A negative household savings rate, high levels of personal indebtedness, low levels of financial literacy and high levels of unemployment are some of the key contributors to this reality. Most individuals become fully or partially dependent on their community, government and/or their family to make ends meet during retirement.

The path to achieving financial independence at retirement poses many challenges for selfemployed individuals and members of Retirement Funds. In order to address this challenge, various key elements are required as part of a well-designed savings and investment retirement plan. The recently launched Sasfin Wealth Umbrella Retirement Fund (SWURF) was designed with the member in mind, and opens a whole new world that can make financial independence at retirement a reality.

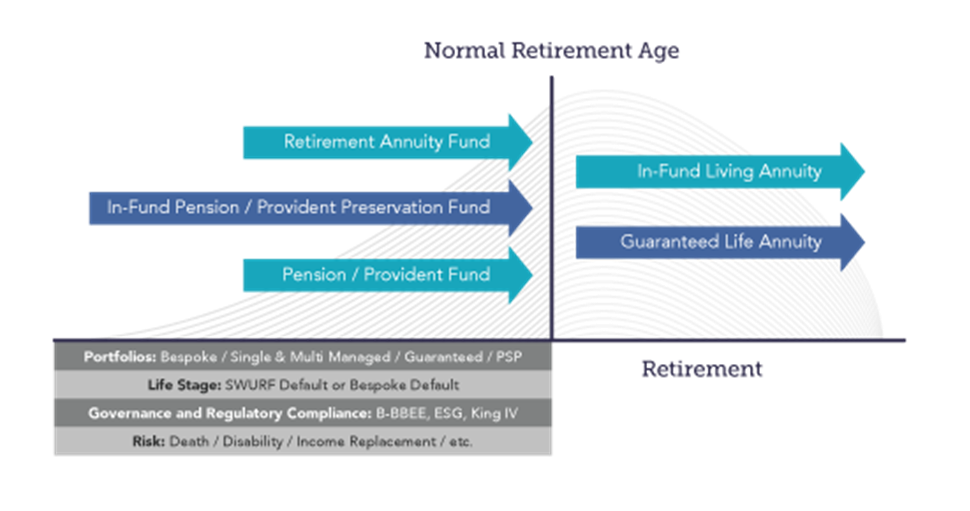

The SWURF is an Umbrella Retirement Fund solution sponsored by Sasfin Wealth, which offers a Pension Fund, Provident Fund, Preservation Fund and a Retirement Annuity Fund option for capital accumulation purposes. Members of participating employers in the SWURF are able to transfer benefits from a previous employer to the Preservation Fund or their Pension or Provident Fund of their new employer. Any additional savings over and above their monthly Pension or Provident Fund contributions can be made to the Sasfin Retirement Annuity option. The same Fund or investment portfolio can be used by a member across any of the pre-retirement savings vehicles in SWURF. This allows for a co-ordinated investment strategy and consolidated member investment reporting.

A member that resigns and moves to a new employer can remain invested in the SWURF Pension or Provident Funds as a paid-up member or move to the SWURF in-fund Preservation Fund, which allows for the preservation of Retirement Fund benefits. Preservation is one of the very critical requirements for members to accumulate sufficient capital for retirement, and is one of the reasons why Default Regulations were introduced as part of Retirement Fund reform

When reaching retirement, a member can either select the in-fund Living Annuity option, or a guaranteed Life Annuity option as a monthly retirement income solution. When selecting the SWURF in-fund Living Annuity option, the units of the pre-retirement investment portfolio strategy can be seamlessly transferred from the various pre-retirement savings vehicles into the SWURF Living Annuity. This allows a SWURF Living Annuity Fund member to avoid market timing risk or unnecessary investment fees, and also for the continuation of the investment strategy that the member knows and trusts.

