Investment markets continue to be very volatile as we navigate our way through concerns about the war in Ukraine and the Middle East, sticky global inflation, interest rates that are expected to be higher for longer, a potential economic recession in the United States and some South African-specific challenges. As a result, the investment returns of fund managers that invest in the markets on behalf of retirement fund members can go through periods of weak or underperformance.

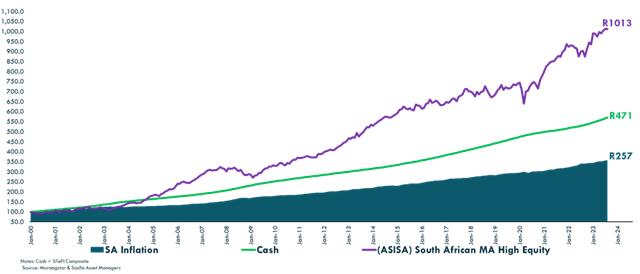

During these times, it is normal for members of retirement funds to consider the safety and certainty provided by cash as an investment solution for their retirement savings. However, history has shown us that cash is not the appropriate asset class in the long term to address the challenge posed by the rising cost of living as measured by cpi inflation. The graph below shows the return a cash investment provides compared to cpi inflation and a multi-asset high equity portfolio, which forms the basis of most retirement funds’ default life stage models. It is clear from the graph that the best long-term solution as a member of your retirement fund is to remain invested in a portfolio that can grow your retirement benefits.

Investment Growth versus CPI Inflation – January 2000 to August 2023

For every R100 invested by a fund member at the start of 2000, an investment in a cash or money market portfolio would have grown to R471 by the end of August 2023. Over this period, the rising cost of living as measured by cpi inflation would have required you to grow your retirement benefits to R257 for every R100 invested in January 2000. While cash has provided some real growth over this period, it does not come close to the growth an investment in the average ASISA multi-asset class high equity portfolio would have delivered. The high equity portfolio delivered more than double the growth and benefits relative to the cash or money market portfolio.

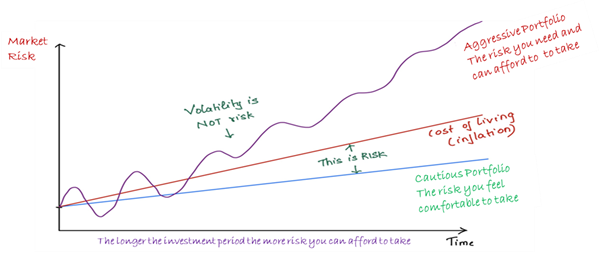

The risk of not being able to grow the purchasing power of your money sufficiently in the long term needs to be weighed up against the short-term movements in the markets. You need to make your retirement savings work as hard for as long as possible to improve your chances of retiring with sufficient savings. As illustrated below, market movements, or volatility, is not risk and is a normal part of achieving good returns above cpi inflation and growing your retirement benefits in real terms. Not keeping up and growing your money by more than inflation is the most significant risk for retirement fund members. It is not about the risk you feel comfortable taking but rather about the investment risk you can afford to take as a long-term investor.

We also know from experience that moving in and out of the market with your investments is not a good long-term strategy as it involves market timing risk. Staying invested in the markets is the best strategy for members of retirement funds who can afford to take investment risks. A well-structured and diversified investment portfolio, which includes cash investments and time are excellent investment risk management tools. They allow fund members to stay focused on the horizon and not make short-term emotional decisions that can cause harm to their long-term retirement planning. As they say, successful investing is not about avoiding risk but about managing risk.

In conclusion, Sasfin is your key to a secure retirement. Act now and secure your financial future!