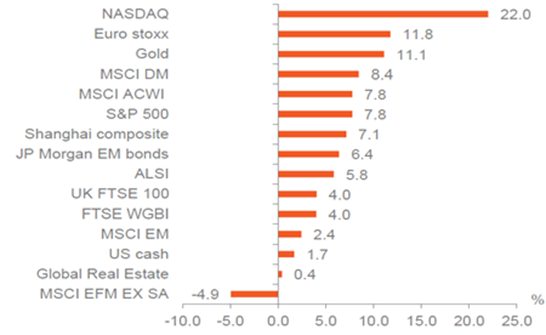

Despite challenges, global markets have had a positive start for 2023 with most major asset classes having performed positively.

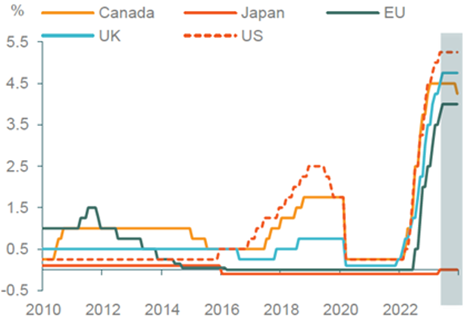

Since the start of 2023, global and local investment markets have been characterised by much volatility and uncertainty as a result of economic and geopolitical developments. The trajectory of inflation numbers in the developed world and the resulting implications for monetary policy for the major central banks remain top of mind. Concerns about a possible US recession, more failures in the banking industry and the debt ceiling that is looming for the US government are additional factors that will influence future interest rate decisions by the US Federal Reserve Bank. Current market expectations are that the Federal Reserve Bank might adopt a wait-and-see approach at the next FOMC meeting in June while the European Central Bank and the Bank of England are also approaching the peak of their current rate cycles.

Central Banks Approaching Interest Rate Cycle Peaks

Despite these challenges, global markets have had a positive start for 2023 with most major asset classes having performed positively in base currency terms up to 11 May 2023 as per the graph below.

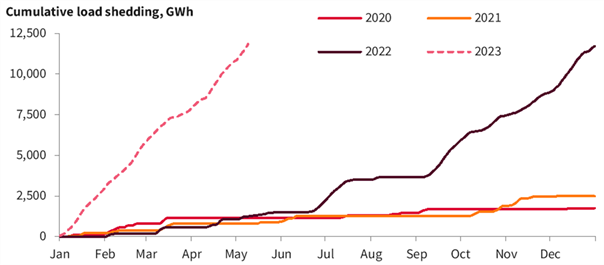

Cumulative Load Shedding Year to Date

Source: Absa Economic Research

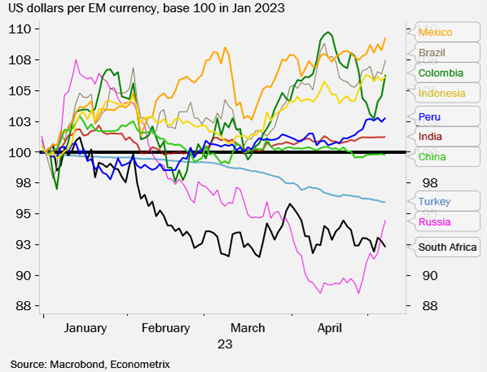

In addition, South Africa was added to the grey list by the Financial Action Task Force as the global financial crime watchdog on 24 February due to a lack of controls in preventing illicit financial flows. This has implications for the ease and cost of doing cross-border business for South African businesses and individuals. The recent developments relating to suggestions by the US government that South Africa supplied arms to Russia was a tipping point for the rand which went into freefall to reach a historic intra-day low of R19,50 to the US Dollar.

Rand Suffering the Most Against the US Dollar When Compared to EM Peers Year to Date

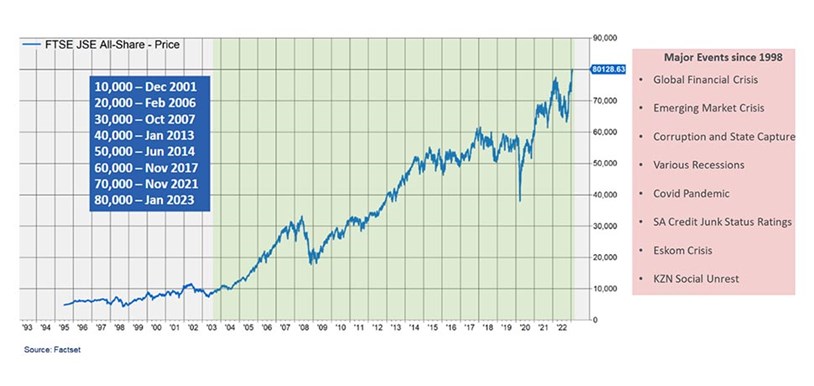

Despite a low economic growth outlook for 2023, the greylisting in February, elevated inflation, rising interest rates, power supply challenges and the most recent diplomatic fallout the JSE reached an all-time high above the 80 000 level in January and continues to remain in positive territory for 2023. This is largely due to the strong rand hedge characteristics of the JSE with around 70% of the total earnings of companies listed on the JSE being generated in foreign currency through their offshore interests. The ability of the JSE to create wealth despite various major global and local events over the past 20 years serves as proof of the ability of South African listed companies to adjust to a challenging operating environment as well as the natural rand hedge protection element that the local equity market enjoys.

The JSE Has Been Able to Create Wealth in Real Terms Despite Major Challenges

Recent geo-political events have created opportunities for the asset managers of multi-asset class funds to pick up local bonds at yields above 12%, which offers the potential to achieve very attractive returns, in real terms. The offshore component of the multi-asset class portfolios that members of your fund are invested in provides additional protection and growth as a result of the weaker rand and exchange rate benefits.

Much uncertainty remains for the rest of 2023 with regard to the impact of the weaker rand on local interest rates, the ongoing energy crisis on the local economy, the diplomatic tussle with the United States for trade relations and the exchange rate as well as a possible economic recession in the United States. However, a good measure of this uncertainty has also been priced into the markets already. In addition, the well-diversified nature of the investment portfolios that fund members are invested in should provide them with the comfort that their retirement savings are managed with the necessary care and diligence.

It is important to guard against getting caught up in the current negative news flow in the media and making emotionally driven investment decisions at an institutional or personal level when it comes to retirement savings. The South African retirement savings industry is highly regulated and protects the interest of fund members from a legislative and governance perspective. Staying invested for the long term has always served retirement fund members well as time provides an additional and effective source of diversification and the powerful benefits of compound growth. Growing the retirement benefits of members in real terms (above inflation) should not be pursued through the avoidance of risk and volatility rather than the management of investment portfolio risk and volatility.

Visit Sasfin Wealth to keep up with the latest investment updates!