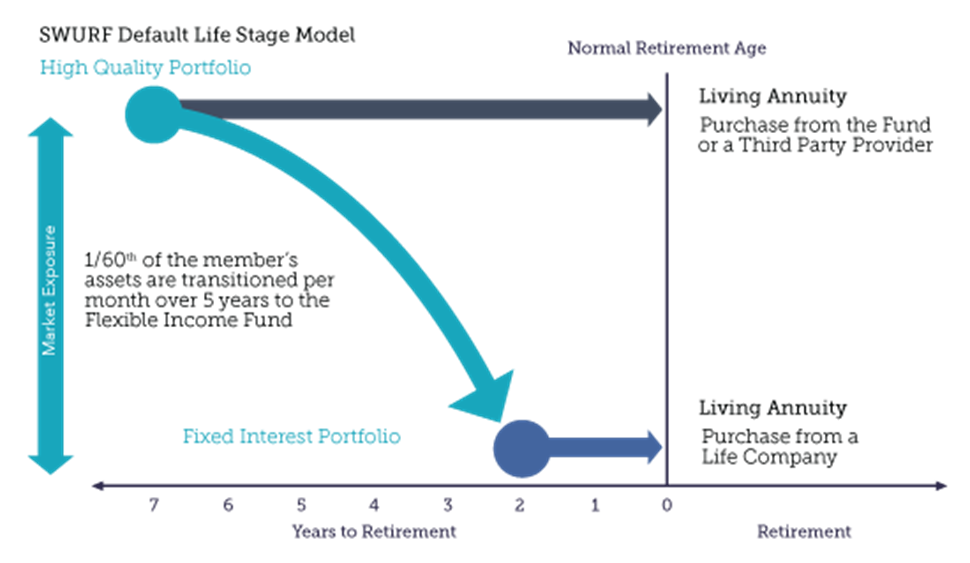

Participating employers are able to select investment options from the SWURF default portfolio range or selected third party investment solutions. The robust and awardwinning range of SWURF funds and portfolios can be selected as part of the SWURF default, or to construct a custom-designed life stage investment strategy. The SWURF default life stage strategy allows for a smooth transition from pre- to post-retirement, where the member is looking to purchase a Life Annuity at retirement. From seven years to two years to the normal retirement age of the Fund, one sixtieth of the member’s retirement benefits are transitioned from a high equity to a fixed interest portfolio. This allows the member to avoid any market and capital risk close to retirement, and for the maximum monthly income to be purchased by means of a guaranteed annuity.

As part of the retirement process, SWURF Fund members also have access to benefit counsellors who can assist them with information in order to make a more informed investment decision at retirement. This service is offered free of charge and is available to all members at any point in their retirement journey.

SWURF Fund members also have access to the Member App that is available for use on both android and IOS portable devices. This userfriendly Application allows members to do basic financial planning calculations, access their personal and latest benefit information, do a financial budget, track investment performance, load and change beneficiaries, upload relevant documents, as well as SWURF contact details.

Members also have online access to similar information and selfservice options via the Member Web. Management Committees of participating employers have access to the Employer Web that provides online access to details relating to the member profile of their Fund, as well as self-service reporting options. Member and Fund data are protected against cybersecurity risk by means of proper governance, Information Technology policies, security firewalls, daily data back-ups, a disaster recovery plan and the necessary insurance cover.

“Most individuals become fully or partially dependent on their community, government and/or their family to make ends meet during retirement...”

The SWURF is a well-governed Umbrella Retirement Fund offering that allows for truly independent and personalised advice. It speaks to the very important guidelines and requirements contained in the King IV Code on Corporate Governance, Default Regulations, TCF and RDR principles, as well as Regulation 28 from an ESG perspective. From a pricing perspective, SWURF applies a transparent and value for money fee model as per the ASISA Retirement Savings Cost Disclosure Standard (RSC).

Fees are charged based on a sliding scale model for each of the investment management, consulting and administration services. Management Committees have access to details relating to each of the service elements as the SWURF fee model breaks the mould by not applying any cross subsidisation.

The SWURF offering also allows for the integration of a member’s investment, risk and healthcare benefits which allows for the necessary flexibility to speak to the requirements of each participating employer and each Fund member. Participating employers and Fund members also have access to supplementary service offerings such as healthcare consulting, financial planning and estate planning.