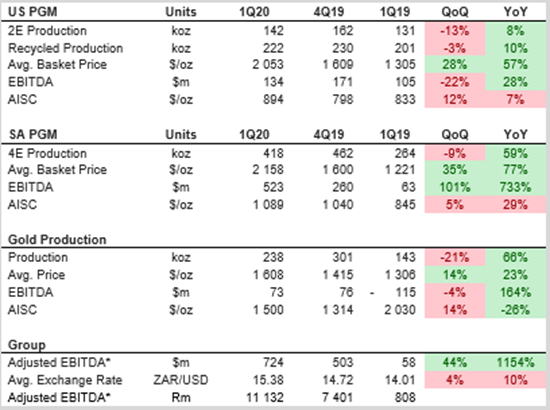

Table 1: First Quarter Production Summary (Source: www.sibanyestillwater.com)

1.Primarily Platinum and Palladium

2.Platinum, Palladium, Rhodium and Gold

3.Includes the impact of the streaming transaction

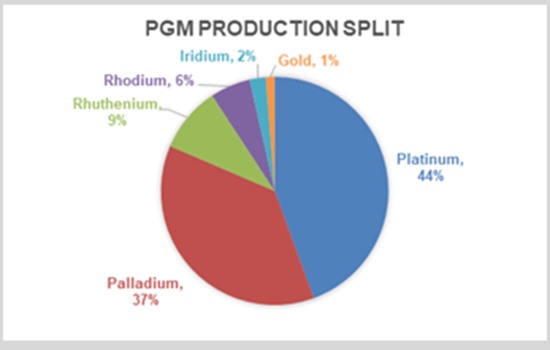

Figure 1: PGM production split (source: www.sibanyestillwater.com)

Sibanye-Stillwater had a solid 1Q20 when compared with 1Q19. quarter-on-quarter (QoQ) production was down across divisions but showed a significantly stronger year-on-year (YoY) performance. The average realised Precious Group Metals (PGM) basket price (USD terms) was up 57% YoY in the US PGM business and up 77% in the SA PGM business. Group earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 44% QoQ driven by a surge in EBITDA of 101% QoQ in SA PGM and 28% QoQ in US PGM. The average realised gold price was up 23% YoY. The materially higher production in the SA PGM business was on the back of the integration of Marikana Mine following the Lonmin acquisition in June 2019.

US PGM sales volumes were lower in March with an inventory build being realised, however recycled volumes were strong. Volume sales subsequently recovered in April and recycled volumes reduced to normalised levels. A meaningful increase in production from the US operations is expected for 2020. Group EBITDA increased to R11.13bn ($724m) in 1Q20 from R808m in 1Q19, with the additional boost to the SA earnings being driven by rand depreciation. The All-in Sustaining Cost (AISC) in US PGMs was 7% higher than 1Q19 due to higher royalties and taxes as a result of an inflated PGM basket price. AISC in SA PGMs was 29% higher YoY due to the inclusion of Marikana (which has a higher average AISC) and higher royalty payments. The SA operations realised a 1-week lockdown-related impact on production as a result of the operations being placed on care and maintenance. A phased build-up in production has begun in the SA operations in line with the lockdown relaxations.

The 66% YoY increase in SA gold production was primarily due to the recovery from a five-month long labour strike that ended in April 2019. This resulted in a 26% improvement in the AISC. The quarterly production was impacted by disruptions from seasonal factors and Eskom power outages. The return to normalised production levels post the strike as well as a higher realised gold price resulted in a turnaround in EBITDA from a loss of $115m in 1Q19 to $73m. No production guidance was provided given the uncertainties being caused by the COVID-19 pandemic.

The YoY performance reflects a normalised scenario for SSW and shows that prior to the COVID-19 pandemic, the company was on track to a materially stronger performance in FY20 than the previous financial year. We believe Sibanye-Stillwater’s nearly equal exposure to both PGMs and gold gives it a competitive advantage over other SA PGM producers. The company also provides good geographic diversification through its US PGM operations. Given that before the outbreak of COVID-19, there was an increasing demand for palladium and rhodium which supported elevated PGM basket prices; it is our view that under ‘normal’ economic conditions, the supply deficits in both these metals support an attractive cash flow profile for Sibanye-Stillwater. It is for this reason that the company has been able to build the R11.13bn EBITDA it realised in the first quarter and brought down its Net Debt/EBITDA ratio to 0.75x from 1.25x in December 2019. This supports our view of the resumption of the payment of dividends in the near future.

The consensus 12-month forward multiple for SSW is 3.6x which is below its long-term average of 5.7x (source: FactSet). The consensus target price is R50.09 per share versus a current price of R36.40 per share. This suggests an attractive upside on SSW, however, given the current uncertainties resulting from the pandemic, we maintain a cautious view on Sibanye-Stillwater.