GLOBAL MARKET DEVELOPMENTS

A few key developments during the 4th quarter of 2021 have shaped markets: the emergence of the Omicron variant of Covid, which data shows has proven to be significantly less dangerous than before; the stickiness of inflation at higher levels in the US; and a shift in China’s long run-growth objectives. Equity markets had a stellar quarter with these developments as a backdrop – the S&P 500 for example rose by 10.7% in the 4th quarter alone. For once, the JSE All Share Index outperformed the S&P though, delivering a mouth-watering 15.1% in the quarter, as commodity prices remained elevated at higher levels. This is clearly indicated in the even better return of the JSE Resources 10 Index rising over 22% for the same period.

Markets evidently looked at the global developments as contributing to a relatively benign, slightly inflationary environment in which real assets like commodities would be a primary beneficiary. There are, however, some storm clouds on the horizon. The US Fed has already indicated that its overly accommodative stance would begin shifting – in particular taking note of the tightness of the labour markets, with the unemployment rate declining from its high of 13% at the Covid peak to a little above 4% by year end. Wage inflation too may leak into second rate inflationary effects and the Fed will need to walk a tight line between calming inflation effects but at the same time not killing off economic growth.

Geopolitical issues also raised their head in the quarter, with a Russian troop build-up on the Ukraine border sending shivers down NATO’s spine. This has led to elevated gas and oil prices – the WTI Spot Oil price for example bottomed below $20/barrel in Q1 2020 but ended the year at $77 – an enormous rise, contributing to the deteriorating inflation outlook.

These developments though must give rise to some questions around the growth expectations built into asset prices – our assessment is that they are too high in the US and too low for China.

LOCAL MARKET DEVELOPMENTS

On the back of the resource sector steaming ahead, local markets have appeared very rosy. The Rand has remained well behaved, if a little skittish at times, and is also benefitting from some of our FX peers – e.g., Russia and Turkey, having a few meltdown moments, making us look very stable by comparison. Bond yields have traded in a rather narrow range – trapped between the positive of a rather benign local inflation outlook and the negative of a deteriorating socio-political environment.

The SARB has also initiated a rate-hiking cycle, but expectations are that it will be a very cautious approach to normalising levels of interest rates, as the consumer remains very constrained, and a distinct lack of confidence permeates our business confidence levels. We expect the up cycle to be muted at best, and South Africa also remains vulnerable to global shocks – especially if the US Fed is forced to hike rates more rapidly than was initially expected.

Outside of the resource sector, the SA Inc companies have had a tremendous run, and with our muted growth outlook questions will be asked about the sustained upwards run in asset prices. We prefer the global growth story, but valuation concerns there lead us to requiring a hedge in place.

With local elections in SA leading to further electoral losses for the governing ANC, as well as an upcoming ANC presidential election scheduled for end-2022, we do not expect significant policy shifts in the SA political scene for the immediate future - another year of muddle through is what awaits.

LOOKING AHEAD

There are several key big picture issues that markets will need to absorb during the course of 2022:

The net result of these dynamics leads us to several scenarios: A ‘bullish’ one, where none of the worst risks in these issues are realised, but the outcome would still imply heightened volatility for markets, with the backdrop of already strained valuations in some market segments. This would entail modest tightening from the Fed – less than currently priced – with lower inflation levels than current and an easing of geopolitical tensions, but not final resolution. We would expect to see only 3-4 rate hikes in this scenario.

A bearish scenario would see the current ‘transitory’ inflation spilling over into stickier long-run inflation, requiring a more aggressive monetary policy response. With current consensus pricing in 5 rate hikes within the next 12 months, there is a possibility in this scenario of even more tightening.

Our base case here works on an expectation that the Fed needs to signal a fairly robust inflationary response, which would be accomplished by a 50 b.p. move in March, followed by a series of 25 b.p. increments, after which economic weakness, in the face of both monetary and fiscal headwinds, leads to the Fed backing off from the current consensus path.

If we turn to the local scenarios, we are reasonably confident that there is very little room for truly significant policy shifts from government, caught between internal frictions, the radical nature of the shift required in dealing with (internal) corruption, and an economy weighed down by increasing inequality, unable to generate an economic “escape trajectory” and hence trapped by past policy choices that have been unable to shift the needle on the unemployment rate. This is overlaid with significant economic headwinds in the form of our reliance on foreign capital, as well as an energy generation constraint in the form of Eskom’s operational and financial difficulties.

