends close to nothing on advertising. Musk did however mention at the company’s most recent AGM that it may delve into the advertising market, though a cynic might point to his recent acquisition of Twitter, now “X”, as the potential platform for such an advertising campaign. Tesla has also sought to efficiently remove costs from the manufacturing process through innovative measures. One such achievement is the Giga Press (see image below). The imposing piece of equipment, which is similar in size to a school bus or small house, is an enormous die-casting machine that injects molten aluminium into casting moulds. The process reduces the number of parts from seventy down to three to effectively form a three-piece chassis. This significantly reduces the number of robots required to assemble a vehicle and also leads to an increased rate of production.

Beyond pricing power, the Teslarati will also highlight a number of other growth areas for Tesla. One such avenue would be the launch of its vehicles in new markets such as India and Brazil, two of the largest auto markets in the world. Tesla’s models are not exactly the cheapest vehicles around and to break into these markets Tesla will need to offer more affordable alternatives. To this end, Tesla has already stated that it is developing a model that would retail for $25,000. Much as Tesla’s cheaper models, the 3 and Y, outsold their more expensive counterparts, the S and X, it is quite likely that this entry level model could very well become Tesla’s best-selling car and quite easily the highest selling vehicle across the globe, at least that is what the bulls will tell you. In addition to this model, Tesla is about to launch its futuristic-looking Cybertruck (see image below) which is rumoured to have a waiting list that is nearing two million. Musk is confident that these new models will propel demand to even higher levels, so much so that he predicts by the year 2030, Tesla will be selling around 20 million EVs annually. For some perspective, Toyota currently sells a little under 10 million cars annually. Musk and his acolytes believe the limiting factor for Tesla to achieve this goal is not demand but rather supply, specifically Tesla’s ability to produce this many vehicles. Could this objective be a bridge too far?

To understand why Tesla is so optimistic about achieving this milestone one has to return to Tesla’s driver-assisted software or as they call it, Full Self-Driving (“FSD”). It is as this point where the divide between the Tesla bulls and bears moves from the chasm that it already is to the realm of space, specifically the distance between Elon Musk’s two homes, Earth and Mars. For some, the idea of cars driving around without an actual driver is pure science fiction and at best the technology is still decades away from becoming mainstream. This could soon change if Tesla has anything to say about it. Through the use of artificial intelligence (“AI”), Tesla is training its fleet of vehicles to learn to drive without the need for a driver.

Tesla is building a massive supercomputer that it has aptly named “Dojo” to train Teslas such that they will be able to drive in any conditions in just about any part of the world. Using generative AI, Dojo is able to generate a video feed on which the FSD technology can be trained, a simulation if you will. Combined with the vast amount of real-time data that Tesla already receives from the video cameras installed on the existing Tesla fleet, Musk believes Tesla will be able to “solve” for fully autonomous driving sooner rather than later, possibly as early as 2024.

The FSD feature would likely be in high demand by Tesla owners who would willingly pay the subscription price for this piece of software. It is the combination of entry-level Tesla models equipped with FSD software that starts the heart racing for Tesla investors and possibly the greatest factor behind their optimism for the company. The ability for Teslas to drive around without the need for a driver could possibly lead to Tesla’s largest, most lucrative opportunity of all but also the most controversial. In general, vehicles are only used for a couple of hours during the day while remaining idle for the vast majority. Tesla owners could potentially let other people make use of their car during this down time in the form of a “robotaxi” service, a driverless Uber. Receiving a fee for this service would significantly reduce the cost of ownership for a vehicle user with some estimating that it could decline to around $0.25/mile. This compares quite favourably with the current estimated taxi or ride-sharing costs of between $0.5/mile and $2.0/mile while personal vehicles are estimated to be around $0.75/mile on average.

The drastic reduction in vehicle ownership costs has the potential to create an industry that some believe will be worth trillions of dollars. Even owning a small piece of this pie would be incredibly lucrative for Tesla and were it to come to fruition, Tesla could quite likely become the most valuable company in the world.

You might think that having the most profitable cars, with the most sought-after features and the possibility of a dominant position in what could become a multi trillion-dollar industry would be the end of the bull case but you would be mistaken. Making use of the very same AI that is being developed to train Teslas to “see”, Tesla is also developing a robotic humanoid (“bot”) named Optimus. Still very much in a conceptual stage, the Tesla bot could potentially be deployed on the Tesla factory floor, replacing existing workers but the use case for bot assistants could be far greater than we imagine.

Note: Tesla Optimus Bots

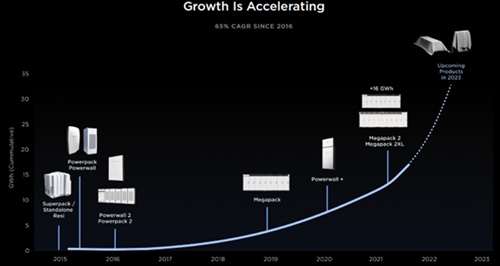

Finally, while it may not garner as much excitement and interest as self-driving cars or robots, one area of Tesla that is less spoken about, perhaps given its relatively smaller size than the automotive segment, is Tesla’s energy business (see graphic below). The company’s product offering, which includes solar panels and battery packs, ranges from small scale, such as those being fitted to houses around South Africa as the country battles with “electricity issues”, and increases in size to commercial enterprises as well as large scale deployments for utilities. As with Tesla vehicles, it is the battery that underpins this business. In particular, it is the large size battery packs or “Megapacks” as they are termed, that are driving the rapid growth in this segment. Each Megapack, which is essentially a container filled with lithium phosphate batteries, can store a little under 4 MWh and they are being rolled out at a rapid pace following the completion of Tesla’s dedicated Megapack factory in Lathrop California. Production capacity will be further enhanced once Tesla completes its second Megapack factory in Shanghai, China, which is scheduled to come online in 2024.

