Sasfin Financial Planning Across Life Stages | Expert Strategies

Explore Sasfin's expert financial planning strategies tailored to different life stages. Secure your financial future with our guidance and expertise.

As a financial planner, the conversations held with clients are unique to their financial story, each stage revealing new opportunities and challenges. While the core questions remain constant, the answers and strategies evolve in response to life stages, financial literacy, goals, and individual needs. In this article, we look at the essential aspects of financial planning and how they adapt to various life stages.

Covering unforeseen events

The cornerstone of financial planning is safeguarding against unforeseen events that could potentially disrupt your financial stability. To achieve this, two key components come into play:

Once these safeguards are in place, the path to financial well-being becomes clearer, allowing for a focus on investment strategies.

Building an emergency fund

Planning for the future

Short-term, Medium-term, Long-term Goals: With your emergency fund established, you can turn your attention to planning. Identify your short-term (e.g. vacations, car purchases), medium-term (e.g. home buying, family expansion), and long-term (e.g. retirement) financial goals. Tailor your investment strategy to align with these goals, adjusting risk levels as appropriate.

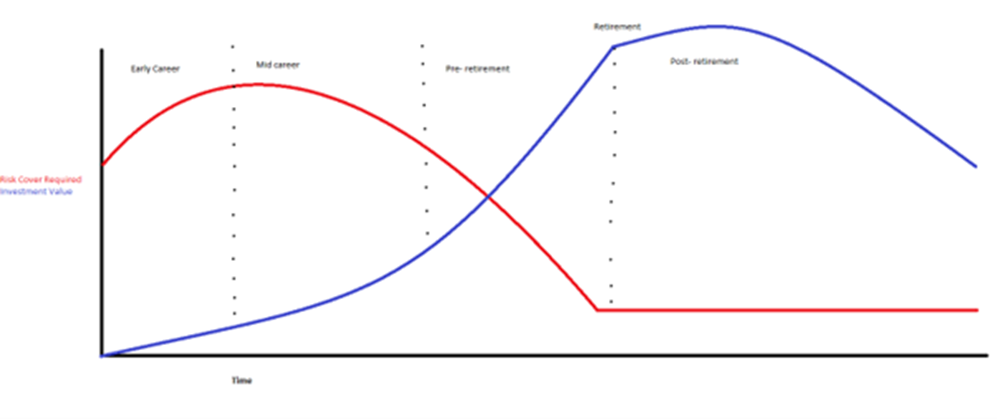

As your investments grow over time, the need for extensive risk cover naturally diminishes. For many, diligent saving and investing mean that risk cover becomes redundant by the time retirement approaches.

Risk and Investments at different life stages:

Preparing for life beyond work

The pre-retirement phase, typically spanning ages 50 to 65, is when retirement planning takes center stage. It is important to consider several critical aspects:

Liquidity: Ensure that your investments provide liquidity at retirement, allowing you to access funds when needed. Balancing long-term investments with accessible assets is key to financial flexibility.

Tax Efficiency: Optimize your retirement savings for tax efficiency. Explore tax-advantaged retirement accounts and strategies that minimize your tax burden during retirement.

Long-term Strategy: Recognize that retirement planning is a long-term strategy. A combination of liquid investments and retirement funds should be implemented, with the equity component adjusted based on your risk profile.

As financial planners, it's essential to adapt our guidance to the unique needs of clients at different life stages.

Life altering events throughout the life stages:

If you have any life altering events for example: Marriage, divorce, change in employment, inheritance, retrenchment, birth of a child, new house, starting of a business throughout these stages it is important to consult a financial advisor as the advice regarding each of these events will be personal to your circumstances.

Childhood (Age 6-12)

Market Day: Encourage practical financial lessons, such as Market Day at school. Parents should provide guidance but allow children to develop their ideas and learn about costs, profit margins, and sales strategies.

Allowance: Introduce allowances for completed chores, teaching responsibility and money management.

Adolescence (Age 12-18)

Budgeting: Discuss budgeting with teenagers, providing them with a basic budget to manage household expenses.

Allowance: Transition to more financial responsibility, with teenagers covering expenses like clothing and social outings.

Early Career (Ages 20-35)

Risk Cover Requirements: Understand the importance of income protection, life insurance, and severe illness cover, especially if you have dependents and financial obligations.

Investment Planning: Save 15-20% of your income towards an emergency fund, retirement planning, and discretionary investments based on your financial goals, risk profile, and tax situation.

Mid-Career (Ages 35-50)

Risk Cover: Continuously assess the appropriateness of your risk cover and adjust as needed.

Investments: Keep the focus on continued savings, maintaining a balance between risk and liquidity while reevaluating your retirement goals.

Pre-Retirement (Ages 50-65)

Risk Cover: Continue assessing the relevance of your risk cover, making changes, as necessary.

Retirement Planning: Concentrate on comprehensive retirement planning, ensuring a mix of liquid and retirement investments, and employ tax-efficient strategies.

Retirement Planning

Risk Cover: By this stage, most of your risk cover requirements should be redundant if proper financial planning has been executed. However, medical aid, gap cover, and short-term insurance should remain in place.

Investment Planning at Retirement: Seek expert advice at retirement, considering liquidity, tax implications, and your specific goals and needs. Ensure that the advice you receive aligns with your long-term retirement strategy.

In conclusion, financial planning is a dynamic journey that unfolds across the various stages of life. While the questions may remain consistent, the answers and strategies must adapt to individual needs and evolving circumstances. A well-tailored financial plan, combined with sound advice from financial planners, can help individuals navigate the complexities of life and secure their financial future at every turn.

Explore Sasfin Wealth for expert advice on how to achieve your global investment goals, to retire with dignity and to leave a lasting legacy.