On 7 April Prosus announced that it will sell 191.89 million shares in Tencent, reducing its stake to 28.9% from 30.9%. The shares were sold at HK$595 per share, a 5.5% discount to Tencent’s closing price on 7 April 2021.

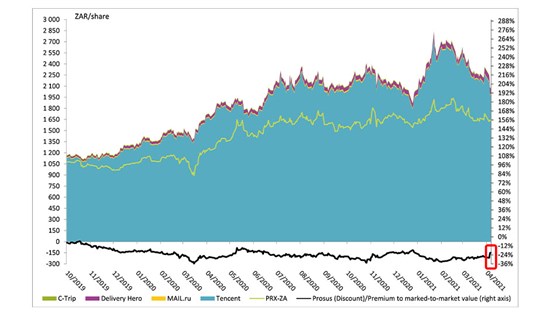

On the last trading day prior to the announcement the marked-to-market value of the Tencent investment was worth R2 261 per Prosus share versus the latter’s closing price of R1 729.52, representing a 23.5% discount.

Therefore, the shares sold were theoretically worth about R163bn, that is, R101 per Prosus share. By selling the shares AT FULL VALUE (HK$595), Prosus receives about R213bn or R132 per Prosus share. Thus, Prosus shareholders theoretically realise the discount of R31 per share, the amount by which one could reasonably have expected the Prosus share price to increase on the day. However, Prosus closed down R70 on the day.

We believe this reflected the scepticism that market participants have of the capital allocation and operational execution ability of management. After all, management has failed to successfully close any large‑scale M&A deals since listing in Amsterdam and now they reduced their stake in a strongly profitable and growing business (Tencent) to invest further funds in their loss‑making unlisted operations.

While the share price reacted negatively, the sale of Tencent shares certainly narrowed the discount at which Prosus trades relative to the marked-to-market value of its listed investments (Tencent, Mail.ru, Delivery Hero and C-Trip) to 21.1% from 28%. However, if one attaches some value to Prosus’s unlisted assets (using peer multiples), cash and treasury shares, then the discount to the group’s net asset value stands at about 33%.

The graph below tracks Prosus’s discount to the marked-to-market value of its listed investments.