Source: Tesla Investor Day 2023 – Energy deployment

The Tesla bears are not convinced. Despite the adoption rate of EVs being greater than expected, recent EV price cuts may point to demand plateauing, with bears noting that many of those that wanted to purchase an electric vehicle have already done so. One could, however, argue that secular growth for EVs will continue to be strong as many governments have mandated that by 2030 the majority of new vehicles sold must be electric. The bears still remain sceptical, as supply constraints relating to the materials used in batteries, such as lithium nickel and cobalt, casts a shadow over the ability to meet government-mandated EV requirements.

The bears also believe that the pricing cuts mentioned above put into question Tesla’s much-vaunted pricing power. The bears remain steadfast in their view that the combination of falling demand for Teslas combined with new EV models from other automakers beginning to hit the showroom floor, will continue to deflate any pricing power that Tesla may possess.

The bulls grow ever more excited as Tesla continues to show progress in FSD but the bears will note that Tesla is behind the curve in this area. Companies such as Alphabet-owned Waymo and Cruise, a subsidiary of General Motors, have already launched their own robotaxi services which make use of their inhouse self-driving software. It is, however, worth noting that these services are somewhat limited in their functionality in that they only operate in a handful of US cities at the moment such as San Francisco and Phoenix. Tesla is instead opting to launch its FSD service on a global basis, capable of functioning in any environment across the globe, rather than being bound by the confines of a single city. That said, competition in the arena of autonomous driving and robotaxis is likely to be intense. Beyond Waymo and Cruise, Nvidia, the so-called poster child for AI, is developing its own autonomous driving solution which is already being used by its customers that include Mercedes Benz and Jaguar as well as Chinese automakers such as BYD and Xpeng, to name but a few.

The bears are somewhat more sanguine on Tesla’s energy business but are quick to point out that the growth in the segment will be insufficient to offset Tesla’s automotive margin degradation and the potential profitability of energy storage is far lower than what Tesla management is projecting.

As for the future growth potential of Optimus, the bears are quick to draw parallels to the Michael Bay Transformer movies, a lot of fanfare with special effects and explosions…but little substance.

One thing both the bulls and bears will agree on is that the Tesla stock price reflects a lot of future growth. Tesla could very well meet or exceed these expectations given the secular growth trends underpinning the business. Whether it is the shift towards green energy solutions, such as Tesla’s EVs and Megapacks, or its investment in AI, Tesla can easily be considered an industry leader in both megatrends and is therefore well positioned to benefit from such tailwinds. An argument could very well be made that despite its already lofty valuation, Tesla could become the world’s most valuable company as it continues to innovate and disrupt.

Despite the large opportunity set in front of Tesla, there is still plenty uncertainty surrounding the rate of adoption of EVs and the feasibility of autonomous driving. Given the potential variability in possible outcomes it would be ill-considered to ignore arguments put forward by the bears that Tesla’s future growth will not come to fruition and that buying Tesla at such an elevated level will only lead to disappointment and wealth destruction.

One cannot ignore the Musk factor either. His antics on Twitter and his alleged treatment of his staff have rubbed many a person the wrong way. His recent acquisition of the company has even led some Tesla bulls to grow concerned that he may be spreading himself too thinly, potentially losing focus on the challenge of running the world’s most valuable automaker. Perhaps there may be some truth to these points but one cannot ignore his achievements thus far. Not to be bound by what is considered to be the conventional way of doing things, the South-African born entrepreneur has taken on the might of the Detroit automotive monopoly and effectively won, he has taken on the minds of NASA and won, and he has been crucially involved in the development of many well-known technology businesses that include the likes of OpenAI, the company behind ChatGPT, as well as PayPal.

Your feelings on Elon Musk and Tesla may have already guided you towards the bull or bear camp and no amount of persuasion, one way or the other, is likely to change your view. For those that remain curious, your decision will likely come down to the lens through which you view the stock and its CEO. Do you see Tesla as an innovative organisation that will continue to innovate and disrupt industries? Or is it merely a sheep in wolfs clothing destined to disappoint its supporters? Is Elon Musk a genius that will continue to drive Tesla to greater heights or is he an egomaniacal snake oil salesman selling empty promises to his loyal supporters. This debate is likely to rage on for many years to come and the only certainty is that it will be a bumpy ride!

In the midst of these contrasting viewpoints on stock market dynamics, understanding the intricate interplay between the bulls and bears is paramount for informed investment decisions. For more expert insights and market analyses, visit the Sasfin website today.