Thus, our normalisation of monetary policy is always going to be constrained, and even though the SARB has already begun a rate hiking cycle, we strongly believe that the economy remains so fragile in its post-Covid and post-rioting recovery that a scenario in which the SARB hikes by more than a further cumulative 1.5% hike from current levels will further damage our growth trajectory. In this scenario the Rand will remain volatile – all essentially dependent on which way 2 winds blow – the first being the commodity cycle, driven primarily by China, and secondly the pace of Fed rate hikes, driven by their inflation outlook. Of course, throw in some SA specific risks and this could, as we have seen in the past, obliterate any positive global sentiment that may be presented.

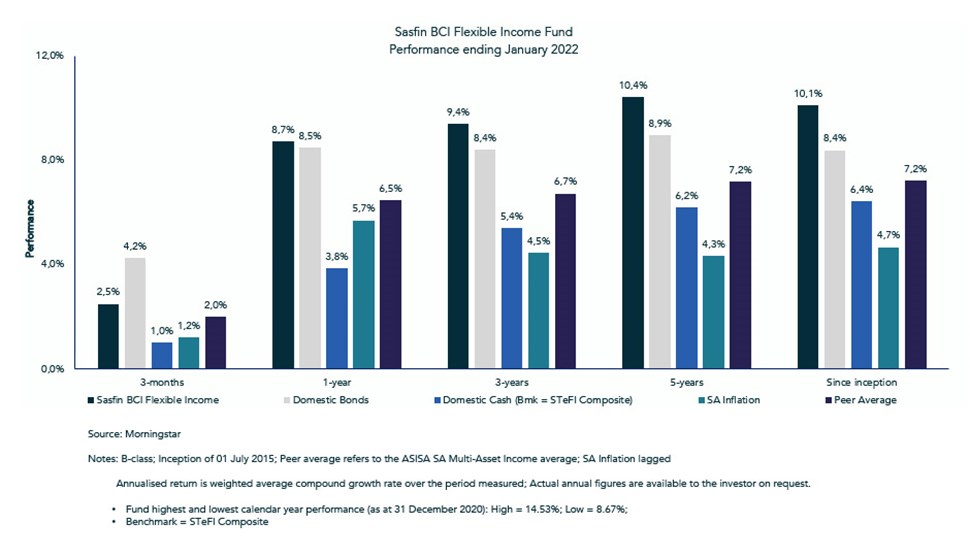

CURRENT FUND POSITIONING AND PERFORMANCE

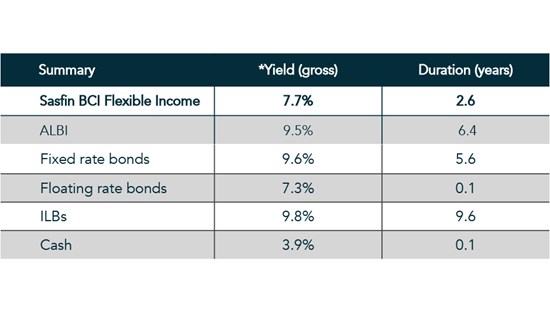

Over the past 12 months we have followed an active duration management strategy in the fund, as we identified different entry and exit yield levels. Currently the fund has a reasonably elevated duration level at 2.6, as we believed that recent government revenue overruns would play into a positive yield trend, despite the global inflation concerns. In addition, recent commodity price moves have been a positive for the Rand as well. Recently we have seen continued yield falls, and we are in the process of reducing duration again by selling longer dated bonds.

Further to this tactical shift, the weighted average yield on the fund will temporarily reduce as we shift down the yield curve towards a more defensive position. Post the Budget, we expect to see yields drift upwards again, as we do not foresee much room for government to shift the needle on growth projections, and these fiscal concerns will again become an area of focus.

Our overall credit risk profile within the fund has also been improved, with a reduction in overall SOE exposures, as well as a reduction some lower tier Bank securities. Given the high government bond yields available and the still steep nature of our yield curve, we see no need to add credit risk to the fund in order to chase returns. This also has the added benefit of increasing liquidity within the fund giving us the ability to shift our risk positions with agility.

FUND ALLOCATION & POSITIONING ENDING JANUARY 2022

WHAT TO EXPECT GOING FORWARD

In the scenario we paint above, we expect the fund to continue to do reasonably well, and with our current forecasts we believe it is again possible to generate 12-month returns of between 7.5-9.0%. This will come predominantly from active duration management in a world where we expect SA bond yields to remain trapped in a broad range at elevated (and historically cheap) levels. Inflation is likely to remain fairly well behaved and remain within the SARB’s target range.

It is important to note here that we have reduced credit risk within the fund and due to the shape of the yield curve been able to continue to provide high real returns without being tempted to add credit risk. In our minds, given the fragile nature of the economic trajectory in SA, we should be wary of using credit risk to enhance performance when spreads are at relatively low levels.

We are comfortable that the overall risk budget within the fund is well balanced, and we intend to maintain that approach going forward.

For more on the BCI Flexible Income Fund click on the link below.