Every year the finance minister tables the National Budget in February and then refreshes the estimates each October in the Medium-term Budget Policy Statement (“MTBPS”). Every year since the 2007/08 fiscal year, South Africa has been running a budget deficit. Government has been spending more than it has been receiving in revenue and has been issuing debt to finance the shortfall. The outstanding amount of our sovereign debt has grown so significantly over that period, that interest payments on debt are consuming increasingly more of the annual budget (around 20%) and leaving less and less for expenditure on the real economy (the “social wage”). That economy is currently one with 32% unemployment, millions living in poverty, crumbling infrastructure and growth that is not expected to get close to 2% for the near future.

In another budget that took less than an hour to deliver, Finance Minister Enoch Godongwana pulled a rabbit out of the hat that improved many of the budget estimates over the three-year medium-term expenditure framework.

Since the National Budget was tabled in February last year, government revenue has fallen short of estimates and government expenditure have exceeded estimates – widening the budget deficit. Quite simply, we knew what we could not afford (public sector wage increases?) but we bought it anyway. Each budget time we revert to the overworn question of “can the finance minister pull a rabbit out of the hat” (and he loves his hats) and this time it has been no different. While the budget is always important, this one carry unique significance in that it is a budget to be executed by a government that will only be constituted following the national elections on 29 May.

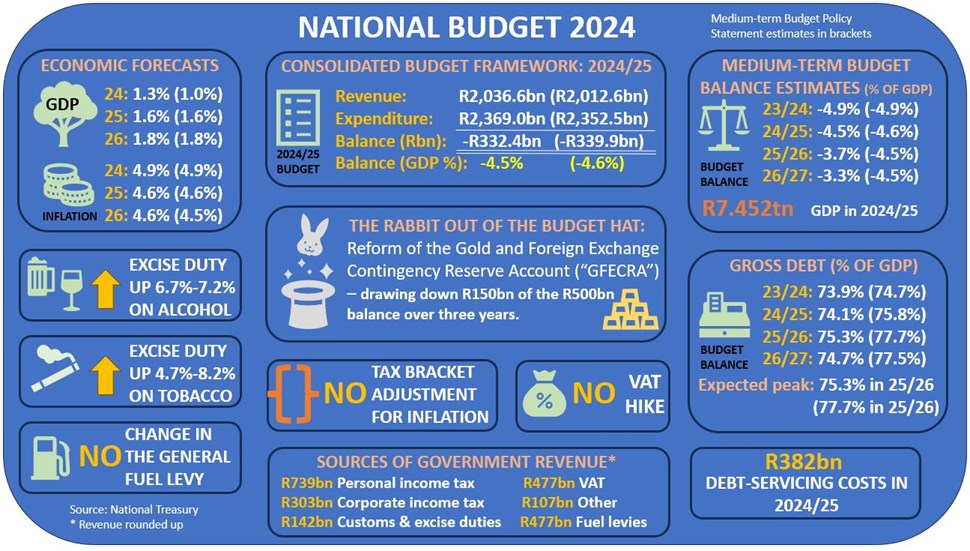

In another budget that took less than an hour to deliver, Finance Minister Enoch Godongwana pulled a rabbit out of the hat that improved many of the budget estimates over the three-year medium-term expenditure framework. That rabbit was a golden one that took the form of a proposed change to the regulations around the South African Reserve Bank’s Gold and Foreign Exchange Contingency Reserve Account (“GFECRA”). That change will see National Treasury receive R150bn over the next three years from the R500bn balance in the GFECRA. Essentially the account captures the revaluation amounts from the country’s reserves based on fluctuations in our exchange rate. With the rand’s depreciation over a prolonged period of time, the balance in the account had grown to R500bn. While the move could be considered controversial and have implications for the currency and investor sentiment around South Africa’s fiscal and monetary policy, the finance minister moved to alleviate any market concerns. He noted that this was not a novel practice for South Africa or for other countries and that it would be conducted in a responsible and transparent fashion.

One could argue whether or not South Africa is already in a public debt trap but this drawdown of the GFECRA will be used to reduce debt and this will ultimately reduce debt-servicing costs and make more of the budget available for uplifting the South African economy and its people. The worsening debt position needed a big helping hand and this move could be its much-needed push start. The contingency account cannot, however, be considered an ongoing “get-out-of-jail-free” card to be tapped at any time to help make the budget look better cosmetically in the short-term. Ongoing fiscal discipline and prudence is required to get debt levels down further and to ensure that we don’t just slip back to where we came from. A peak in gross debt at 75.3% of GDP in 2025/26 as budgeted would be welcomed but it’s still a long journey back to “safety”. We’re unlikely to go back there but in the mid-nineties we had gross debt of just 25% of GDP.

Leaning on the GFECRA crutch has helped National Treasury to reduce the budget deficit numbers of the next three years that were presented in the MTBPS. The deficit declines over the period and that fiscal consolidation, if achieved, will be welcomed and will see the budget deficit decline from 4.5% of GDP in 2024/25 to 3.3% in 2026/27. The deficit for the 2023/24 budget year did not deteriorate and was left unchanged from the 4.9% of GDP in the MTBPS. The forecast for economic growth for 2024 was revised up from 1.0% to 1.3% but the forecasts for 2025 and 2026 were left unchanged at 1.6% and 1.8% respectively. The inflation forecasts for 2024 (4.9%) and 2025 (4.6%) were also left unchanged but the 2026 forecast was lifted modestly from 4.5% to 4.6%. Taxpayers will be disappointed that the tax brackets were not adjusted for inflation and this will ultimately eat into household disposable income and provide additional tax revenue for the fiscus. The general fuel levy, a political hot potato, was left unchanged for the third year in a row and that impacted the fiscus negatively to the tune of R4bn.

Taxpayers will be disappointed that the tax brackets were not adjusted for inflation and this will ultimately eat into household disposable income and provide additional tax revenue for the fiscus.

“Sin taxes” were increased as always with the excise duties on alcohol being hiked by between 6.7% and 7.2% and those on tobacco products being increased by between 4.7% and 8.2% respectively. Vaping came in for special attention in the budget speech this year with an increase in the excise duty rate to R3.04/ml. Imbibers of the amber nectar will see their can of beer cost 14c more, wine drinkers will pay 47c more per bottle and spirits will cost an extra R5.53 per bottle. A pack of 20 cigarettes will set you back an additional 97c in duties. VAT was left unchanged and no other exotic tax changes were announced. The permanent social grants were increased with the old age and disability grant increasing by R100, the foster care grant increasing by R50 and the child support grant by R20. The finance minister also intimated that work was being done to extend the Social Relief for Distress Grant beyond 2025 (with details and a likely increase to be announced in time).

The system of National Health Insurance received a small budget allocation to reflect government’s commitment to the policy but the finance minister noted that much development was still needed on the proposed programme. It’s a green light for the two-pot retirement system though with first withdrawals from the “savings pot” being permitted from 1 September.

The finance minister concluded his budget speech with a warning to resist the extremes of blind optimism or crippling pessimism as we face multiple challenges on both the local and global fronts. The optimists will look to the tapping of the GFECRA as a fantastic first step to attaining more manageable debt levels while the pessimists will see the move as politically expedient in an election year. Time will tell who is right. The minister cannot be faulted on his assertion though that this is a journey and that even with some success, there’s still a long way to go.